Sen. Josh Hawley Introduces ‘PELOSI Act’ to Ban Lawmakers from Trading Stocks

-

WATCH: Judge, Fani Willis Prosecutor Get Into Heated Argument in Court

-

Tucker Carlson Interviews Telegram Founder Pavel Durov

-

WATCH: Florida Police Have Zero Tolerance for Anti-Israel Activists Blocking Streets

-

VIDEO: Student Charged After Slapping Female Teacher in Profanity-Filled Classroom Tantrum

A Republican in the U.S. Senate is looking to prevent lawmakers and their spouses from trading stocks on which the officials would have privileged information and used the bill’s title to make a not-so-subtle dig at former House Speaker Nancy Pelosi.

On Tuesday, Sen. Josh Hawley, R-Mo., introduced the PELOSI Act, officially the Preventing Elected Leaders from Owning Securities and Investments Act, requiring members and their spouses to divest any holdings or put them in a blind trust within six months of entering office.

“Members of Congress and their spouses shouldn’t be using their position to get rich on the stock market – today l’m introducing legislation to BAN stock trading & ownership by members of Congress. I call it the PELOSI Act,” he wrote Tuesday on Twitter.

The bill comes after revelations last year that Nancy’s husband, Paul Pelosi, traded between $1 million and $5 million of stocks for semiconductors just days before Congress allocated $52 million to the industry. The stocks were later sold at a loss to remove the appearance of impropriety.

Other lawmakers and their spouses have made similarly advantageous trades, including Sen. Richard Burr, R-N.C., who sold investments after receiving classified briefings on the coronavirus pandemic.

Hawley’s bill excludes mutual funds, exchange-traded funds and Treasury bonds purchases.

Hawley’s bill would require any profits made by a lawmaker to be returned to American taxpayers.

It also specifically amends the Ethics in Government Act of 1978, which prohibits using nonpublic information for private profit, commonly known as insider trading — which is already illegal for business leaders and everyday Americans.

The bill currently requires the President of the United States, the vice president, specific executive branch employees, the Postmaster General, some civilian employees, certain members of Congress and judicial officers to file a report that includes the source, type and value of income gained from any source other than their current employment.

This bill was previously amended in 2012, when Rep. Louise McIntosh Slaughter, D-N.Y., and Sen. Joe Lieberman, I-Conn., introduced the “Stop Trading on Congressional Knowledge Act” or the “STOCK Act” to help eliminate congressional insider trading.

The legislation, which was signed into law, prohibits lawmakers and employees from utilizing information gained through legislative meetings to profit privately. The act also says lawmakers are not exempt from insider trading prohibitions under securities laws.

It requires congressional lawmakers to report any stock transactions by themselves or their family members of $1,000 or more within 45 days.

The push to prevent lawmakers from privately profiting through their public office has bipartisan support, and Hawley and others on both sides of the proverbial aisle have initiated legislative action to outlaw such action.

News

Israel Strikes Back at Iran

Israel has conducted strikes on a target in Iran, defying President Joe Biden’s warnings over plunging the Middle East further into conflict.

An official told ABC News that strikes hit a site in Iran, however it is unclear what exact target was hit or the extent of the damage.

Officials say the city of Isfahan in central Iran was struck at 5am local time. The city hosts one of Iran’s nuclear facilities, although US military sources reportedly said the target was not believed to be nuclear.

Iranian news outlet FARS reported that the strikes were located ‘near Isfahan Airport and the eighth hunting base of the Army Air Force.’

Iranian state news reported the nation’s air defense systems have been activated, and were firing at an unknown object in Tabriz, around 500 miles north of Isfahan.

It comes in response to Iran launching a barrage of hundreds of drones and rockets at Israel on Saturday, which was largely thwarted by Israel and its international allies. Isfahan was one of several launch sites used in the attack.

Biden had warned Israel not to retaliate to Saturday’s strikes and urged them to ‘take the win’ of the foiled Iranian attack.

🚨Sirens sound in Isfahan, Iran. pic.twitter.com/wPI0Bug6sN

— Israel War Room (@IsraelWarRoom) April 19, 2024

Israeli officials warned the Biden administration of its intent to strike before launching, but an official told CNN that the US did not ‘green light’ any Israeli response.

Several hours after reports of the Israeli strikes emerged, sirens reportedly sounded in northern Israel.

Flights have been diverted and multiple airports in Tehran, Isfahan and Shiraz have been closed following the Israeli attack, and further unconfirmed explosions have reportedly hit Iraq and Syria.

Although the US military played a central role in halting Iran’s strikes on Saturday, President Biden said he made it ‘very clear’ to Israeli Prime Minister Benjamin Netanyahu that he had to act ‘carefully and strategically.’

Biden urged Netanyahu to ‘take the win’ of the derailed attack, and cautioned that the US would not participate in any Israeli counter-offensive.

The Israeli leader brushed off Biden’s warnings, insisting Israel would ‘make its own decisions’ in how to react to Iran’s attack.

US officials said there was an expectation that if Israel defied warnings, they would not target nuclear or civilian sites.

The Iranian attack came in retaliation to a suspected Israeli strike on Iran’s consulate in Syria on April 1, which killed 13 people including two generals in the Islamic Revolutionary Guard.

As Israel maintained its plans to retaliate on Iran, a senior Iranian official warned that the nation would respond by starting production of nuclear weapons if Israel attacked its nuclear facilities.

Iran threatened to use ‘weapons it has never used’ if Israel struck, and indicated that it did not wish to continue escalating the conflict unless Israel fired back.

As the West urged for calmer heads to prevail in the Jewish state, Iranian Parliament’s National Security Committee Abolfazl Amoue stated that Iran is prepared for a ‘painful response’ to the ‘slightest action.’

On Thursday, Iranian Foreign Minister Hossein Amir-Abdollahian also cautioned that Iran would strike back at the ‘maximum level’ if Israel fired.

‘In case the Israeli regime embarks on adventurism again and takes action against the interests of Iran, the next response from us will be immediate and at a maximum level,’ Amir-Abdollahian told CNN.

The instability in the region has immediately impacted global oil markets, with brent crude prices increasing above $90 a barrel as news of the Israeli strikes emerged.

The Islamic republic, which has always insisted its nuclear program is peaceful and denies seeking an atomic bomb, has accused arch foe Israel of sabotage attacks on its facilities and assassinations of nuclear scientists in recent years.

According to Ahmad Haghtalab, the Islamic Revolutionary Guards’ head of nuclear protection and security, Iran has ‘identified’ Israeli nuclear centres and holds ‘necessary information of all targets’.

Israel is widely known to have nuclear weapons but has never admitted so.

News

Meet the 12 Jurors Who Will Decide Trump’s Fate

Twelve jurors have been selected and sworn in to serve on the jury for former President Donald Trump’s historic and unprecedented first criminal trial.

Trump, the presumptive Republican presidential nominee, has been charged by Manhattan District Attorney Alvin Bragg with 34 counts of falsifying business records in the first degree. The charges are related to alleged hush money payments made to adult film actress Stormy Daniels ahead of the 2016 presidential election.

Trump has pleaded not guilty to all counts. He has blasted the trial as pure politics, a “political persecution” and maintains his innocence. The former president is expected to testify during his trial.

By the end of jury selection on Thursday, the third day of jury selection, 12 jurors had been selected and sworn in. The jury pool so far includes four men and three women, all living in New York City. Their professions included work in law, finance, technology and more.

“We have our jury,” Judge Juan Merchan said when the 12th juror was picked Thursday afternoon. “Let’s pick our alternates.”

Merchan dismissed the remaining prospective jurors and asked that they return to court Friday so that alternate jurors could be selected.

Here is a look at each of the jurors so far.

Juror #1 and the foreperson

Juror #1 lives in New York City. He has no children and enjoys doing anything outdoorsy. He gets his news from The New York Times, Daily Mail, Fox News and MSNBC.

When asked by Trump defense attorney Todd Blanche if he was aware Trump is charged in other cases and jurisdictions, and how that affects him, the man said, “I don’t have an opinion.”

Juror #2

Juror #2 is a man who said he follows Trump’s former lawyer Michael Cohen on “X,” formerly known as Twitter, as well as other “right wing” accounts, including former Trump adviser Kellyanne Conway.

The reason, he said, he follows those figures was so he could be plugged in to “anything that might move the markets I might need to know about.”

When asked if he would unfollow Cohen, as he may be a witness in the trial, the man said: “Absolutely.”

The man also said he has “not seen any evidence” relating to the case.

“I will try to keep an open mind,” he said.

Responding to questions from Trump lawyer Susan Necheles about his feelings about the former president, the man said that Trump has done some good for the country.

