Silicon Valley Bank Collapses in Second-Biggest Bank Failure in US History

-

WATCH: Judge, Fani Willis Prosecutor Get Into Heated Argument in Court

-

Tucker Carlson Interviews Telegram Founder Pavel Durov

-

WATCH: Florida Police Have Zero Tolerance for Anti-Israel Activists Blocking Streets

-

VIDEO: Student Charged After Slapping Female Teacher in Profanity-Filled Classroom Tantrum

Regulators took over California-based Silicon Valley Bank on Friday in the second-biggest bank failure in US history.

The Santa Clara-headquartered bank was shuttered by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as the receiver.

This is the biggest bank collapse in the US since the 2008 failure of Washington Mutual during the height of the global financial crisis.

Silicon Valley Bank failed after depositors — mostly technology workers and venture capital-backed companies — began withdrawing their money, creating a run on the bank.

Shares of the bank were halted on Friday before the opening bell of the Nasdaq after they tumbled 66 per cent in premarket trading. The FDIC did not announce a buyer of the bank’s assets, which is usually done when there’s an orderly wind-down of a financial institution.

The seizure of Silicon Valley’s assets in the middle of the business day rather than at the close of business is perhaps a sign of how dire the situation had become. Questions were raised this week after the bank announced plans to raise up to $1.75bn in order to strengthen its capital position amid concerns about higher interest rates and the economy.

Silicon Valley Bank was the 16th largest in the US — and had approximately $209bn in total assets and about $175.4bn in total deposits, as of 31 December 2022. Washington Mutual has total assets of $307bn when it was shuttered on 25 September 2008, 10 days after Lehman Brothers failed.

What led to the collapse of Silicon Valley Bank?

Founded in 1983, Silicon Valley Bank was the 18th largest bank by assets in the US prior to its collapse, with 17 branches in California and Massachusetts.

Headquartered in Santa Clara, California, it primarily catered to startups in the technology and healthcare sectors.

Ultimately, the failure of SVB can be traced back to the Federal Reserve’s battle against inflation through aggressive interest rate hikes, which have battered the tech sector over the past year.

In 2021, when interest rates were near zero and easy money flooded the economy, venture capital investments in startups surged to a record high of $671 billion in the US, according to KPMG.

That also meant booming business for SVB, as the bank’s startup clients increased their deposits with the bank, which roughly doubled in 2021.

The bank then used those deposits to grow its loan portfolio, the basic business model banks use to generate a profit, though its interest-generating loans did not grow as quickly as its soaring deposits.

For safekeeping, SVB invested much of the extra cash from customer deposits into US Treasuries and other government bonds, which is a standard practice at banks.

The situation began to change after the Fed began its rate hikes one year ago.

As interest rates rose, VC investments began to dwindle, and SVB’s startup clients drew down their accounts at the bank faster than expected to cover expenses.

At the same time, rising interest rates also decreased the market value of the Treasury securities in which SVB had invested deposited funds.

On Wednesday, SVB revealed that in the face of a cash burn from dwindling deposits, it was forced to sell off its bond holdings at a $1.8 billion loss. The bank announced plans to seek $2 billion from investors to cover the shortfall.

The announcement triggered a panic in Silicon Valley, and on Thursday some prominent venture capitalists, including Peter Theil, began urging their portfolio companies to withdraw any deposits from SVB.

What followed appears to be a classic bank run: a rush of customer withdrawals that tips a bank into failure when it is unable to meet the demand for immediate cash.

SVB scrambled on Friday to find alternative funding, including through a sale of the company. Later in the day, however, the Federal Deposit Insurance Corporation (FDIC) then announced that SVB was shut down and placed under its receivership.

Will SVB’s customers get their money back?

Following the shutdown, the FDIC said SVB depositors will have full access to their insured deposits no later than Monday morning.

The federal agency insures each depositor up to at least $250,000.

For customers that have deposits larger than $250,000, which likely includes many of the bank’s startup company customers, what happens next is less clear.

Depositors with funds above the insured amount will receive a dividend within the next week, and a receivership certificate for the remaining amount of their uninsured funds.

As the FDIC sells off the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.

The FDIC said that at the time of the shutdown, the amount of uninsured deposits at the bank was undetermined.

In theory, it is possible that uninsured deposits could eventually be repaid in full, because the bank’s total assets are larger than the amount it owes depositors.

At the time of failure, SVB had $209 billion in total assets and owed depositors about $175.4 billion, according to the FDIC.

However, some of those assets could be difficult to liquidate, such as ownership stakes in companies that are not publicly traded, or loans to early-stage startups.

Ultimately, only time will tell how much of the uninsured deposits are returned to customers.

CEO sold $3.57 million just two weeks before collapse

The CEO of Silicon Valley Bank sold $3.57m of stock in a pre-planned, automated sell-off two weeks before it collapsed – and the CFO ditched $575,000 the same day.

Greg Becker sold 12,451 shares at an average price of $287.42 each on February 27. The price plunged to just $39.49 in premarket Friday before the Federal Deposit Insurance Corporation (FDIC) seized the bank’s assets.

The day his sale went through, Becker bought the same number of shares using stock options priced at $105.18 each, according to filings with the Securities and Exchange Commission. The options, which allow you to buy a company’s stock at a set price, were due to expire May 2. The transactions were made through a trust that he controls, using a trading plan that he had set up on January 26, records show.

SVB’s CFO Daniel Beck sold 2,000 shares at $287.59 per share on the same day as his boss. He set up his trading plan on January 24.

What happens next at Silicon Valley Bank?

To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB).

When the bank was shuttered Friday, the FDIC immediately transferred all insured deposits of Silicon Valley Bank to the DINB.

Starting on Monday, the main office and all branches of Silicon Valley Bank will reopen under the control of the DINB.

‘Banking activities will resume no later than Monday, March 13, including on-line banking and other services. Silicon Valley Bank’s official checks will continue to clear,’ the FDIC said in a statement.

Customers with accounts in excess of the insured amount of $250,000 should contact the FDIC toll-free at 1-866-799-0959.

News

Two Jurors Dismissed in Trump’s Hush Money Trial

The judge in former President Trump’s New York criminal trial excused two jurors on Thursday after one questioned her ability to be impartial in a high profile case and a second may not have answered a jury questionnaire honestly.

Seven jurors had been selected at the start of proceedings Thursday morning, but now the panel has been winnowed to five.

Juror number four, dismissed Thursday afternoon, was excused after prosecutors said they found a news article showing that someone with the same name as his juror had previously “been arrested in Westchester for tearing down political advertisements.”

While it’s unclear it at this point whether it was the same person, Merchan said told the juror he “should not come back” Monday morning, per a pool report.

They also found that the juror’s wife “was previously accused of or involved in a corruption inquiry,” per the pool report.

The prosecutor, Joshua Steinglass, said the information suggested that the juror’s answer to a question about previous arrests “was not accurate.”

Both the defense and prosecution agreed to wait for the juror to arrive in court to confirm whether he is the same person from the news story.

The first juror dismissed Thursday morning told the judge she “definitely has concerns now” about what has been publicly reported about her, noting that some of her friends, colleagues and family indicated that she had been identified as a possible juror.

“I don’t believe, at this point, that I can be fair and unbiased and let the outside influences not affect my thinking in the courtroom,” the juror also said, per Politico.

“We just lost what probably would have been a very good juror,” Judge Juan Merchan said afterward, according to Reuters.

Merchan, who is overseeing the New York criminal trial, said he was directing reporters to avoid publishing physical descriptions of jurors moving forward.

Merchan also said that he is going to redact from the court records prospective jurors’ answers to questions about their current and former employers.

He also directed the media to not report on answers to those questions, per a press pool report.

When jury selection resumed, more than 5o potential jurors were excused, the vast majority saying they could not be impartial in the case.

News

REPORT: Russia Spy Arrested for Plotting Assassination of Zelensky

A Polish national has been arrested on suspicion of handing sensitive information to Russia in order to facilitate a possible assassination plot against Ukrainian President Volodymyr Zelensky.

Suspect Paweł K faces up to eight years in prison after he was detained in Poland and charged with ‘reporting his readiness to act for foreign intelligence’.