“It’s ambivalent,” he said. “It goes both ways.”

The first person who was labeled juror #2 was excused Thursday morning after saying she could not be a fair juror.

Juror #3

Juror #3 is a young to middle-aged man who lives in Manhattan. The man said he grew up in Oregon and has been an attorney for five years practicing corporate law. The man said he enjoys hiking and running, and gets his news from The New York Times and Google.

Juror #4

Juror #4 is originally from California, but has lived in New York City for 15 years. The man said he has been a security engineer for 25 years and holds a high school diploma, with some college education.

The man is married with three children. His wife is a teacher.

During his spare time, he enjoys being with his children, woodworking and metal working.

The man said he has served on a jury before — on both a grand jury and a jury in a criminal trial.

The man said he gets his news from “a smattering” of news sources. As for social media, he said he doesn’t use it.

The man said he has a relative who works in finance and brothers-in-law that work as lawyers.

The man said he has no feelings about how Trump is being treated in this case.

The person who was first labeled as Juror #4 was excused Thursday morning after it was revealed that he had been previously arrested in Westchester, New York, for tearing down right-wing political advertisements.

Juror #5

Juror #5 is a young and a New York native who has been a teacher of English Language Arts for eight years.

The woman was previously a caseworker at a juvenile detention center. She said she has a masters’ degree in education.

“I’m creative at heart,” she said, adding that she enjoys photography.

The woman said that she is not married and does not have children. Her mother was an administrative aide for a police department, and her godfather was a homicide detective.

The woman said she gets her news from Google and TikTok.

She was asked if Trump chose not to testify, whether she would hold that against him.

“I won’t hold that against him,” she said.

She explained that she has friends who have strong opinions on the former president but said she is not a political person and tries to avoid political conversations.

She did say, however, that she appreciates Trump’s candor.

“President Trump speaks his mind, and I’d rather that than someone who’s in office who you don’t know what they’re thinking,” she said.

When jurors were asked if they were aware Trump was charged in other cases than Bragg’s, most jurors were. However, juror #5 raised her hand to indicate that she was learning of additional charges for the first time.

Juror #6

Juror #6 is a young woman who lives in Manhattan. She described herself as a New Yorker.

The woman is a software engineer and said she likes to dance.

Juror #7

Juror #7 is originally from North Carolina and works as an attorney and civil litigator.

The man said he is married with two children, and his wife works in risk management for a bank. He said he enjoys spending time outdoors and with his family.

The man said he gets his news from The New York Times, The Wall Street Journal, the New York Post and The Washington Post.

When asked if his career as a lawyer would impact his ability to serve fair and impartially, or whether his opinions would get in his way, the man said that he does have “political views as to the Trump presidency” and said there were likely Trump administration policies he disagreed with.

“I don’t know the man and I don’t have any opinions about him personally,” he said.

As for his career as a lawyer, he said he does not have any opinions about Trump’s character.

“I certainly follow the news,” he said. “I’m aware there are other lawsuits out there. But I’m not sure that I know anyone’s character.”

Juror #8

Juror #8 has been selected. Information on this juror is not yet available.

Juror #9

Juror #9 is a woman who lives in Manhattan. She is originally from New Jersey and works as a speech therapist.

The woman is not married and does not have children. She said she likes to spend time with friends, go to restaurants and go on walks.

The woman said she has never served on a jury before, and does not watch the news or follow current events too closely. The woman said she did, though, have email subscriptions to CNN and The New York Times. She said she follows social media accounts, listens to podcasts and enjoys reality television.

The woman said she does not listen to talk radio.

The woman said she can be fair and impartial. She said she does have opinions about Trump, but said she believes she can put them aside and be fair and impartial.

Juror #10

Juror #10 is a man who lives in Manhattan. He was born and raised in Ohio and works in commerce for a large company. The man has a college degree.

The man said he is not married and has no children, but lives with another adult who works in accounting.

The man said he enjoys being outdoors and loves animals.

The man said he does not really follow the news, but listens to podcasts on behavioral psychology.

The man said he has no strong opinions on how Trump is being treated in this case.

Juror #11

Juror #11 has been selected. Information on this juror was not immediately available.

Juror #12

Juror #12 has been selected. Information on this juror was not immediately available.

News

US Vetoes Palestine’s Request for Full UN Membership

The U.S. vetoed a Palestinian bid to be recognized as a member state of the United Nations during a Security Council vote Thursday evening.

The final vote on Monday had 12 members of the Security Council vote in favor of the resolution, two abstentions — the U.K. and Switzerland — and the U.S. with the lone veto, effectively killing the measure.

Before the vote, Vedant Patel, principal deputy spokesperson for the State Department, described as premature an effort by the Palestinian Authority (PA) to gain member status at the U.N.

He said there was not unanimity among the Security Council’s 15 members that the Palestinian Authority had met the criteria for membership, with unresolved questions over the governance of the Gaza Strip, where Israel is in a war to defeat and eliminate the controlling power, Hamas.

“And for that reason, the United States is voting no on this proposed Security Council resolution,” Patel said.

For the Palestinian bid to be successful it would have had to secure nine votes among the Security Council’s 15-member body, and not have any of the five permanent members exercise their veto.

But the vote tally signaled that the majority of members were putting their support behind the Palestinian measure, despite the U.S. push to promote negotiations as the only pathway for recognition of a Palestinian state.

If the U.S. had not exercised its veto, a second vote would be taken by the General Assembly to admit the Palestinian Authority as a voting-member under the title of “State of Palestine.”

The PA launched a bid for statehood recognition at the U.N. earlier this month as part of efforts to legitimize its leadership amid Israel’s war against Hamas in the Gaza Strip and escalating unrest in the West Bank, with surging violence between Israelis and Palestinians.

The U.S. is working on a plan to “revitalize” and “reform” the Palestinian Authority and prepare it for governance of the Gaza Strip. It is part of a larger plan to have Gulf and Arab partners participate in stabilizing Gaza in the aftermath of Israel’s war and establish open ties with Israel.

“We do not think that actions in New York, even if they are the most well-intentioned, are the best appropriate path,” Patel said.

“It remains our view that the most expeditious path toward statehood for the Palestinian people is through direct negotiations between Israel and the Palestinian Authority with the support of the United States and other partners who share this goal.”

“It remains our view that the most expeditious path toward statehood for the Palestinian people is through direct negotiations between Israel and the Palestinian Authority with the support of the United States and other partners who share this goal.”

In 2012, the Palestinian Authority secured the status of “non-member observer state” at the U.N., in the face of U.S., Israeli and other countries objecting, arguing that the establishment of a Palestinian state could only occur between direct negotiations between Israelis and Palestinians.

Ziad Abu Amr, special representative of the Palestinian president, said in remarks that recognizing the State of Palestine would not be a substitute “for serious negotiations that are time-bound to implement the two-state solution,” the Associated Press reported.

News

Kennedy Family Endorses Biden

Members of the Kennedy family appeared en masse and in force to endorse President Biden at a campaign event in Philadelphia on Thursday.

It’s a public display of support that reveals a weakness Democrats privately acknowledge: Biden is likely more at risk from Robert F. Kennedy Jr.’s third-party challenge than former President Trump is.

With a substantial number of voters telling pollsters they are dissatisfied with both Biden and Trump, Democrats are increasingly petrified that a Kennedy name on the ballot will throw the election to Trump.

A similar fear pervaded over the potential No Labels unity ticket. But with those plans scuttled, Biden is turning his focus on the scion of the storied Kennedy family.

RFK Jr.’s sister, Kerry Kennedy, invoked the legacy of her slain father, former Attorney General Robert F. Kennedy, as well as that of her uncles: former President John F. Kennedy and Sen. Ted Kennedy (D-Mass.).

“I can only imagine how Donald Trump’s outrageous lies and behavior would have horrified my father,” she said.

“President Biden has been a champion for all the rights and freedoms that my father and uncles stood for,” she added.

Kerry Kennedy lauded Biden’s track record fighting for “working people,” his support for unions, and his efforts to relieve “the debt incurred by middle-and-working class kids trying to get ahead by getting an education.”

By contrast, if Trump wins he will “incite more chaos, division, and political violence with his extreme agenda,” she said.

In a veiled dig at her brother’s campaign, Kennedy added that “in 2024 there are only two candidates with any chance of winning the presidency.”

“What an incredible honor, to have the support of the Kennedy family,” Biden said when he took the stage.

After Biden’s remarks, Kennedy family members plan to knock on doors and make calls on behalf of the Biden campaign.

From inflation to abortion, the Biden campaign is seizing every opportunity to make 2024 a choice between two candidates — and two competing visions for America.

Kennedy’s independent bid threatens that strategy.

Democrats view anything that turns the election into a referendum on Biden — and gives voters a chance to register their discontent with the status quo — as a grave threat to Biden’s candidacy.

The event on Thursday is part of an increasingly aggressive effort to take on Kennedy, with most polls showing Trump’s advantage grows with the ex-Democrat’s famous last name on the ballot.

The Democratic Party is also preparing to fight Kennedy’s attempts to get on the ballot in key swing states, and has hired communications professionals at the DNC with the explicit aim of combatting Kennedy.

Biden advisers aren’t concerned about Kennedy making deep inroads with Democrats and independents. They’re worried about his effect on the margins in a few key swing states.

Two of the last three GOP presidential victories — President Bush in 2000 and Trump in 2016 — can partly be explained by the appeal of third-party candidates to disaffected voters.

The electoral math bolsters those fears.

Trump’s 2016 margin of victory over Hillary Clinton in Michigan, Pennsylvania and Wisconsin was smaller than the total number of votes won by Green Party candidate Jill Stein in those states.

Kennedy is actually sounding a lot more like Trump — with pledges to “seal the border” and appoint a special counsel to review Jan. 6 prosecutions — than a traditional Democrat from a storied family.

But Republicans are also concerned about Kennedy’s potential crossover appeal, with pro-Trump media abruptly shifting its tone on his candidacy.

Many Kennedy family members have been critical of Robert F. Kennedy Jr.’s candidacy.

Biden posed with dozens of them, including Kerry Kennedy, at a St. Patrick’s Day party at the White House last month.

Thursday’s event will consolidate that criticism and try to turn it into positive momentum for Biden.

News

Ilhan Omar’s Daughter Arrested, Suspended from College Over Pro-Palestinian Protests

The daughter of Minnesota Democratic U.S. Rep. Ilhan Omar was arrested Thursday while participating in pro-Palestinian protests in New York, and said she was suspended from her private liberal arts college in the city over her participation.

At a news conference, New York City police confirmed that Isra Hirsi was among the 108 protesters arrested for alleged trespassing.

The confirmation of Hirsi’s arrest came after comments from Mayor Eric Adams and Police Commissioner Edward Caban, who said Columbia University requested police to respond to the protests, and to “intervene if necessary.”

Hirsi said she was among a few Barnard College students who were suspended for participating in a “Gaza Solidarity Encampment” at Columbia University.

Barnard and Columbia are partner schools across the street from each other.

“i’m an organizer with CU Apartheid Divest @ColumbiaSJP, in my 3 years at @BarnardCollege i have never been reprimanded or received any disciplinary warnings. i just received notice that i am 1 of 3 students suspended for standing in solidarity with Palestinians facing a genocide,” Hirsi posted on X.

i’m an organizer with CU Apartheid Divest @ColumbiaSJP, in my 3 years at @BarnardCollege i have never been reprimanded or received any disciplinary warnings

i just received notice that i am 1 of 3 students suspended for standing in solidarity with Palestinians facing a genocide.

— isra hirsi (@israhirsi) April 18, 2024

“those of us in Gaza Solidarity Encampment will not be intimidated. we will stand resolute until our demands are met. our demands include divestment from companies complicit in genocide, transparency of @Columbia’s investments and FULL amnesty for all students facing repression,” Hirsi wrote.

Omar has been an outspoken critic of Israel’s government and an advocate for a permanent cease-fire in Gaza. Omar declined to comment through her spokeswoman.

Barnard College issued a statement Thursday saying the students had set up an unauthorized encampment on Columbia’s south lawn early Wednesday morning and had been asked to leave multiple times. College staff told the students they would be sanctioned if they didn’t leave, the statement said.

“This morning, April 18, we started to place identified Barnard students remaining in the encampment on interim suspension, and we will continue to do so,” the college’s statement said.

Hirsi’s announcement that she was suspended came a day after Columbia University President Nemat Shafik testified before Congress about antisemitism on campus. During that hearing, Omar questioned Shafik about how the college treats protesters. She did not mention her daughter’s role in campus protests.

“There has been a recent attack on the democratic rights of students across the country. I was appalled to learn that in April, Columbia suspended and evicted six students for their involvement in the pro-Palestinian panel event on campus,” Omar said to Shafik. “It happened that all six students were arbitrarily targeted after the university brought in a team of private and former police investigators. These investigators harassed, intimidated Palestinian students at their homes, demanding to see students’ private text messages.”

WATCH: Rep. Omar questions the president of Columbia University about protests on campus and the broader hostile environment faced by students. pic.twitter.com/2v50Vt8vyR

— Rep. Ilhan Omar (@Ilhan) April 17, 2024

Shafik responded: “This was a very serious case. We had students who on an online call … invited people who were inciting violence, and that is unacceptable. We needed to get to the bottom of it, and so that’s why we brought private investigators, along with notifying the FBI.”

The panel event that Omar questioned Shafik about appears to have been highly controversial. In a statement in early April, Shafik called the event an “abhorrent breach of our values” and said “it featured speakers who are known to support terrorism and promote violence.”

“That I would ever have to declare the following is in itself surprising, but I want to make clear that it is absolutely unacceptable for any member of this community to promote the use of terror or violence,” Shafik said in her statement.

News

FBI on Alert for Threats to Jews Ahead of Passover

Federal law enforcement is on alert for any potential threats to the US Jewish community ahead of the start of the Passover holiday, FBI Director Christopher Wray told a group of nationwide security officials Wednesday.

“We at the bureau remain particularly concerned that lone actors could target large gatherings, high profile events, or symbolic or religious locations for violence – particularly a concern, of course, as we look to the start of Passover on Monday evening,” Wray said.

Speaking at an event hosted by the Secure Community Network, a Jewish community nonprofit safety and training organization, Wray said threats to the US Jewish community had already been elevated before Hamas’ October 7 terrorist attack on Israel, but the number of FBI hate crime cases tripled in the wake of the incident.

“Between October 7 and January 30 of this year, we opened over three times more anti-Jewish hate crime investigations than in the four months before October 7,” said Wray, who noted raw statistics about investigations represent “very real threats to your institutions, to your houses of worship, to your schools and university organizations, and to the individuals in your communities simply for being who you are.”

An Anti-Defamation League audit released Tuesday showed there was a dramatic upward trend of incidents after the start of the Israel-Hamas war. Between October 7 and December 31, there were 5,204 incidents, CNN reported earlier this week.

The Jewish civil rights advocacy group tracked 8,873 antisemitic incidents in the United States in 2023 – the highest number of incidents reported since the organization began tracking data in 1979.

Wray said his remarks were not intended to stir alarm, but he noted “it is a time for continued vigilance” – comments echoed by other security professionals.

“Unprecedented threats do not need to equate to unnecessary fear or panic,” said SCN national director and CEO Michael Masters, who added that the public can “rest assured that those focused on the safety and security of the community are maintaining a laser-like focus on this so Jewish life can exist and thrive.”

In addition to homegrown violence and a surge in hoax threats against Jewish facilities, Wray warned that the FBI was also observing a range of threats from abroad.

“We’ve seen – since October 7 – a rogues’ gallery of foreign terrorist organizations call for attacks against the United States and our allies,” said Wray, including calls by global terrorist groups “to target Jewish communities both in the United States and Europe.”

In addressing Jewish community security officials, Wray also called out state-sponsored threats.

“After the last few days, in particular, the threat posed by Iran itself is very real,” he said.

Wray added that after Iran’s missile and drone attack on Israel last week in retaliation for a suspected Israeli strike on an Iranian diplomatic complex in Syria, “we are urging all of our partners here and around the world to stay vigilant” against any “potential threats that may emerge from Iran or its proxies both overseas and even here in the homeland.”

News

Argentina’s Milei Submits Request to Join NATO

Argentina has submitted a request for the country to become a “global partner” of NATO.

The country’s president Javier Milei has repeatedly said he wants to protect his country’s sovereignty claim on the Falkland Islands – while also trying to tie closer links with the West. Indeed, since his election win, Argentina has become much closer to the United States and other western powers.

However, in January, Foreign Secretary Lord Cameron met with the Argentine President and the future of the islands was discussed. According to the Foreign Office: “On the Falkland Islands, the Foreign Secretary and President Milei said they would agree to disagree, and do so politely. The UK position and ongoing support for the Falkland Islanders’ right to self-determination remains unchanged.”

Today, Defense Minister Luis Alfonso Petri submitted the formal request. He said on X: “I met with Deputy Secretary General of NATO Geoana. I transmitted a letter of intent to him, which contains a request from Argentina to become a global partner of this organisation.”