The man was tasked with ‘collecting… military intelligence… with information on the security of the Rzeszów-Jasionka Airport’ in order to ‘help Russian special services plan a possible attack’ on the Ukrainian leader, Polish prosecutors believe.

Polish authorities worked with their counterparts in Ukraine during the investigation, leading to Paweł K’s detention on Wednesday. The investigation is still ongoing.

A number of attempts on the life of President Zelensky have been reported since the Russian invasion of Ukraine in February 2022.

According to the Prosecutor’s Office, an investigation revealed how Paweł K had ‘declared his readiness to act for the military intelligence’ of Russia and made contacts with citizens ‘directly involved in the war in Ukraine’.

They claimed he became involved in gathering and relaying military intelligence back to Russia, including information on the security of the Rzeszów-Jasionka Airport in southeastern Poland.

This was ‘among other things’ intended to help special services plan an attack on Zelensky, the prosecutors allege.

The Office of the Prosecutor General of Ukraine raised suspicions about Paweł K with the Polish Prosecutor’s Office, who conducted an investigation into the suspect.

The ‘Polish side’ emphasised the strong collaboration with Ukraine to foil the alleged plot, sharing information and collating evidence from within and outside of Poland.

The investigation continues to be conducted by the Internal Security Agency under the supervision of the National Prosecutor’s Office.

Earlier today, two men described as German-Russian national were also detained in Germany, suspected of planning to sabotage German military aid for Ukraine.

Interior Minister Nancy Faeser said authorities had also prevented ‘possible explosive attacks’.

The men were accused of scouting US military facilities and other sites. One was remanded in pre-trial detention, accused of offences including plotting an explosion and maintaining contact with Russian intelligence.

The other was accused of helping him identify potential targets.

As early as March 2022, Pravda reported that the Ukrainian military had ‘destroyed’ a Chechen outfit tasked with ‘eliminating’ Zelensky.

Chechnya is a republic within Russia.

‘Putin assigned the head of Chechnya Ramzan Kadyrov to do the dirtiest work and personally instructed him during a meeting on February 3, 2022,’ the outlet reported, dated more than two weeks before the invasion.

The Chechen group were tasked with taking out Ukrainian leaders before they were repelled by the Armed Forces of Ukraine, Pravda claimed.

Mikhail Podolyak, presidential adviser to Zelensky, claimed previously that the Ukrainian leader had survived more than a dozen attempts in the first two weeks of the war alone.

‘Our foreign partners are talking about two or three attempts. I believe that there were more than a dozen such attempts,’ he told Ukrainian Pravda in March 2022.

‘We have a very powerful intelligence and counterintelligence network – they monitor it all and all these DRGs [Russian reconnaissance groups] are being eliminated on the way.

‘That is, we understand all the plans and our counterintelligence is working on them.’

In March 2023, a group of foreign citizens were arrested on suspicion of spying for Russia, Polish government officials told the BBC.

Polish security services reportedly broke up the spy network accused of installing secret cameras at the Rzeszow-Jasionka airport in order to film transport infrastructure used to deliver aid to Ukraine.

The group allegedly installed dozens of cameras near railway junctions and key transport routes in areas border Ukraine, local radio station RMF FM reported.

Military and cargo aircraft from the US and Europe regularly use the airport in Poland to deliver supplies headed for Ukraine.

News

Prosecutors Accuse Trump of Breaching Gag Order 7 More Times

Prosecutors accused former President Trump on Thursday of repeatedly violating the gag order the judge placed on him in his New York hush money case.

Judge Juan Merchan, who is overseeing the case, had previously scheduled a hearing for next Tuesday over prosecutors’ request to hold Trump in contempt for alleged gag order violations.

Prosecutors on Thursday alleged that Trump has violated the gag order seven more times since Monday, according to court pool reports.

Prosecutors pointed to Trump’s social media posts linking to articles calling Cohen a “serial perjurer” and alleging that “undercover liberal activists” are lying to the judge to get on the jury, per a pool report.

The prosecution filed a new motion requesting the posts be included in next week’s hearing, per NBC News.

It’s ridiculous and it has to stop,” prosecutor Chris Conroy said, CNN reported.

Emil Bove, one of Trump’s lawyers, argued the social media posts didn’t “establish any willful violations” of the gag order and that reposting other people’s public comments shouldn’t constitute a violation, per a pool report.

Instead, Bove argued, Trump’s posts highlighted some of the order’s “ambiguities.”

Bove said that Cohen has been attacking Trump in “connection to the campaign,” and therefore Trump’s comments were related to the campaign.

Merchan did not rule Thursday regarding the possible violations, saying he will wait for next week’s hearing, the New York Times reported.

Merchan issued a gag order against Trump last month, prohibiting him from commenting on witnesses, prosecutors, court staff and jurors in the case, with the exception of Manhattan District Attorney Alvin Bragg who is an elected official.

The judge expanded the order earlier this month, barring Trump from attacking family members of those involved in the case.

News

911 Emergency Lines Go Down Across Multiple States

Police forces across several states, from Nebraska to Nevada, reported their 911 phone lines are down – causing chaos for those needing emergency assistance.

Cities as big as Las Vegas, as well as the entire state of South Dakota and locales in Texas and Nebraska announced the outages on Wednesday night.

Officials in South Dakota, Nevada and Las Vegas said 911 services had been restored, but without identifying the cause of the failure.

The Department of Homeland Security has warned, of increased risks of cyber attacks on 911 services as they have migrated to digital systems based on Internet Protocol standards.

Several cyberattacks targeting 911 systems have taken down the services in recent years, one of which, in 2017, paralyzed 911 centers in more than a dozen states.

In Las Vegas specifically, no estimate was initially given after an outage wiped out landline and mobile phones connectivity to the crucial 911 number.

Authorities asked for callers not to test out the phone line while they try and get service back up, amid fears that unreported crimes may be taking place.

Nearby Henderson, Nevada was also facing a down 911 – but various other emergency services were still running.

The entire state of South Dakota, Dundy County, Kearney County, Howard County and Fremont, Nebraska, as well as Del Rio, Texas were also affected.

The emergency mobile number to get a hold of police, ambulance, and fire services was not connecting to call centers for many hours throughout the night.

Police urged the public to call alternative numbers if they needed help.

In South Dakota, one county did say that text messages to 911 did appear still be going through.

Others suggested that members of the public needing help ought to call 911 on a mobile device, and wait for the service to call you back.

In Vegas and South Dakota, police announced just after 10pm local time that service was restored following a three hour outage.

News

UPDATE: Kaylee Gain Is Walking, “Greatly Improved”

Kaylee Gain is “greatly improved” and walking again less than two months after suffering horrific brain injuries from having her head repeatedly slammed into the ground during a fight near her school, her family has revealed.

“We have been truly amazed by the progress she has made in such a short time,” Kaylee’s parents, Clint and Jaime Gain, wrote in a GoFundMe update on Tuesday.

“Physically she is doing well, walking with little to no assistance but must wear a helmet for her safety as she is still missing her bone flap,” the proud parents wrote of the 16-year-old’s health status.

The bone flap will be repaired with “another surgery” in the future, Kaylee’s parents explained.

“Cognitively Kaylee has greatly improved since first waking up from her coma however there is still a lot of work she will need to do in order to get fully back to herself prior to the incident,” they added.

Kaylee has been in the hospital since March 8, when she and another girl got into a caught-on-camera brawl near their St. Louis high school.

The footage of the altercation showed the second girl getting on top of Kaylee and repeatedly slamming her skull into the pavement while stunned peers looked on.

Kaylee was in a coma for several days before eventually regaining consciousness.

In a previous GoFundMe update, her parents shared that she had started speaking short phrases or sentences.

News

Illegal Immigrant Charged Over Hit-and-Run Crash That Killed Advisor to Dem Senator

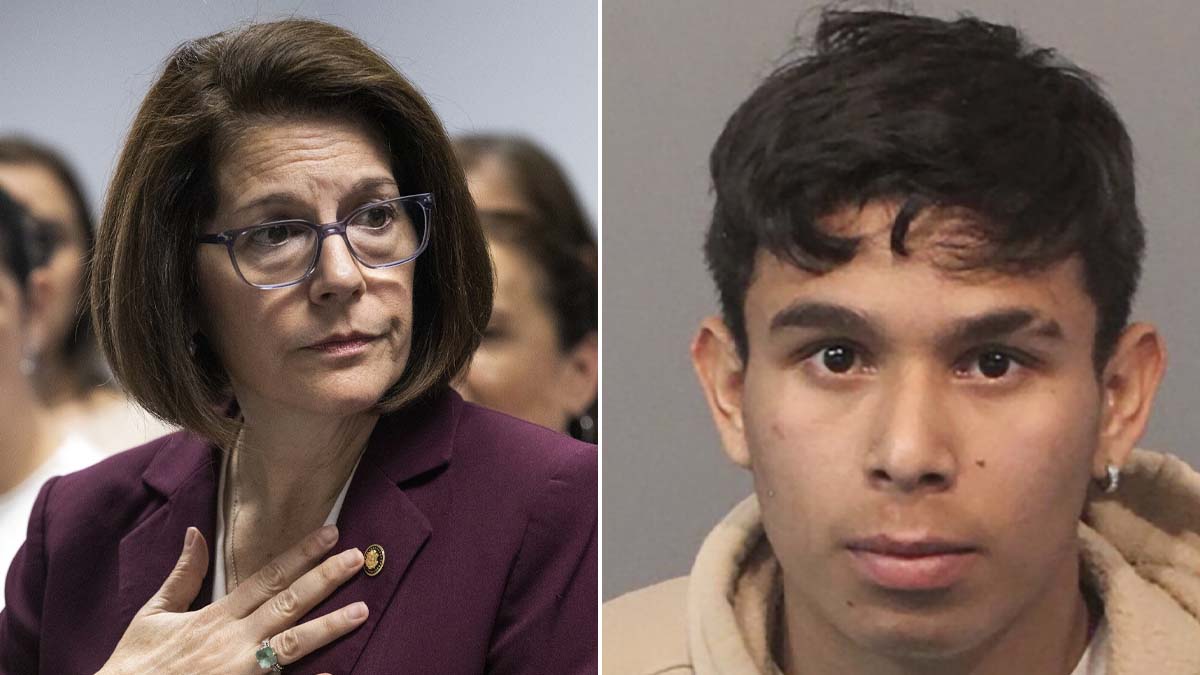

An illegal immigrant has been charged over a car crash that killed an advisor to Democratic Nevada Sen. Catherine Cortez Masto earlier this month.

The suspect, 18-year-old Elmer Rueda-Linares, was charged by police with failing to stop at the scene of an accident after a crash at 4:30 a.m on April 6 in Reno led to the death of 38-year-old Kurt Englehart, a senior state advisor to Masto. Rueda-Linares was first charged by police with felony hit-and-run, according to the Reno Gazette Journal.

According to the Department of Homeland Security, Rueda-Linares illegally entered the United States in March 2021.

“Rueda entered the United States March 12, 2021, at or near the Rio Grande City, Texas, Port of Entry without inspection by an immigration official,” DHS told the Reno Gazette Journal. “United States Customs and Border Protection arrested him, and he was later released on his own recognizance June 22, 2021.”

Immigration and Customs Enforcement placed an immigration detainer on Rueda-Linares on April 8. The suspect is currently behind bars at the Washoe County Jail with a $100,000 bail and is expected to appear before a Reno Justice Court judge Thursday afternoon.

“The occupants who fled the scene were later located by police, and the driver arrested,” authorities said in a statement after the crash. “Impairment does appear to be a factor in this crash.”

A spokesman for Masto said that she “looks forward to justice being served and has confidence in the local police and prosecutors.”

In a statement remembering Englehart, Masto said he was a “beloved figure.”

“He touched many lives and I know almost everyone in Northern Nevada has a great story about Kurt helping them or making them laugh,” the senator said . “Kurt was a dedicated public servant, a loyal friend, and a loving father.”

Republican lawmakers have called on President Joe Biden and Homeland Security Secretary Alejandro Mayorkas to take stronger actions to secure the border as reports of illegal aliens being involved in fatal crashes have continued to make national news.

Earlier this year, the House voted to impeach Mayorkas over his handling of the border, which has seen record crossings in recent years. On Wednesday, the Democrat-controlled Senate, including Masto, voted to dismiss the charges.

“There is no evidence that [Mayorkas] committed high crimes and misdemeanors, so I voted to end this waste of time,” Masto said. “Republicans could have made real policy changes, but they decided to play games and killed the bipartisan border package in favor of this frivolous impeachment.”

Masto narrowly survived a challenge from Republican Adam Laxalt in 2022, winning by less than one percentage point.

News

Homeless Build House with Garden, BBQ and Working Electricity Along LA Freeway

Homeless Californians built a house complete with rock walls, a garden, a barbecue grill, a hammock, decorative string lights, potted plants and working electricity on a strip of land wedged between a busy freeway and the Arroyo Seco in Los Angeles.

The impressive and seemingly sturdy structure stands out among the dozens of makeshift shelters, tents and tarps that those without a home have constructed along the drainage basin, as filmed by local news station KTLA.

The number of encampments built above the “dry river” has increased in recent years as 46,000 Los Angeles residents are experiencing homelessness, the station reported.

The people who live in the makeshift home on the edge of the 110 freeway would not speak to the station, but neighbors who did gave mixed reactions.

“They don’t bother me,” one nearby resident said in Spanish, noting that most of the encampment inhabitants keep to themselves.

But neighbor Mike Ancheta, who was biking by, said he “admired” the work they’ve done, though the shelters shouldn’t be there.

“This doesn’t belong here. This is public property,” Ancheta told KTLA. “But this is not what it’s supposed to be used for. This is dangerous. As you can see, someone is cooking out there, an open fire. They are stealing electricity. I mean, come on.”

The house-like encampment, however, does have two fire extinguishers in its “yard,” photos show.

“It sucks that some of these people are here,” Enrique Rodriguez said. “I do wish better for those people. [But] I cannot be sorry for the mistakes that they made.”

Yet another resident blamed Los Angeles’ rental costs.

“It’s messed up,” Ulysses Chavez told the local station.

“They should lower rent. They should lower all kinds of stuff, especially in LA.”

News

US and Chinese Scientists Are Working in China to Develop New Deadly Viruses

Lawmakers are demanding answers after it was revealed the US is sending taxpayer dollars to a Chinese army lab to make bird flu viruses more dangerous to people.

Eighteen members of Congress are demanding answers from the Department of Agriculture (USDA) about the project, which was first revealed by DailyMail.com.

It is part of a $1million collaboration between the USDA and the CCP-run Chinese Academy of Sciences – the institution that oversees the Wuhan lab at the center of the Covid lab-leak theory.

In a scathing letter to USDA Secretary Tom Vilsack last week, the bipartisan group said: ‘This research, funded by American taxpayers, could potentially generate dangerous new lab-created virus strains that threaten our national security and public health.’

The research comes as fears about bird flu rise. A farm worker in Texas caught the H5N1 strain that is racing through cattle across the US earlier this month, becoming only the second ever American to be diagnosed – and experts are bracing for more cases.

In February, it was revealed the United States government was funneling $1million to China to see if scientists could make ‘highly pathogenic avian influenza’ more contagious to mammals using gain-of-function research.

Government records showed the collaboration began in April 2021 and is scheduled to be funded through March 2026. The USDA previously told this website the project was applied for in 2019 and approved in 2020.

The research involves infecting ducks and geese with different strains of viruses to make them more infectious, and studying the viruses’ potential to ‘jump into mammalian hosts,’ according to research documents obtained by the watchdog group White Coat Waste Project and shared exclusively with this website.

It is being funded through the USDA and the main collaborators on the project are USDA Southeast Poultry Research Laboratory, the Chinese Academy of Sciences and the University of Edinburgh’s Roslin Institute – a Wuhan lab partner.

And it has been ongoing despite similar research being restricted in 2022 and growing concerns that dubious Chinese studies may have started the Covid pandemic.

Just yesterday, President Joe Biden’s administration announced it will work with 50 countries to identify and respond to infectious diseases, with the goal of preventing a pandemic that the US’ own research could actually spark.

Last week’s letter was spearheaded by Rep Nick Langworthy, a Republican from New York who serves on the House Agriculture Committee.