Romanian Mircea Geoană met with 47-year-old Mr Petri in Brussels, saying: “It is a great pleasure to welcome Defence Minister Petri to NATO Headquarters.

“Argentina plays an important role in Latin America, and I welcome today’s request to explore becoming a NATO partner. NATO works with a range of countries around the world to promote peace and stability. Closer political and practical cooperation could benefit us both.”

The request from enigmatic Mr Milei’s government won’t be rubber-stamped unless all 32 members support it. At present, the only South American partner the defensive military alliance has is Colombia.

Despite the long-haired president’s overtures towards the West, he has not backed off over the Falklands, as the sovereignty of the islands remains politically exercising in Argentina.

Earlier this week, Ian Shields OBE, a retired RAF officer who spent four months on the Falklands, told Express.co.uk that it is hard to reconcile Mr Milei’s drift towards the West with his stance on the islands: “My take is that he is playing two different games.”

However, the military man turned Cambridge academic noted that Mr Milei’s rhetoric over what he would call Las Malvinas is aimed at a domestic audience.

He said that amping up emotions over the Falklands “plays well with a nationalist, right-wing agenda, and also distracts the people from domestic economic issues”.

News

WARNING: The Real-Time Deepfake Romance Scams Have Arrived

Romance scams are getting a whole lot more convincing with the latest tactic: using two phones, one running a face-swap app, to conduct live video calls with victims …

Romance scams

Romance scams are where a fraudster creates fake dating profiles, establishes communication with a victim, and wins their trust over time before creating a fake emergency for which they say they need a short-term loan.

A typical example will see the scammer claim they have been robbed while abroad, and need cash sent to enable them to settle a hotel bill so they can fly home. They will claim the money will be repaid as soon as they land back in the US, a day or so later.

In most cases, the best a scammer can do to draw victims in is using a mix of text and voice chat, but a new tactic is seeing them now conduct live video calls to make their fake identity seem even more convincing.

Uses two phones with a face-swap app

A paywalled Wired report says the scammers are known as Yahoo Boys. The site got access to videos of the scammers at work which show two different methods. The first involves using two phones.

The scammers use a setup of two phones and a face-swapping app. The scammer holds the phone they are calling their victim with—they’re mostly seen using Zoom, Maimon says, but it can work on any platform—and uses its rear camera to record the screen of a second phone. This second phone has its camera pointing at the scammer’s face and is running a face-swapping app. They often place the two phones on stands to ensure they don’t move and use ring lights to improve conditions for a real-time face-swap, the videos show.

The second runs on a laptop.

Here, the scammer uses a webcam to capture their face and software running on the laptop changes their appearance. Videos of the setup show scammers are able to see their own face alongside the altered deepfake, with just the manipulated image being displayed over the live video call.

If you’re wondering what subterfuge Wired had to employ to obtain video footage of the scams in operation, the astonishing answer is: none at all. The scammers are so brazen they are happy to boast about their cons in Telegram group chats, complete with video footage. In some cases, this is to sell the setups to other scammers.

Rachel Tobac, cofounder of SocialProof security, says the apps have improved dramatically in the past year.

Especially the ones where they’re able to change the pitch of their voice and the look of their face—sometimes changing skin tone, hair, eye color, everything’s matched. It’s pretty wild.

Protecting yourself from romance scams

As always, the advice when using dating apps is to be cautious until you’ve met someone, and anyone asking for money is an immediate giveaway that you’re talking to a scammer – no matter how convincing they may seem.

Additionally, beware social media apps that ask you to upload a face photo to be transformed into something like an older or younger version of you, a Samurai warrior or whatever. These apps are designed to collect data used to train things like face-swap apps.

News

Two Jurors Dismissed in Trump’s Hush Money Trial

The judge in former President Trump’s New York criminal trial excused two jurors on Thursday after one questioned her ability to be impartial in a high profile case and a second may not have answered a jury questionnaire honestly.

Seven jurors had been selected at the start of proceedings Thursday morning, but now the panel has been winnowed to five.

Juror number four, dismissed Thursday afternoon, was excused after prosecutors said they found a news article showing that someone with the same name as his juror had previously “been arrested in Westchester for tearing down political advertisements.”

While it’s unclear it at this point whether it was the same person, Merchan said told the juror he “should not come back” Monday morning, per a pool report.

They also found that the juror’s wife “was previously accused of or involved in a corruption inquiry,” per the pool report.

The prosecutor, Joshua Steinglass, said the information suggested that the juror’s answer to a question about previous arrests “was not accurate.”

Both the defense and prosecution agreed to wait for the juror to arrive in court to confirm whether he is the same person from the news story.

The first juror dismissed Thursday morning told the judge she “definitely has concerns now” about what has been publicly reported about her, noting that some of her friends, colleagues and family indicated that she had been identified as a possible juror.

“I don’t believe, at this point, that I can be fair and unbiased and let the outside influences not affect my thinking in the courtroom,” the juror also said, per Politico.

“We just lost what probably would have been a very good juror,” Judge Juan Merchan said afterward, according to Reuters.

Merchan, who is overseeing the New York criminal trial, said he was directing reporters to avoid publishing physical descriptions of jurors moving forward.

Merchan also said that he is going to redact from the court records prospective jurors’ answers to questions about their current and former employers.

He also directed the media to not report on answers to those questions, per a press pool report.

When jury selection resumed, more than 5o potential jurors were excused, the vast majority saying they could not be impartial in the case.

News

REPORT: Russia Spy Arrested for Plotting Assassination of Zelensky

A Polish national has been arrested on suspicion of handing sensitive information to Russia in order to facilitate a possible assassination plot against Ukrainian President Volodymyr Zelensky.

Suspect Paweł K faces up to eight years in prison after he was detained in Poland and charged with ‘reporting his readiness to act for foreign intelligence’.

The man was tasked with ‘collecting… military intelligence… with information on the security of the Rzeszów-Jasionka Airport’ in order to ‘help Russian special services plan a possible attack’ on the Ukrainian leader, Polish prosecutors believe.

Polish authorities worked with their counterparts in Ukraine during the investigation, leading to Paweł K’s detention on Wednesday. The investigation is still ongoing.

A number of attempts on the life of President Zelensky have been reported since the Russian invasion of Ukraine in February 2022.

According to the Prosecutor’s Office, an investigation revealed how Paweł K had ‘declared his readiness to act for the military intelligence’ of Russia and made contacts with citizens ‘directly involved in the war in Ukraine’.

They claimed he became involved in gathering and relaying military intelligence back to Russia, including information on the security of the Rzeszów-Jasionka Airport in southeastern Poland.

This was ‘among other things’ intended to help special services plan an attack on Zelensky, the prosecutors allege.

The Office of the Prosecutor General of Ukraine raised suspicions about Paweł K with the Polish Prosecutor’s Office, who conducted an investigation into the suspect.

The ‘Polish side’ emphasised the strong collaboration with Ukraine to foil the alleged plot, sharing information and collating evidence from within and outside of Poland.

The investigation continues to be conducted by the Internal Security Agency under the supervision of the National Prosecutor’s Office.

Earlier today, two men described as German-Russian national were also detained in Germany, suspected of planning to sabotage German military aid for Ukraine.

Interior Minister Nancy Faeser said authorities had also prevented ‘possible explosive attacks’.

The men were accused of scouting US military facilities and other sites. One was remanded in pre-trial detention, accused of offences including plotting an explosion and maintaining contact with Russian intelligence.

The other was accused of helping him identify potential targets.

As early as March 2022, Pravda reported that the Ukrainian military had ‘destroyed’ a Chechen outfit tasked with ‘eliminating’ Zelensky.

Chechnya is a republic within Russia.

‘Putin assigned the head of Chechnya Ramzan Kadyrov to do the dirtiest work and personally instructed him during a meeting on February 3, 2022,’ the outlet reported, dated more than two weeks before the invasion.

The Chechen group were tasked with taking out Ukrainian leaders before they were repelled by the Armed Forces of Ukraine, Pravda claimed.

Mikhail Podolyak, presidential adviser to Zelensky, claimed previously that the Ukrainian leader had survived more than a dozen attempts in the first two weeks of the war alone.

‘Our foreign partners are talking about two or three attempts. I believe that there were more than a dozen such attempts,’ he told Ukrainian Pravda in March 2022.

‘We have a very powerful intelligence and counterintelligence network – they monitor it all and all these DRGs [Russian reconnaissance groups] are being eliminated on the way.

‘That is, we understand all the plans and our counterintelligence is working on them.’