It states: ‘We are disturbed by recent reports about the US Department of Agriculture’s (USDA) collaboration with the Chinese Communist Party (CCP)-linked Chinese Academy of Sciences (CAS) on bird flu research.’

The CAS is the parent organization of WIV and has previously been prohibited from receiving US government money for ‘blatantly violating grant and biosafety policies, refusing to share lab notebooks and other data, and otherwise obstructing investigations into the likely role of the lab’s risky coronavirus [gain of function] research in the origin of Covid-19.’

The letter continued: ‘Recognizing the problematic behavior of CAS, our House and Senate colleagues have called for sanctions against CAS and its affiliates and for taxpayer funding to be cut for all research involving CAS.’

The signatories then requested written answers to seven questions inquiring about the potential of the research to increase transmissibility of bird flu viruses, details about specific experiments being performed, the biosafety levels of the experiments, what oversight the USDA is providing over CAS and if the FBI performed a safety risk assessment on the collaboration – and, if so, what those results were.

Bird flu is of particular concern right now because a farmer in Texas recently contracted the H5N1 strain of the virus.

The patient caught the bird flu from an infected cow, which was the first time the strain had been found in cattle.

They are only the second person to contract H5N1 after someone in Colorado caught the virus in 2022.

While there is no sign of person-to-person spread — a development that would signal the start of a human epidemic — experts say the ease with which the strain is jumping between species raises the risk of it evolving to infect people more easily.

The Centers for Disease Control and Prevention report a ‘low’ public health risk.

The virus, however, is widespread in wild birds, with sporadic infections in poultry and mammals.

Experts have previously told DailyMail.com H5N1 has the potential to spark a new pandemic.

Dr Aaron Glatt, an infectious diseases expert at Mount Sinai in New York, warned: ‘It is absolutely true that H5N1 has the potential to cause a pandemic.

‘People who work with these animals do need to be careful.

‘The more that this virus is spread, the more likely it is that it could become a strain that could mutate and start to spread from human-to-human.’

The H5N1 spreading across the world emerged in 2020 after a bird was infected with both a bird flu from domestic poultry and a virus from wild birds.

During the infection, the two viruses met in the same cell and swapped genes — in a process scientifically termed re-assortment — to create the new virus that now had multiple attributes that made it better at infecting bird cells.

It quickly spread globally, with the first cases identified in Europe — before infections were also detected in Africa, the Middle East and Asia.

This month’s letter is not the first written to the USDA from lawmakers.

Following February’s investigation, Republican Sen Joni Ernst of Iowa wrote a letter to Sec Vilsack seeking more information about the department’s ongoing funding of the research.

The letter read: ‘I was troubled to learn from the non-profit group White Coat Waste Project that USDA is supporting experiments involving a “highly pathogenic avian influenza virus” that poses a “risk to both animals and humans.”‘

Sen Ernst said in a statement to DailyMail.com at the time: ‘The health and safety of Americans are too important to just wing it, and Biden’s USDA should have had more apprehension before sending any taxpayer dollars to collaborate with [China] on risky avian flu research.

‘They should know by now to suspect “fowl” play when it comes to researchers who have ties to the dangerous Wuhan Lab, and simply switching from bats to birds causes concern that they are creating more pathogens of pandemic potential.

‘Here’s my warning: the Biden administration should be walking on eggshells until they cut off every cent going to our adversaries. We cannot allow what happened in Wuhan to happen again.’

The specific viruses the research said it will study include H5NX, H7N9 and H9N2, WCW reported.

A 2023 study described H5NX viruses as ‘highly pathogenic’ with the ability to cause neurological complications in humans.

The H7N9 strain first infected humans and animals in China in March 2013 and the World Health Organization said it is of concern ‘because most patients have become severely ill.’

The H9N2 strain has been found in doves in China and while it has a lower pathogenicity than the other strains, it can still infect humans.

Despite the concerns, a USDA spokesperson told this website it is ‘common for international researchers to conduct independent research that’s connected to the same end goal’ and that the research does not qualify as gain-of-function.

News

Senate Dems Kill Mayorkas Impeachment Trial

The Senate on Wednesday ended the impeachment trial of Homeland Security Secretary Alejandro Mayorkas, making him the second Cabinet official in history to evade a conviction and removal from office — but the first to be acquitted without evidence being presented of alleged “high crimes and misdemeanors.”

Senate Majority Leader Chuck Schumer (D-NY) convened the upper chamber in the early afternoon to swear in the 51 Democrats or independents who caucus with them and 49 Republicans as jurors, before offering a motion to dismiss the first of the charges without a trial.

The unprecedented move set off a series of objections from Republicans, with Sen. John Kennedy (R-La.) proposing a motion to adjourn the proceedings until April 30 and Senate Minority Leader Mitch McConnell (R-Ky.) rising to oppose Schumer’s point of order that the first impeachment article was “unconstitutional.”

“At this point, in any trial in the country, the prosecution presents the case, the defense does the same and the jury listens,” McConnell said. “But the Senate has not had the opportunity to perform this duty.”

GOP senators brought other objections on the second article, pushing for a closed session, asking to adjourn until after the 2024 election and questioning whether they were setting a precedent of absolving federal officials of potential felonies without a trial.

Senate Minority Whip John Thune (R-SD) also offered a direct challenge to Schumer’s procedural attempt to kill the trial. Each Republican objection fell, with all 51 Democrats voting against them.

Alaska GOP Sen. Lisa Murkowski voted present on the question of dismissing the first article and against dismissing the second, whereas all other members voted on the party line — letting both fall, 51-49.

After nearly two hours of deliberations, Mayorkas became the first impeached government official in US history to dodge a trial, which had followed 21 impeachments for three presidents — including twice-charged former President Donald Trump — a Cabinet secretary, a senator and many federal judges.

“They’re gonna try to sweep this under the rug and act as if the Biden border crisis never existed. But the evidence is very plain,” Sen. John Cornyn predicted to Fox News on Wednesday.

Schumer indicated in a Senate floor speech on Tuesday that he wanted “to address this issue as expeditiously as possible” and that “impeachment should never be used to settle a policy disagreement.”

The House voted 214-213 in February to impeach Mayorkas, 64, for his “willful and systemic refusal to comply” with federal immigration law and lying to Congress about the Biden administration maintaining a “secure” border.

Eleven House impeachment managers, led by Homeland Security chairman Mark Green (R-Tenn.), delivered the two articles of impeachment to the Senate on Tuesday.

The Senate had an obligation to conduct a full trial, hear the evidence, and render a verdict,” Green said in a statement following the Senate vote. “However, just as Secretary Mayorkas has grievously failed in his constitutional duty, now so has the Senate. Instead of addressing the serious charges against Secretary Mayorkas, the upper chamber has chosen to neglect its responsibility.

“This is an unprecedented failure by the Senate to do its duty, which, for the first time in our history, has outright refused to conduct an impeachment trial when given the opportunity to do so,” Green added. “This is not only a tacit approval of Secretary Mayorkas’ assault on our constitutional order, but an insult to the millions of Americans who want to end this crisis and hold accountable those who intentionally created it. Sadly, the Senate has now failed on both fronts.”

“Today’s decision by the Senate to reject House Republicans’ baseless attacks on Secretary Mayorkas proves definitively that there was no evidence or Constitutional grounds to justify impeachment,” DHS spokeswoman Mia Ehrenberg said in a statement.

“As he has done throughout more than 20 years of dedicated public service, Secretary Mayorkas will continue working every day to enforce our laws and protect our country. It’s time for Congressional Republicans to support the Department’s vital mission instead of wasting time playing political games and standing in the way of commonsense, bipartisan border reforms.”

Record-breaking numbers of migrants have crossed illegally into the US every year that Biden has been in office, with a total of more than 9 million encountered at land borders, according to US Customs and Border Protection statistics.

More than 7.5 million migrants have been caught along the southern border, and another 1.8 million have evaded apprehension but nevertheless been observed making the illegal entries.

The massive influx has led to a backlog of more than 3 million cases of asylum seekers in the US, the House impeachment resolution noted.

The impeachment articles also alleged that Mayorkas failed to enforce the Immigration and Nationality Act of 1952 and misled Congress about the Department of Homeland Security having “operational control” of the border.

In a Sept. 30, 2021, memo, the secretary had also changed policies for detaining and expelling migrants, allowing his department to institute a de facto “catch and release” policy for millions of illegal border crossers, the resolution states.

In March 1876, the House impeached Secretary of War William Belknap on charges of corruption, but he handed in his resignation to President Ulysses S. Grant hours before the vote was held.

House managers and more than 40 witnesses argued that Belknap’s resignation shouldn’t keep the upper chamber from voting to convict — but the Senate acquitted him on five articles of impeachment for taking kickbacks in exchange for a political appointment.

News

WATCH: Judge, Fani Willis Prosecutor Get Into Heated Argument in Court

A Georgia prosecutor from Fulton County District Attorney Fanni Willis’ office got into a shouting match Wednesday with the judge overseeing the trial of rapper Young Thug as the pair argued over evidentiary matters.

Chief Deputy District Attorney Adriane Love and Fulton County Judge Ural Glanville got into a heated shouting match when the judge ruled that the evidence Love wanted to introduce would be excluded.

“Why didn’t we file this stuff months ago and let’s wind it out and air it out at that point in time,” Glanville told the defense before asking Love about the matter.

The judge asked Love if prosecutors had discussions about the evidence before excluding the material. As Love began voicing her frustration, Glanville said: “Well then you all should have gotten yourself together beforehand.”

“Have a seat, madam. Have a seat,” he said after telling court officers to summon the jury, which was not present during the exchange. “You better exclude that and next time, make sure you’re prepared.”

Love argued that her team tried discussing the evidence with the defense.

“Oh it’s going to be inadmissible right now,” Glanville replied. “I am not going to have any more discussion about this, madam.”

“Judge, we talked to them this morning about that! And I attempted to talk to them earlier this week!” Love shouted. “Your honor, so the court punishes the state because (of) the defense?”

“I’m not punishing anybody,” the judge replied. “But prior preparation prevents poor performance.”

“We prepared, judge! That’s why I sent them what I sent them last week! A whole week and a half ago! Two weeks, your honor!” Love yelled before Glanville told her the jury was coming into the room.

Watch:

Judge DESTROYS Fani Willis’ Prosecutor – He’s Had Enough!

Watch as Fulton County Assistant District Attorney Adriane Love goes nuts, argues and yells at Judge Ural Glanville when she doesn’t get her way during the YSL trial involving rapper Young Thug.

This should’ve been… pic.twitter.com/rDTrOVCO9e

— Conservative Brief (@ConservBrief) April 17, 2024

Love’s boss, Fani Willis, has garnered national attention for her prosecution of former President Trump for alleged election interference.

Willis was accused of having an “improper” relationship with Nathan Wade, the special counsel she hired to prosecute Trump. She was also accused of financially benefiting from the position Wade held in her office. Both Willis and Wade denied the allegations.

Wade resigned from the case, allowing Willis to stay on it.

Love is the lead prosecutor in the trial against Young Thug, an Atlanta-based hip-hop artist, who’s given name is Jeffery Lamar Williams.

Williams and six others are charged in connection with participating in a criminal street gang responsible for violent crimes. In addition, he is accused of racketeering conspiracy as well as drug and gun charges.

Young Thug achieved tremendous success after starting to rap as a teenager and serves as CEO of his own record label, Young Stoner Life, or YSL. Artists on his record label are considered part of the “Slime Family,” and a compilation album, “Slime Language 2,” rose to No. 1 on the charts in April 2021.

But prosecutors say YSL also stands for Young Slime Life, which they allege is an Atlanta-based violent street gang affiliated with the national Bloods gang and founded by Young Thug and two others in 2012. Prosecutors say people named in the indictment are responsible for violent crimes — including killings, shootings and carjackings — to collect money for the gang, burnish its reputation and expand its power and territory.

News

Biden Claims His Uncle Was Eaten by Cannibals During WWII — But Military Has Different Story

President Joe Biden appeared to suggest that cannibals ate his uncle after he was shot down during World War II, though military records say otherwise.

Speaking with reporters on Wednesday in Scranton, Pennsylvania, Biden twice recalled the story of his uncle, Ambrose Finnegan, who served in the U.S. Army Air Forces in the Pacific theater of World War II.

The president claimed that he was shot down over Papua New Guinea in an area infested with cannibals.

“He flew single-engine planes, reconnaissance flights over New Guinea. He had volunteered because someone couldn’t make it. He got shot down in an area where there were a lot of cannibals in New Guinea at the time,” Biden said.

“They never recovered his body, but the government went back when I went down there, and they checked and found some parts of the plane.”

Watch:

Biden has a new story: Uncle Bosey got shot down in a plane and was possibly eaten by African cannibals. pic.twitter.com/9cSP29GSxx

— End Wokeness (@EndWokeness) April 17, 2024

Biden used the story as a roundabout way to bash Donald Trump, citing a disputed story claiming that the former president refused to visit a cemetery for American soldiers in France because he thought they were “suckers” and “losers.”

Military records contradicted nearly every detail of Biden’s story about his uncle, instead noting that Finnegan’s plane crashed in the ocean due to engine failure.

“For unknown reasons, this plane was forced to ditch in the ocean off the north coast of New Guinea,” a report from the Department of Defense’s POW/MIA Accounting Agency said.

“Both engines failed at low altitude, and the aircraft’s nose hit the water hard. Three men failed to emerge from the sinking wreck and were lost in the crash. One crew member survived and was rescued by a passing barge. An aerial search the next day found no trace of the missing aircraft or the lost crew members.”

The plane was also cited as an A-20 Havoc, a two-engined plane.

In his remarks, Biden also claimed that the government conducted a search “when I went down there,” finding parts of the plane.

In reality, the president caused a diplomatic rift with Papua New Guinea when he scrapped plans to visit last year. No U.S. president has yet visited the island nation, and there are no records of any search that found parts of Finnegan’s plane.

News

Google Fires 28 Employees Involved in Sit-In Protest Over $1.2B Israel Contract

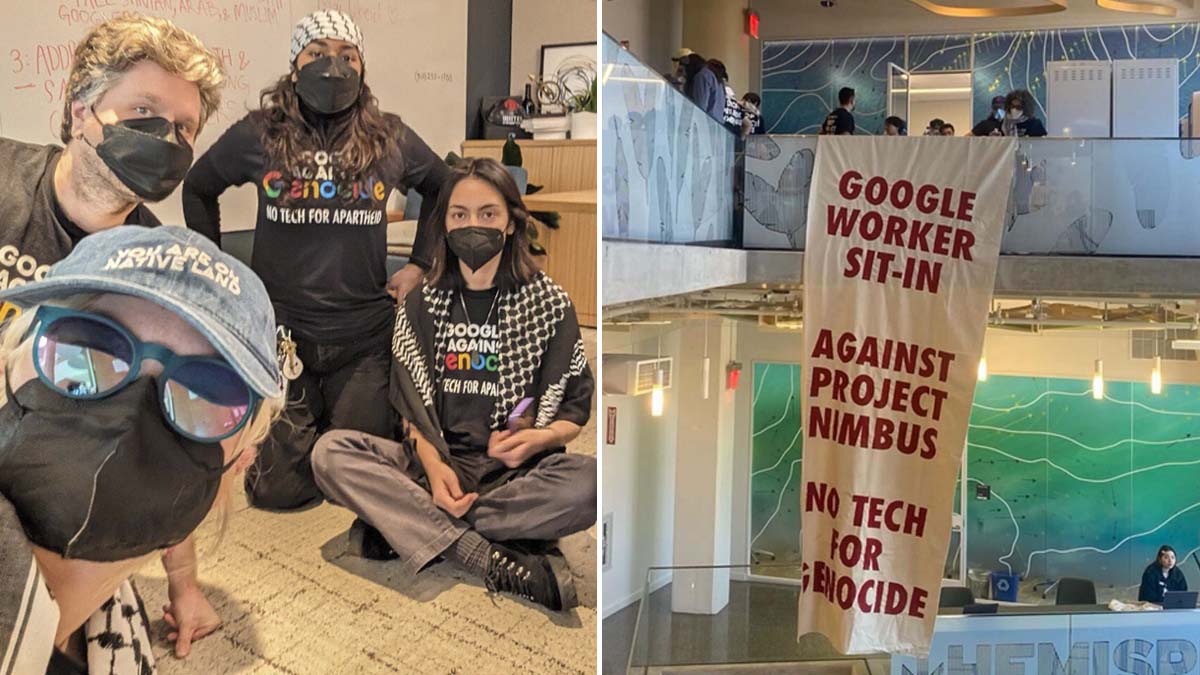

Google has fired 28 employees over their participation in a 10-hour sit-in at the search giant’s offices in New York and Sunnyvale, California, to protest the company’s $1.2 billion cloud contract with Israel, The Post has learned.