In March 2023, a group of foreign citizens were arrested on suspicion of spying for Russia, Polish government officials told the BBC.

Polish security services reportedly broke up the spy network accused of installing secret cameras at the Rzeszow-Jasionka airport in order to film transport infrastructure used to deliver aid to Ukraine.

The group allegedly installed dozens of cameras near railway junctions and key transport routes in areas border Ukraine, local radio station RMF FM reported.

Military and cargo aircraft from the US and Europe regularly use the airport in Poland to deliver supplies headed for Ukraine.

News

Prosecutors Accuse Trump of Breaching Gag Order 7 More Times

Prosecutors accused former President Trump on Thursday of repeatedly violating the gag order the judge placed on him in his New York hush money case.

Judge Juan Merchan, who is overseeing the case, had previously scheduled a hearing for next Tuesday over prosecutors’ request to hold Trump in contempt for alleged gag order violations.

Prosecutors on Thursday alleged that Trump has violated the gag order seven more times since Monday, according to court pool reports.

Prosecutors pointed to Trump’s social media posts linking to articles calling Cohen a “serial perjurer” and alleging that “undercover liberal activists” are lying to the judge to get on the jury, per a pool report.

The prosecution filed a new motion requesting the posts be included in next week’s hearing, per NBC News.

It’s ridiculous and it has to stop,” prosecutor Chris Conroy said, CNN reported.

Emil Bove, one of Trump’s lawyers, argued the social media posts didn’t “establish any willful violations” of the gag order and that reposting other people’s public comments shouldn’t constitute a violation, per a pool report.

Instead, Bove argued, Trump’s posts highlighted some of the order’s “ambiguities.”

Bove said that Cohen has been attacking Trump in “connection to the campaign,” and therefore Trump’s comments were related to the campaign.

Merchan did not rule Thursday regarding the possible violations, saying he will wait for next week’s hearing, the New York Times reported.

Merchan issued a gag order against Trump last month, prohibiting him from commenting on witnesses, prosecutors, court staff and jurors in the case, with the exception of Manhattan District Attorney Alvin Bragg who is an elected official.

The judge expanded the order earlier this month, barring Trump from attacking family members of those involved in the case.

News

911 Emergency Lines Go Down Across Multiple States

Police forces across several states, from Nebraska to Nevada, reported their 911 phone lines are down – causing chaos for those needing emergency assistance.

Cities as big as Las Vegas, as well as the entire state of South Dakota and locales in Texas and Nebraska announced the outages on Wednesday night.

Officials in South Dakota, Nevada and Las Vegas said 911 services had been restored, but without identifying the cause of the failure.

The Department of Homeland Security has warned, of increased risks of cyber attacks on 911 services as they have migrated to digital systems based on Internet Protocol standards.

Several cyberattacks targeting 911 systems have taken down the services in recent years, one of which, in 2017, paralyzed 911 centers in more than a dozen states.

In Las Vegas specifically, no estimate was initially given after an outage wiped out landline and mobile phones connectivity to the crucial 911 number.

Authorities asked for callers not to test out the phone line while they try and get service back up, amid fears that unreported crimes may be taking place.

Nearby Henderson, Nevada was also facing a down 911 – but various other emergency services were still running.

The entire state of South Dakota, Dundy County, Kearney County, Howard County and Fremont, Nebraska, as well as Del Rio, Texas were also affected.

The emergency mobile number to get a hold of police, ambulance, and fire services was not connecting to call centers for many hours throughout the night.

Police urged the public to call alternative numbers if they needed help.

In South Dakota, one county did say that text messages to 911 did appear still be going through.

Others suggested that members of the public needing help ought to call 911 on a mobile device, and wait for the service to call you back.

In Vegas and South Dakota, police announced just after 10pm local time that service was restored following a three hour outage.

News

UPDATE: Kaylee Gain Is Walking, “Greatly Improved”

Kaylee Gain is “greatly improved” and walking again less than two months after suffering horrific brain injuries from having her head repeatedly slammed into the ground during a fight near her school, her family has revealed.

“We have been truly amazed by the progress she has made in such a short time,” Kaylee’s parents, Clint and Jaime Gain, wrote in a GoFundMe update on Tuesday.

“Physically she is doing well, walking with little to no assistance but must wear a helmet for her safety as she is still missing her bone flap,” the proud parents wrote of the 16-year-old’s health status.

The bone flap will be repaired with “another surgery” in the future, Kaylee’s parents explained.

“Cognitively Kaylee has greatly improved since first waking up from her coma however there is still a lot of work she will need to do in order to get fully back to herself prior to the incident,” they added.

Kaylee has been in the hospital since March 8, when she and another girl got into a caught-on-camera brawl near their St. Louis high school.

The footage of the altercation showed the second girl getting on top of Kaylee and repeatedly slamming her skull into the pavement while stunned peers looked on.

Kaylee was in a coma for several days before eventually regaining consciousness.

In a previous GoFundMe update, her parents shared that she had started speaking short phrases or sentences.

News

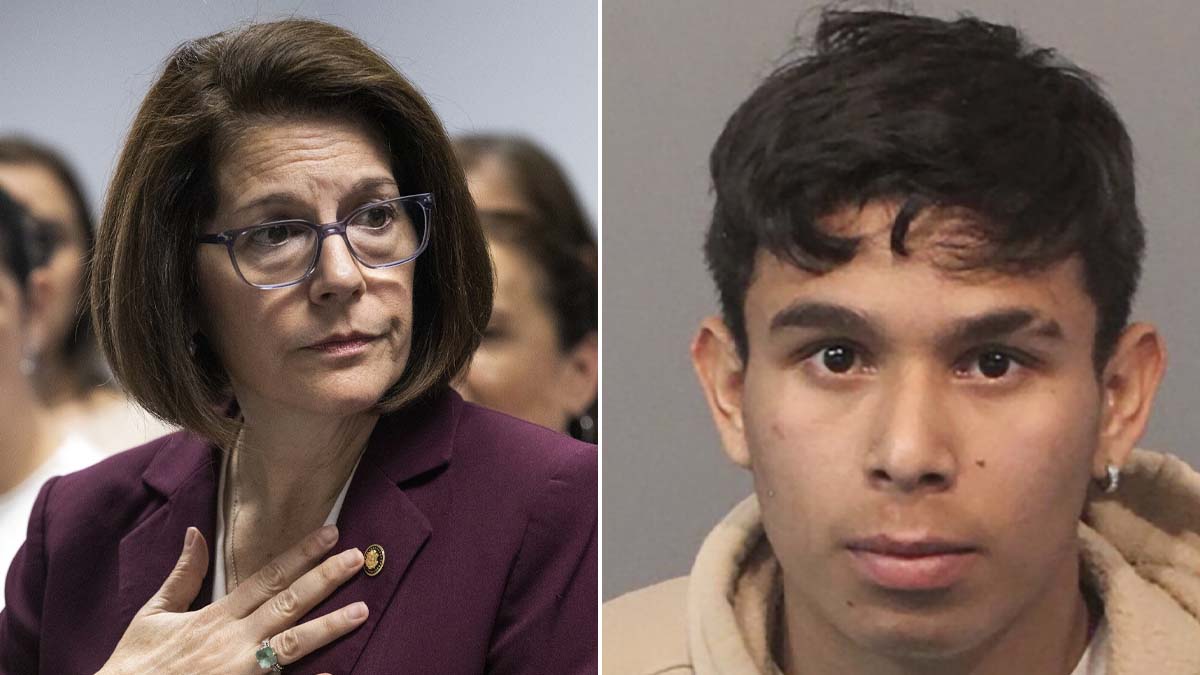

Illegal Immigrant Charged Over Hit-and-Run Crash That Killed Advisor to Dem Senator

An illegal immigrant has been charged over a car crash that killed an advisor to Democratic Nevada Sen. Catherine Cortez Masto earlier this month.

The suspect, 18-year-old Elmer Rueda-Linares, was charged by police with failing to stop at the scene of an accident after a crash at 4:30 a.m on April 6 in Reno led to the death of 38-year-old Kurt Englehart, a senior state advisor to Masto. Rueda-Linares was first charged by police with felony hit-and-run, according to the Reno Gazette Journal.

According to the Department of Homeland Security, Rueda-Linares illegally entered the United States in March 2021.

“Rueda entered the United States March 12, 2021, at or near the Rio Grande City, Texas, Port of Entry without inspection by an immigration official,” DHS told the Reno Gazette Journal. “United States Customs and Border Protection arrested him, and he was later released on his own recognizance June 22, 2021.”