The unruly staffers — who had donned traditional Arab headscarves as they stormed and occupied the office of a top executive in California on Tuesday — were terminated late Wednesday after an internal investigation, Google vice president of global security Chris Rackow said in a companywide memo.

“They took over office spaces, defaced our property, and physically impeded the work of other Googlers,” Rackow wrote in the memo obtained by The Post. “Their behavior was unacceptable, extremely disruptive, and made co-workers feel threatened.”

“Following investigation, today we terminated the employment of twenty-eight employees found to be involved. We will continue to investigate and take action as needed,” Rackow said in the memo.

“Behavior like this has no place in our workplace and we will not tolerate it. It clearly violates multiple policies that all employees must adhere to – including our code of conduct and policy on harassment, discrimination, retaliation, standards of conduct, and workplace concerns.”

Rackow added that the company “takes this extremely seriously, and we will continue to apply our longstanding policies to take action against disruptive behavior – up to and including termination.”

It couldn’t immediately be learned if all nine arrested employees were among those who were fired. Google had earlier placed the employees on administrative leave and cut their access to internal systems.

The pro-Palestinian staffers are affiliated with a group called No Tech For Apartheid, which has been critical of Google’s response to the Israel-Hamas war.

The impacted workers blasted Google over the firings in a statement shared by No Tech For Apartheid spokesperson Jane Chung.

“This evening, Google indiscriminately fired 28 workers, including those among us who did not directly participate in yesterday’s historic, bicoastal 10-hour sit-in protests,” the workers said in the statement.

“This flagrant act of retaliation is a clear indication that Google values its $1.2 billion contract with the genocidal Israeli government and military more than its own workers — the ones who create real value for executives and shareholders.”

“Sundar Pichai and Thomas Kurian are genocide profiteers,” the statement added, referring to Google’s CEO and the CEO of its cloud unit, respectively.

“We cannot comprehend how these men are able to sleep at night while their tech has enabled 100,000 Palestinians killed, reported missing, or wounded in the last six months of Israel’s genocide — and counting.”

The group posted several videos and livestreams of the protests on its X account — including the exact moment that employees were issued final warnings and arrested by local police for trespassing.

“These protests were part of a longstanding campaign by a group of organizations and people who largely don’t work at Google,” the spokesperson said in a statement.

“A small number of employee protesters entered and disrupted a few of our locations. Physically impeding other employees’ work and preventing them from accessing our facilities is a clear violation of our policies, and completely unacceptable behavior.”

“We have so far concluded individual investigations that resulted in the termination of employment for 28 employees, and will continue to investigate and take action as needed,” the spokesperson added.

Earlier, an NYPD spokesperson said the Tuesday protest “involved approximately 50 participants” and confirmed “four arrests were made for trespassing inside the Google building.”

Separately, the Sunnyvale Department of Public Safety said the protest in California had “consisted of around 80 participants.”

Five staffers who refused to leave the Google office were “arrested without incident for criminal trespassing,” booked and released, a spokesperson added.

The protesters demanded that Google pull out of a $1.2 billion “Project Nimbus” contract — in which Google Cloud and Amazon Web Services provide cloud-computing and artificial intelligence services for the Israeli government and military.

Critics at the company raised concerns that the technology would be weaponized against Palestinians in Gaza.

The demonstrators stormed the personal office of Google Cloud CEO Thomas Kurian in Sunnyvale.

Kurian’s custom-made, framed Golden State Warriors jersey was visible on the office wall in the background of the livestream, and employees wrote a list of their demands on his white board.

The pro-Palestinian employees, who are affiliated with a group called No Tech For Apartheid, posted several videos and livestreams of the protests — including the moment they were issued final warnings and arrested by local police for trespassing.

The companywide memo can be read in its entirety below.

Googlers,

You may have seen reports of protests at some of our offices yesterday. Unfortunately, a number of employees brought the event into our buildings in New York and Sunnyvale. They took over office spaces, defaced our property, and physically impeded the work of other Googlers. Their behavior was unacceptable, extremely disruptive, and made co-workers feel threatened. We placed employees involved under investigation and cut their access to our systems. Those who refused to leave were arrested by law enforcement and removed from our offices.

Following investigation, today we terminated the employment of twenty-eight employees found to be involved. We will continue to investigate and take action as needed.

Behavior like this has no place in our workplace and we will not tolerate it. It clearly violates multiple policies that all employees must adhere to – including our Code of Conduct and Policy on Harassment, Discrimination, Retaliation, Standards of Conduct, and Workplace Concerns.

We are a place of business and every Googler is expected to read our policies and apply them to how they conduct themselves and communicate in our workplace. The overwhelming majority of our employees do the right thing. If you’re one of the few who are tempted to think we’re going to overlook conduct that violates our policies, think again. The company takes this extremely seriously, and we will continue to apply our longstanding policies to take action against disruptive behavior – up to and including termination.

You should expect to hear more from leaders about standards of behavior and discourse in the workplace.

Chris

News

China Lobbies Congress Behind Closed Doors on TikTok

The Chinese Embassy has held meetings with congressional staff to lobby against the legislation that would force a sale of TikTok, according to two of the Capitol Hill staffers.

TikTok, which is owned by the Beijing-based company ByteDance, has repeatedly denied a relationship with the Chinese government and sought to distance itself from its Chinese origins. But now, with the fate of legislation to force the sale of the company facing an uncertain path forward in the Senate, the Chinese Embassy appears to be leveraging its political weight to protect the company’s future in the United States.

The meetings with Hill staff were initiated by the Chinese Embassy in outreach that did not initially mention TikTok, according to the congressional staffers, one of whom worked for the House and the other for the Senate, and who were granted anonymity to discuss conversations that they were not authorized to reveal publicly. The meetings, which took place with Chinese diplomats, were held after the House in March overwhelmingly voted in favor of the Protecting Americans from Foreign Adversary Controlled Applications Act, the legislation that would force ByteDance to sell TikTok.

Additionally, in a separate phone call to set up a meeting, an embassy official said that the Chinese ambassador was interested in discussing, among other matters, the House’s TikTok bill, according to a third staffer, a Democratic Senate aide who was approached.

The embassy downplayed the national security concerns with TikTok in both meetings, the two staffers said, and sought to align the app with American interests: In one meeting, the embassy said a ban on TikTok would harm U.S. investors who hold some ownership in ByteDance. In the other, the embassy emphasized that not all ByteDance board members were Chinese nationals.

The embassy also sought to claim the company as Chinese, the staffers said, despite TikTok’s public efforts to distance itself from the origin of its founders. TikTok, unlike ByteDance, is based in Singapore and the United States. In one of the meetings, the embassy argued that the legislation amounted to a forced data transfer of a Chinese company, according to the House staffer. In the other, the embassy argued that the effort was not fair to a Chinese company because the U.S. would not treat a company with a different national origin the same way, according to the Senate staffer.

TikTok said in a statement that the embassy meetings were “news to us, and it’s absurd to ask us to comment on anonymous sources we know nothing about.”

“Since the bill’s introduction, we’ve been publicly vocal about why we oppose the ban bill,” said Alex Haurek, a TikTok spokesperson. “This so-called reporting doesn’t pass the smell test and it’s irresponsible for Politico to print it.”

The Chinese Embassy, however, did not deny having held the meetings. In a statement, embassy spokesperson Liu Pengyu said that the “Chinese Embassy in the US tries to tell the truth about the TikTok issue to people from all walks of life in the US.”

“This is not about lobbying for a single company,” the spokesperson added, “but about whether all Chinese companies can be treated fairly.”

The statement went on to repeat some of the arguments that staffers said had been made at the meetings, including pushing back on national security concerns, and emphasizing international investment in ByteDance.

The statement also emphasized that although TikTok’s operation is legal, the United States “has tried every means to use state power to suppress it.”

TikTok has armed itself with dozens of lobbyists and spent millions of dollars to push back on the narrative around the company in Washington, where the app’s opponents have repeatedly argued that it’s a powerful tool for China to influence sentiment in the United States. The company has also spent millions on advertisements to rally public support against the legislation and leveraged its consumer base via push alerts that allowed the app’s users to easily call Congress. The conservative Club for Growth, the political kingmaking group funded in part by major ByteDance investor Jeff Yass, has also pushed lawmakers on the bill.

The broad efforts to sway congressional offices may ultimately prove successful, as the Senate remains at an impasse. Sen. Maria Cantwell (D-Wash.), chair of the Senate Commerce Committee, has been negotiating with other offices about the bill’s language, as part of an effort to solidify its legal standing. The House bill’s champion, Mike Gallagher (R-Wis.), chair of the Select Committee on the Chinese Communist Party, will leave the House this month. The forced sale of TikTok is expected to be included in a series of bills released by the House Speaker Mike Johnson on Wednesday around foreign aid and foreign adversaries.

Lobbying from diplomats is largely shrouded from public view, as they are not usually covered by the rules on transparency into foreign efforts to influence U.S. politics. The Foreign Agents Registration Act includes provisions that expressly exempt some embassy officials, said David Laufman, who previously oversaw enforcement of the foreign influence law at the Department of Justice.

“If there were other parties assisting them, like U.S. lobbying firms or strategic communications firms crafting message and preparing talking points, things like that, [those parties] might have registration risk,” said Laufman. “Embassy officials here would not.”

One of those staffers who attended the meetings with Chinese officials noted that the embassy had also previously tried to fight U.S. actions against another Chinese technology company, Huawei.

Publicly, China has also been critical of Congress’ actions on TikTok. In the wake of the House bill’s passage, China’s Ministry of Foreign Affairs said the legislation “puts the US on the wrong side of the principles of fair competition and international trade rules.”

Michael Sobolik, senior fellow in Indo-Pacific Studies at the American Foreign Policy Council, argued that the revelations of the embassy’s lobbying campaign underscored the need to separate TikTok from its Chinese parent.

“For once, Chinese diplomats have done America a favor,” said Sobolik, the author of a book on U.S.-China relations called “Countering China’s Great Game.” “By lobbying congressional staff to protect TikTok’s relationship with ByteDance, [People’s Republic of China] officials are revealing how valuable TikTok is to the Chinese Communist Party. Losing control of the app would neuter Beijing’s most potent weapon against Americans.”

News

What’s Inside the $95 Billion Package for Ukraine and Israel

Speaker Mike Johnson has unveiled a long-awaited package of bills that will provide military aid to Ukraine and Israel, replenish U.S. weapons systems and give humanitarian assistance to civilians in Gaza.

The package totals $95.3 billion in spending, which matches the total that the Senate passed in mid-February. But there are also a few differences with the Senate bill designed to win over some House conservatives.

Here’s a look at what is in the bills that Johnson hopes to pass by this weekend.

UKRAINE

The aid to support Ukraine totals about $61 billion. Republicans on the House Appropriations Committee said that more than a third of that amount would be dedicated to replenishing weapons and ammunition systems for the U.S. military.

The overall amount of money provided to Ukraine for the purchase of weapons from the U.S. is roughly the same in the House and Senate bills — $13.8 billion.

The main difference between the two packages is that the House bill provides more than $9 billion in economic assistance to Ukraine in the form of “forgivable loans.” The Senate bill included no such provision seeking repayment.

The president would be authorized to set the terms of the loan to Ukraine and also be given the power to cancel it. Congress could override the cancellation but would have to generate enough votes to override a veto, a high bar considering how the two chambers are so evenly divided.

Johnson, as he seeks GOP support for the package, noted that former President Donald Trump has endorsed a “loan concept.”

He also noted that the House package includes a requirement for the Biden administration to provide a plan and a strategy to Congress for what it seeks to achieve in Ukraine. The plan would be required within 45 days of the bill being signed into law. House Republicans frequently complain that they have yet to see a strategy from Biden for winning the war.

The bill said the report from the administration must be a multiyear plan that spells out “specific and achievable objectives.” It also asked for an estimate of the resources required to achieve the U.S. objectives and a description of the national security implications if the objectives are not met.

ISRAEL

Aid in the legislation to support Israel and provide humanitarian relief to citizens of Gaza comes to more than $26 billion. The amount of money dedicated to replenishing Israel’s missile defense systems totals about $4 billion in the House and Senate bills. An additional $2.4 billion for current U.S. military operations in the regions is also the same in both bills.

Some conservatives have been critical of the aid for Gaza. At the end of the day, though, Johnson risked losing critical Democratic support for the package if Republicans had excluded it. The humanitarian assistance comes to more than $9 billion for Gaza, where millions of Palestinians face starvation, lack of clean water and disease outbreaks.

INDO-PACIFIC

The investments to counter China and ensure a strong deterrence in the region come to about $8 billion. The overall amount of money and the investments in the two bills is about the same with a quarter of funds used to replenish weapons and ammunition systems that had been provided to Taiwan.

News

High School Student Suspended for Saying “Illegal Alien” in Class

A North Carolina high school student has been suspended for using the phrase ‘illegal alien’ in class.

Christian McGhee, 16, was suspended for three days from Central Davidson High School, after using the term during a classroom discussion about word meanings.

Christian questioned the term ‘alien’ in an assignment, asking if it referred to ‘space aliens or illegal aliens without green cards,’ as reported by the Carolina Journal.

His comment reportedly offended another student who physically threatened McGhee, leading to the involvement of school authorities.

‘I didn’t make a statement directed towards anyone — I asked a question,’ Christian told the Carolina Journal.

‘I wasn’t speaking of Hispanics because everyone from other countries needs green cards, and the term ‘illegal alien’ is an actual term that I hear on the news and can find in the dictionary,’ he added.

His suspension could impact his chance of securing an athletic scholarship for college as he played on his school’s track and cross country teams.

His mother, Leah McGhee, said that despite their efforts, the assistant principal has been unwilling to remove the infraction from Christian’s record.

‘Because of his question, our son was disciplined and given THREE days OUT of school suspension for ‘racism,’ wrote Christian’s mother in the email, reported by the Carolina Journal.

‘Christian is devastated and concerned that the racism label on his school record will harm his future goal of receiving a track scholarship. We are concerned that he will fall behind in his classes due to being absent for three consecutive days.’

State Senator Steve Jarvis, representing Davidson County, has reached out to the school district’s superintendent, urging officials to look for the best outcome.

However, Jarvis refrained from taking a stance on the issue, and explained that he needed to understand all perspectives involved.

‘I do not see that that would be an offensive statement, just in getting clarification,’ he said. ‘But there again, I don’t know. I don’t know the situation of this particular incident.’

News

Speaker Johnson Moves on Foreign Aid. Possibly Triggering Vote to Oust Him.

House Speaker Mike Johnson is moving ahead on a foreign aid plan that has roiled his conference and prompted two Republicans to push an effort to oust him from the chamber’s top job.

But instead of the complex four-part plan he floated this week, Johnson now intends to try to pass five bills — one each for aid to Ukraine, Israel, and Indo-Pacific allies — as well as a GOP wish list of foreign policy priorities and a fifth stand-alone bill to address widespread Republican demands to strengthen the southern U.S. border.

The new approach is risky and could blow up on the speaker, whose six-month-old hold on the gavel is being threatened by Rep. Marjorie Taylor Greene’s (Ga.) promise to move a motion to topple Johnson (R-La.) if he puts Ukraine aid on the floor, something many Republicans object to.

Johnson told Republicans in a text to colleagues Wednesday morning: “After significant Member feedback and discussion” this week, the House will move ahead with his plan, with some significant changes. He intends to release bill text on Ukraine, Israel and for Indo-Pacific allies earlier Wednesday, and language for the GOP wish list and border later Wednesday.