Immigration and Customs Enforcement placed an immigration detainer on Rueda-Linares on April 8. The suspect is currently behind bars at the Washoe County Jail with a $100,000 bail and is expected to appear before a Reno Justice Court judge Thursday afternoon.

“The occupants who fled the scene were later located by police, and the driver arrested,” authorities said in a statement after the crash. “Impairment does appear to be a factor in this crash.”

A spokesman for Masto said that she “looks forward to justice being served and has confidence in the local police and prosecutors.”

In a statement remembering Englehart, Masto said he was a “beloved figure.”

“He touched many lives and I know almost everyone in Northern Nevada has a great story about Kurt helping them or making them laugh,” the senator said . “Kurt was a dedicated public servant, a loyal friend, and a loving father.”

Republican lawmakers have called on President Joe Biden and Homeland Security Secretary Alejandro Mayorkas to take stronger actions to secure the border as reports of illegal aliens being involved in fatal crashes have continued to make national news.

Earlier this year, the House voted to impeach Mayorkas over his handling of the border, which has seen record crossings in recent years. On Wednesday, the Democrat-controlled Senate, including Masto, voted to dismiss the charges.

“There is no evidence that [Mayorkas] committed high crimes and misdemeanors, so I voted to end this waste of time,” Masto said. “Republicans could have made real policy changes, but they decided to play games and killed the bipartisan border package in favor of this frivolous impeachment.”

Masto narrowly survived a challenge from Republican Adam Laxalt in 2022, winning by less than one percentage point.

News

Homeless Build House with Garden, BBQ and Working Electricity Along LA Freeway

Homeless Californians built a house complete with rock walls, a garden, a barbecue grill, a hammock, decorative string lights, potted plants and working electricity on a strip of land wedged between a busy freeway and the Arroyo Seco in Los Angeles.

The impressive and seemingly sturdy structure stands out among the dozens of makeshift shelters, tents and tarps that those without a home have constructed along the drainage basin, as filmed by local news station KTLA.

The number of encampments built above the “dry river” has increased in recent years as 46,000 Los Angeles residents are experiencing homelessness, the station reported.

The people who live in the makeshift home on the edge of the 110 freeway would not speak to the station, but neighbors who did gave mixed reactions.

“They don’t bother me,” one nearby resident said in Spanish, noting that most of the encampment inhabitants keep to themselves.

But neighbor Mike Ancheta, who was biking by, said he “admired” the work they’ve done, though the shelters shouldn’t be there.

“This doesn’t belong here. This is public property,” Ancheta told KTLA. “But this is not what it’s supposed to be used for. This is dangerous. As you can see, someone is cooking out there, an open fire. They are stealing electricity. I mean, come on.”

The house-like encampment, however, does have two fire extinguishers in its “yard,” photos show.

“It sucks that some of these people are here,” Enrique Rodriguez said. “I do wish better for those people. [But] I cannot be sorry for the mistakes that they made.”

Yet another resident blamed Los Angeles’ rental costs.

“It’s messed up,” Ulysses Chavez told the local station.

“They should lower rent. They should lower all kinds of stuff, especially in LA.”

News

US and Chinese Scientists Are Working in China to Develop New Deadly Viruses

Lawmakers are demanding answers after it was revealed the US is sending taxpayer dollars to a Chinese army lab to make bird flu viruses more dangerous to people.

Eighteen members of Congress are demanding answers from the Department of Agriculture (USDA) about the project, which was first revealed by DailyMail.com.

It is part of a $1million collaboration between the USDA and the CCP-run Chinese Academy of Sciences – the institution that oversees the Wuhan lab at the center of the Covid lab-leak theory.

In a scathing letter to USDA Secretary Tom Vilsack last week, the bipartisan group said: ‘This research, funded by American taxpayers, could potentially generate dangerous new lab-created virus strains that threaten our national security and public health.’

The research comes as fears about bird flu rise. A farm worker in Texas caught the H5N1 strain that is racing through cattle across the US earlier this month, becoming only the second ever American to be diagnosed – and experts are bracing for more cases.

In February, it was revealed the United States government was funneling $1million to China to see if scientists could make ‘highly pathogenic avian influenza’ more contagious to mammals using gain-of-function research.

Government records showed the collaboration began in April 2021 and is scheduled to be funded through March 2026. The USDA previously told this website the project was applied for in 2019 and approved in 2020.

The research involves infecting ducks and geese with different strains of viruses to make them more infectious, and studying the viruses’ potential to ‘jump into mammalian hosts,’ according to research documents obtained by the watchdog group White Coat Waste Project and shared exclusively with this website.

It is being funded through the USDA and the main collaborators on the project are USDA Southeast Poultry Research Laboratory, the Chinese Academy of Sciences and the University of Edinburgh’s Roslin Institute – a Wuhan lab partner.

And it has been ongoing despite similar research being restricted in 2022 and growing concerns that dubious Chinese studies may have started the Covid pandemic.

Just yesterday, President Joe Biden’s administration announced it will work with 50 countries to identify and respond to infectious diseases, with the goal of preventing a pandemic that the US’ own research could actually spark.

Last week’s letter was spearheaded by Rep Nick Langworthy, a Republican from New York who serves on the House Agriculture Committee.

It states: ‘We are disturbed by recent reports about the US Department of Agriculture’s (USDA) collaboration with the Chinese Communist Party (CCP)-linked Chinese Academy of Sciences (CAS) on bird flu research.’

The CAS is the parent organization of WIV and has previously been prohibited from receiving US government money for ‘blatantly violating grant and biosafety policies, refusing to share lab notebooks and other data, and otherwise obstructing investigations into the likely role of the lab’s risky coronavirus [gain of function] research in the origin of Covid-19.’

The letter continued: ‘Recognizing the problematic behavior of CAS, our House and Senate colleagues have called for sanctions against CAS and its affiliates and for taxpayer funding to be cut for all research involving CAS.’

The signatories then requested written answers to seven questions inquiring about the potential of the research to increase transmissibility of bird flu viruses, details about specific experiments being performed, the biosafety levels of the experiments, what oversight the USDA is providing over CAS and if the FBI performed a safety risk assessment on the collaboration – and, if so, what those results were.

Bird flu is of particular concern right now because a farmer in Texas recently contracted the H5N1 strain of the virus.

The patient caught the bird flu from an infected cow, which was the first time the strain had been found in cattle.

They are only the second person to contract H5N1 after someone in Colorado caught the virus in 2022.

While there is no sign of person-to-person spread — a development that would signal the start of a human epidemic — experts say the ease with which the strain is jumping between species raises the risk of it evolving to infect people more easily.

The Centers for Disease Control and Prevention report a ‘low’ public health risk.

The virus, however, is widespread in wild birds, with sporadic infections in poultry and mammals.

Experts have previously told DailyMail.com H5N1 has the potential to spark a new pandemic.

Dr Aaron Glatt, an infectious diseases expert at Mount Sinai in New York, warned: ‘It is absolutely true that H5N1 has the potential to cause a pandemic.

‘People who work with these animals do need to be careful.

‘The more that this virus is spread, the more likely it is that it could become a strain that could mutate and start to spread from human-to-human.’

The H5N1 spreading across the world emerged in 2020 after a bird was infected with both a bird flu from domestic poultry and a virus from wild birds.

During the infection, the two viruses met in the same cell and swapped genes — in a process scientifically termed re-assortment — to create the new virus that now had multiple attributes that made it better at infecting bird cells.

It quickly spread globally, with the first cases identified in Europe — before infections were also detected in Africa, the Middle East and Asia.

This month’s letter is not the first written to the USDA from lawmakers.

Following February’s investigation, Republican Sen Joni Ernst of Iowa wrote a letter to Sec Vilsack seeking more information about the department’s ongoing funding of the research.

The letter read: ‘I was troubled to learn from the non-profit group White Coat Waste Project that USDA is supporting experiments involving a “highly pathogenic avian influenza virus” that poses a “risk to both animals and humans.”‘

Sen Ernst said in a statement to DailyMail.com at the time: ‘The health and safety of Americans are too important to just wing it, and Biden’s USDA should have had more apprehension before sending any taxpayer dollars to collaborate with [China] on risky avian flu research.

‘They should know by now to suspect “fowl” play when it comes to researchers who have ties to the dangerous Wuhan Lab, and simply switching from bats to birds causes concern that they are creating more pathogens of pandemic potential.

‘Here’s my warning: the Biden administration should be walking on eggshells until they cut off every cent going to our adversaries. We cannot allow what happened in Wuhan to happen again.’

The specific viruses the research said it will study include H5NX, H7N9 and H9N2, WCW reported.

A 2023 study described H5NX viruses as ‘highly pathogenic’ with the ability to cause neurological complications in humans.

The H7N9 strain first infected humans and animals in China in March 2013 and the World Health Organization said it is of concern ‘because most patients have become severely ill.’

The H9N2 strain has been found in doves in China and while it has a lower pathogenicity than the other strains, it can still infect humans.

Despite the concerns, a USDA spokesperson told this website it is ‘common for international researchers to conduct independent research that’s connected to the same end goal’ and that the research does not qualify as gain-of-function.

News

Senate Dems Kill Mayorkas Impeachment Trial

The Senate on Wednesday ended the impeachment trial of Homeland Security Secretary Alejandro Mayorkas, making him the second Cabinet official in history to evade a conviction and removal from office — but the first to be acquitted without evidence being presented of alleged “high crimes and misdemeanors.”

Senate Majority Leader Chuck Schumer (D-NY) convened the upper chamber in the early afternoon to swear in the 51 Democrats or independents who caucus with them and 49 Republicans as jurors, before offering a motion to dismiss the first of the charges without a trial.

The unprecedented move set off a series of objections from Republicans, with Sen. John Kennedy (R-La.) proposing a motion to adjourn the proceedings until April 30 and Senate Minority Leader Mitch McConnell (R-Ky.) rising to oppose Schumer’s point of order that the first impeachment article was “unconstitutional.”

“At this point, in any trial in the country, the prosecution presents the case, the defense does the same and the jury listens,” McConnell said. “But the Senate has not had the opportunity to perform this duty.”

GOP senators brought other objections on the second article, pushing for a closed session, asking to adjourn until after the 2024 election and questioning whether they were setting a precedent of absolving federal officials of potential felonies without a trial.

Senate Minority Whip John Thune (R-SD) also offered a direct challenge to Schumer’s procedural attempt to kill the trial. Each Republican objection fell, with all 51 Democrats voting against them.

Alaska GOP Sen. Lisa Murkowski voted present on the question of dismissing the first article and against dismissing the second, whereas all other members voted on the party line — letting both fall, 51-49.

After nearly two hours of deliberations, Mayorkas became the first impeached government official in US history to dodge a trial, which had followed 21 impeachments for three presidents — including twice-charged former President Donald Trump — a Cabinet secretary, a senator and many federal judges.

“They’re gonna try to sweep this under the rug and act as if the Biden border crisis never existed. But the evidence is very plain,” Sen. John Cornyn predicted to Fox News on Wednesday.

Schumer indicated in a Senate floor speech on Tuesday that he wanted “to address this issue as expeditiously as possible” and that “impeachment should never be used to settle a policy disagreement.”

The House voted 214-213 in February to impeach Mayorkas, 64, for his “willful and systemic refusal to comply” with federal immigration law and lying to Congress about the Biden administration maintaining a “secure” border.

Eleven House impeachment managers, led by Homeland Security chairman Mark Green (R-Tenn.), delivered the two articles of impeachment to the Senate on Tuesday.

The Senate had an obligation to conduct a full trial, hear the evidence, and render a verdict,” Green said in a statement following the Senate vote. “However, just as Secretary Mayorkas has grievously failed in his constitutional duty, now so has the Senate. Instead of addressing the serious charges against Secretary Mayorkas, the upper chamber has chosen to neglect its responsibility.

“This is an unprecedented failure by the Senate to do its duty, which, for the first time in our history, has outright refused to conduct an impeachment trial when given the opportunity to do so,” Green added. “This is not only a tacit approval of Secretary Mayorkas’ assault on our constitutional order, but an insult to the millions of Americans who want to end this crisis and hold accountable those who intentionally created it. Sadly, the Senate has now failed on both fronts.”

“Today’s decision by the Senate to reject House Republicans’ baseless attacks on Secretary Mayorkas proves definitively that there was no evidence or Constitutional grounds to justify impeachment,” DHS spokeswoman Mia Ehrenberg said in a statement.

“As he has done throughout more than 20 years of dedicated public service, Secretary Mayorkas will continue working every day to enforce our laws and protect our country. It’s time for Congressional Republicans to support the Department’s vital mission instead of wasting time playing political games and standing in the way of commonsense, bipartisan border reforms.”

Record-breaking numbers of migrants have crossed illegally into the US every year that Biden has been in office, with a total of more than 9 million encountered at land borders, according to US Customs and Border Protection statistics.

More than 7.5 million migrants have been caught along the southern border, and another 1.8 million have evaded apprehension but nevertheless been observed making the illegal entries.

The massive influx has led to a backlog of more than 3 million cases of asylum seekers in the US, the House impeachment resolution noted.

The impeachment articles also alleged that Mayorkas failed to enforce the Immigration and Nationality Act of 1952 and misled Congress about the Department of Homeland Security having “operational control” of the border.

In a Sept. 30, 2021, memo, the secretary had also changed policies for detaining and expelling migrants, allowing his department to institute a de facto “catch and release” policy for millions of illegal border crossers, the resolution states.

In March 1876, the House impeached Secretary of War William Belknap on charges of corruption, but he handed in his resignation to President Ulysses S. Grant hours before the vote was held.

House managers and more than 40 witnesses argued that Belknap’s resignation shouldn’t keep the upper chamber from voting to convict — but the Senate acquitted him on five articles of impeachment for taking kickbacks in exchange for a political appointment.

News

WATCH: Judge, Fani Willis Prosecutor Get Into Heated Argument in Court

A Georgia prosecutor from Fulton County District Attorney Fanni Willis’ office got into a shouting match Wednesday with the judge overseeing the trial of rapper Young Thug as the pair argued over evidentiary matters.

Chief Deputy District Attorney Adriane Love and Fulton County Judge Ural Glanville got into a heated shouting match when the judge ruled that the evidence Love wanted to introduce would be excluded.

“Why didn’t we file this stuff months ago and let’s wind it out and air it out at that point in time,” Glanville told the defense before asking Love about the matter.

The judge asked Love if prosecutors had discussions about the evidence before excluding the material. As Love began voicing her frustration, Glanville said: “Well then you all should have gotten yourself together beforehand.”

“Have a seat, madam. Have a seat,” he said after telling court officers to summon the jury, which was not present during the exchange. “You better exclude that and next time, make sure you’re prepared.”

Love argued that her team tried discussing the evidence with the defense.

“Oh it’s going to be inadmissible right now,” Glanville replied. “I am not going to have any more discussion about this, madam.”

“Judge, we talked to them this morning about that! And I attempted to talk to them earlier this week!” Love shouted. “Your honor, so the court punishes the state because (of) the defense?”

“I’m not punishing anybody,” the judge replied. “But prior preparation prevents poor performance.”

“We prepared, judge! That’s why I sent them what I sent them last week! A whole week and a half ago! Two weeks, your honor!” Love yelled before Glanville told her the jury was coming into the room.

Watch:

Judge DESTROYS Fani Willis’ Prosecutor – He’s Had Enough!

Watch as Fulton County Assistant District Attorney Adriane Love goes nuts, argues and yells at Judge Ural Glanville when she doesn’t get her way during the YSL trial involving rapper Young Thug.

This should’ve been… pic.twitter.com/rDTrOVCO9e

— Conservative Brief (@ConservBrief) April 17, 2024

Love’s boss, Fani Willis, has garnered national attention for her prosecution of former President Trump for alleged election interference.

Willis was accused of having an “improper” relationship with Nathan Wade, the special counsel she hired to prosecute Trump. She was also accused of financially benefiting from the position Wade held in her office. Both Willis and Wade denied the allegations.

Wade resigned from the case, allowing Willis to stay on it.

Love is the lead prosecutor in the trial against Young Thug, an Atlanta-based hip-hop artist, who’s given name is Jeffery Lamar Williams.

Williams and six others are charged in connection with participating in a criminal street gang responsible for violent crimes. In addition, he is accused of racketeering conspiracy as well as drug and gun charges.

Young Thug achieved tremendous success after starting to rap as a teenager and serves as CEO of his own record label, Young Stoner Life, or YSL. Artists on his record label are considered part of the “Slime Family,” and a compilation album, “Slime Language 2,” rose to No. 1 on the charts in April 2021.

But prosecutors say YSL also stands for Young Slime Life, which they allege is an Atlanta-based violent street gang affiliated with the national Bloods gang and founded by Young Thug and two others in 2012. Prosecutors say people named in the indictment are responsible for violent crimes — including killings, shootings and carjackings — to collect money for the gang, burnish its reputation and expand its power and territory.

News

Biden Claims His Uncle Was Eaten by Cannibals During WWII — But Military Has Different Story

President Joe Biden appeared to suggest that cannibals ate his uncle after he was shot down during World War II, though military records say otherwise.

Speaking with reporters on Wednesday in Scranton, Pennsylvania, Biden twice recalled the story of his uncle, Ambrose Finnegan, who served in the U.S. Army Air Forces in the Pacific theater of World War II.

The president claimed that he was shot down over Papua New Guinea in an area infested with cannibals.

“He flew single-engine planes, reconnaissance flights over New Guinea. He had volunteered because someone couldn’t make it. He got shot down in an area where there were a lot of cannibals in New Guinea at the time,” Biden said.

“They never recovered his body, but the government went back when I went down there, and they checked and found some parts of the plane.”

Watch:

Biden has a new story: Uncle Bosey got shot down in a plane and was possibly eaten by African cannibals. pic.twitter.com/9cSP29GSxx

— End Wokeness (@EndWokeness) April 17, 2024

Biden used the story as a roundabout way to bash Donald Trump, citing a disputed story claiming that the former president refused to visit a cemetery for American soldiers in France because he thought they were “suckers” and “losers.”

Military records contradicted nearly every detail of Biden’s story about his uncle, instead noting that Finnegan’s plane crashed in the ocean due to engine failure.

“For unknown reasons, this plane was forced to ditch in the ocean off the north coast of New Guinea,” a report from the Department of Defense’s POW/MIA Accounting Agency said.

“Both engines failed at low altitude, and the aircraft’s nose hit the water hard. Three men failed to emerge from the sinking wreck and were lost in the crash. One crew member survived and was rescued by a passing barge. An aerial search the next day found no trace of the missing aircraft or the lost crew members.”

The plane was also cited as an A-20 Havoc, a two-engined plane.

In his remarks, Biden also claimed that the government conducted a search “when I went down there,” finding parts of the plane.

In reality, the president caused a diplomatic rift with Papua New Guinea when he scrapped plans to visit last year. No U.S. president has yet visited the island nation, and there are no records of any search that found parts of Finnegan’s plane.

News

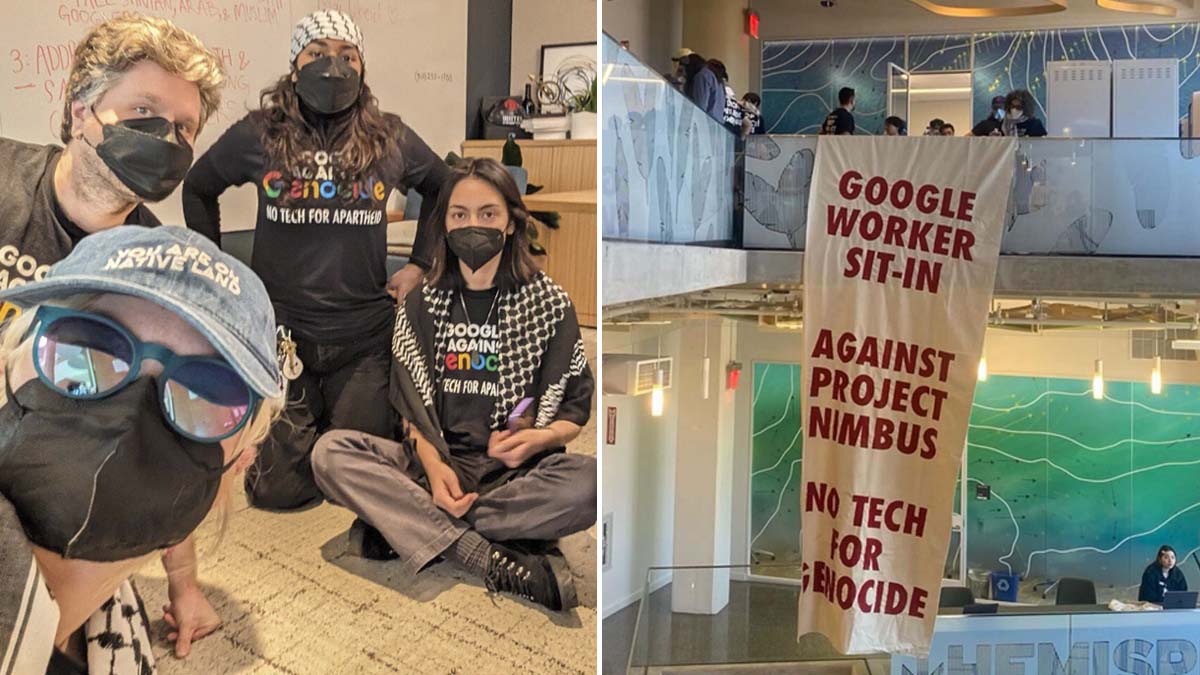

Google Fires 28 Employees Involved in Sit-In Protest Over $1.2B Israel Contract

Google has fired 28 employees over their participation in a 10-hour sit-in at the search giant’s offices in New York and Sunnyvale, California, to protest the company’s $1.2 billion cloud contract with Israel, The Post has learned.

The unruly staffers — who had donned traditional Arab headscarves as they stormed and occupied the office of a top executive in California on Tuesday — were terminated late Wednesday after an internal investigation, Google vice president of global security Chris Rackow said in a companywide memo.

“They took over office spaces, defaced our property, and physically impeded the work of other Googlers,” Rackow wrote in the memo obtained by The Post. “Their behavior was unacceptable, extremely disruptive, and made co-workers feel threatened.”

“Following investigation, today we terminated the employment of twenty-eight employees found to be involved. We will continue to investigate and take action as needed,” Rackow said in the memo.

“Behavior like this has no place in our workplace and we will not tolerate it. It clearly violates multiple policies that all employees must adhere to – including our code of conduct and policy on harassment, discrimination, retaliation, standards of conduct, and workplace concerns.”

Rackow added that the company “takes this extremely seriously, and we will continue to apply our longstanding policies to take action against disruptive behavior – up to and including termination.”

It couldn’t immediately be learned if all nine arrested employees were among those who were fired. Google had earlier placed the employees on administrative leave and cut their access to internal systems.

The pro-Palestinian staffers are affiliated with a group called No Tech For Apartheid, which has been critical of Google’s response to the Israel-Hamas war.

The impacted workers blasted Google over the firings in a statement shared by No Tech For Apartheid spokesperson Jane Chung.

“This evening, Google indiscriminately fired 28 workers, including those among us who did not directly participate in yesterday’s historic, bicoastal 10-hour sit-in protests,” the workers said in the statement.

“This flagrant act of retaliation is a clear indication that Google values its $1.2 billion contract with the genocidal Israeli government and military more than its own workers — the ones who create real value for executives and shareholders.”

“Sundar Pichai and Thomas Kurian are genocide profiteers,” the statement added, referring to Google’s CEO and the CEO of its cloud unit, respectively.

“We cannot comprehend how these men are able to sleep at night while their tech has enabled 100,000 Palestinians killed, reported missing, or wounded in the last six months of Israel’s genocide — and counting.”

The group posted several videos and livestreams of the protests on its X account — including the exact moment that employees were issued final warnings and arrested by local police for trespassing.

“These protests were part of a longstanding campaign by a group of organizations and people who largely don’t work at Google,” the spokesperson said in a statement.

“A small number of employee protesters entered and disrupted a few of our locations. Physically impeding other employees’ work and preventing them from accessing our facilities is a clear violation of our policies, and completely unacceptable behavior.”

“We have so far concluded individual investigations that resulted in the termination of employment for 28 employees, and will continue to investigate and take action as needed,” the spokesperson added.

Earlier, an NYPD spokesperson said the Tuesday protest “involved approximately 50 participants” and confirmed “four arrests were made for trespassing inside the Google building.”

Separately, the Sunnyvale Department of Public Safety said the protest in California had “consisted of around 80 participants.”

Five staffers who refused to leave the Google office were “arrested without incident for criminal trespassing,” booked and released, a spokesperson added.

The protesters demanded that Google pull out of a $1.2 billion “Project Nimbus” contract — in which Google Cloud and Amazon Web Services provide cloud-computing and artificial intelligence services for the Israeli government and military.

Critics at the company raised concerns that the technology would be weaponized against Palestinians in Gaza.

The demonstrators stormed the personal office of Google Cloud CEO Thomas Kurian in Sunnyvale.

Kurian’s custom-made, framed Golden State Warriors jersey was visible on the office wall in the background of the livestream, and employees wrote a list of their demands on his white board.

The pro-Palestinian employees, who are affiliated with a group called No Tech For Apartheid, posted several videos and livestreams of the protests — including the moment they were issued final warnings and arrested by local police for trespassing.

The companywide memo can be read in its entirety below.

Googlers,