The three separate bills that fund military aid for Israel, Ukraine and Taiwan largely mirror the $95 billion Senate-passed supplemental. It turns a portion of the aid, the money sent directly to Ukraine, into a loan, which attempts to satisfy Republicans. It also includes just over $9 billion in humanitarian aid for Gaza, the West Bank, Ukraine and other places in need, which was a demand of Democrats.

Success is anything but guaranteed for Johnson, both on the foreign aid package and keeping his job. Timing on the votes, also, is up in the air — even as members were slated to head home for a one-week recess Thursday.

“The congressman has the flexibility to stay and support the aid package on Saturday,” his office said Wednesday.

The House Freedom Caucus has already panned the proposal. Johnson is “surrendering” on the border, the group tweeted in response to Johnson’s plan. “This flies in the face of every promise Republicans have told you” and they care more about “funding Ukraine than they do securing our own borders.”

Yet Johnson is moving the separate border package in an attempt to appease his unruly conference, many of whom have demanded that the border be secure before funding is sent to Ukraine and other allies.

Keeping border security separate from the foreign aid package is an attempt by Johnson to give both pieces of legislation a greater chance of passing. The national security bill will likely need Democratic support because of the large number of Republicans who don’t want to fund Ukraine — while Johnson aims to pass the border security bill with just Republican support, hoping to satisfy demands from all corners of his conference and send all bills to the Senate.

But in an almost four-hour meeting between Johnson and his allies Tuesday night — before this latest plan was released — Republicans left demoralized after failing to concoct a plan that would ensure enough of them support sending the package to the floor without having to rely on Democrats. Multiple people familiar with the meeting, who spoke on the condition of anonymity to discuss internal dynamics, said the meeting enlightened them and Johnson about what moving on his plan would mean for his future: It could al lead to his ouster.

“The battle lines were very clear at the end,” one Republican said. “It was very clear [the motion to vacate] will be brought if the speaker’s plan proceeds.”

Greene and Rep. Thomas Massie (R-Ky.) are supporting the motion to remove Johnson from the speakership after he relied on Democrats to pass several bills that failed to unite Republicans. If the motion were to be considered under special rules, the House would have 48 hours to vote on the question to oust the speaker.

News

NPR Whistleblower Uri Berliner Resigns

Longtime NPR editor Uri Berliner, who was suspended after blowing the whistle on liberal bias at the organization, announced Wednesday he has resigned.

“I am resigning from NPR, a great American institution where I have worked for 25 years. I don’t support calls to defund NPR. I respect the integrity of my colleagues and wish for NPR to thrive and do important journalism. But I cannot work in a newsroom where I am disparaged by a new CEO whose divisive views confirm the very problems at NPR I cited in my Free Press essay,” Berliner wrote in a statement published on X.

Berliner was referring to Katherine Maher, who took over last month as President and CEO and has gone viral for past social media posts showing far-left personal views.

Berliner recently penned a piece in the Free Press that criticized NPR’s coverage of Russiagate, the COVID lab leak theory, Hunter Biden’s scandalous laptop, embrace of the theory of systemic racism and accused the organization of downplaying antisemitism following Oct. 7.

Berliner also wrote that registration records in 2021 showed an astonishing disparity between Democrats and Republicans in the NPR newsroom in Washington, D.C., and that staffers were out to hurt the presidency of Donald Trump. Berliner, who said he voted against Trump twice, even said “one of NPR’s best and most fair-minded journalists” said it was good to not cover the Hunter Biden laptop story because it could benefit Trump in 2020.

His Free Press piece angered colleagues, with some telling in-house media reporter David Folkenflik they didn’t want to work with him any longer. Berliner was suspended for five days without pay and NPR told him it was a “final warning” and he would be shown the door if he violated NPR’s policy about working with outside news organizations going forward. Instead, he walked away on his own terms.

My resignation letter to NPR CEO @krmaher pic.twitter.com/0hafVbcZAK

— Uri Berliner (@uberliner) April 17, 2024

Berliner’s work has received a Peabody Award, a Loeb Award, Edward R. Murrow Award, and a Society of Professional Journalists New America Award, according to NPR’s website.

Many other NPR figures, including “Morning Edition” host Steve Inskeep, publicly rebuked Berliner’s conclusions.

Reached for comment on Berliner’s resignation, a spokesperson said, “NPR does not comment on individual personnel matters.”

An NPR spokesperson last week directed Fox News Digital to a memo to staff by editor-in-chief Edith Chapin, where she said she and her team “strongly disagree” with the veteran editor’s assessment of the quality of NPR’s journalism and integrity.

“We’re proud to stand behind the exceptional work that our desks and shows do to cover a wide range of challenging stories. We believe that inclusion — among our staff, with our sourcing, and in our overall coverage — is critical to telling the nuanced stories of this country and our world,” she wrote as part of a lengthy memo.

NPR has also stood by Maher, who showed support for Hillary Clinton and Joe Biden’s presidential runs while regularly sharing far-left talking points and criticizing Donald Trump on social media before landing the NPR top job.

“This is a bad faith attack that follows an established playbook, as online actors with explicit agendas work to discredit independent news organizations,” an NPR spokesperson told Fox News Digital of the newly surfaced posts.

News

Boeing Whistleblower Testifies

A Boeing whistleblower told a Congress hearing that he received threats against his life, while another said a probe into the door of an Alaskan Airlines flight that blew out was a ‘criminal cover up’.

Sam Salehpour and Ed Pierson were giving evidence to a hearing on Wednesday around the beleaguered company and their ongoing safety crisis.

Salehpour works as a Quality Engineer for the company, and claimed that sections of the 787 Dreamliner jets have not been properly secured.

While Pierson, Executive Director of The Foundation for Aviation Society and former Boeing manager, had previously warned of ‘chaotic manufacturing’ at the company.

During the hearing on Wednesday, it was revealed that Salehpour had faced threats from his supervisor after he attempted to discuss issues with the jets.

He also said that the safety situation at Boeing was like the company playing ‘Russian roulette’ with peoples lives, adding: ‘We never know exactly when it’s going to happen, when or where or how it’s going to happen.’

Pierson said in written testimony that he believes the investigation into the 737 Max that had its door blown out mid flight was being covered up.

Pierson said: ‘Last Wednesday, the NTSB Chair reiterated to Congress that Boeing has said there are no records documenting the work associated with the removal of the Alaska Airlines door.

‘In my opinion this is a criminal cover-up. Records do exist documenting in detail the hectic work done on the Alaska Airlines airplane and Boeing’s corporate leaders know it too.

‘They fought to withhold these same damning records after the two MAX crashes. I know this Alaska airplane documentation exists because I personally passed it to the FBI.’

While Salehpour told the hearing: ‘I have even been subjected to threats of violence from my supervisor after I attempted to discuss the problems in a meeting in April 9 2023.

‘After the meeting, my supervisor said to me, ‘I would have killed anyone who said what you said if it was from some other group, I would tear them apart.”

“I want to make clear that I have raised these issues over 3 years. I was ignored. I was told not to create delays. I was told, frankly, to shut up.”

WATCH: Boeing Whistleblower Sam Salehpour testifies Wednesday in front of Congress. pic.twitter.com/BSnkD6Itfq

— MSNBC (@MSNBC) April 17, 2024

He added: ‘I provided evidence of this threat as part of an ethics complaint, but no action has been taken and I continue to report to a supervisor who has threatened me with bodily injury for speaking out.’

He also added: ‘Boeing officials attempted to intimidate and retaliate against me by sidelining me from my job duties and excluding me from key meetings.’

As well as the threats being made against Salehpour, Senator Richard Blumenthal held up a picture of a large nail through a car tire.

Directing his questioning towards Salehpour, he said: ‘That bolt was inserted as a threat, perhaps as a risk to you.’

Salehpour explained: ‘I was losing air in my tire and I bring it to someone, they said you have a nail in the tire. That was about a one month old tire.

‘The gentleman told me it wasn’t picked up through normal driving. The nail was inserted in there, I believe it happened at work.’

Salehpour was questioned further on this, and asked by Senator Roger Marshall if he believed the tire incident and the threats was part of efforts by the company to silence and prevent him from sharing his story.

Salehpour said: ‘I think the retaliation was somebody calling me on my personal phone time after time. This is my personal phone.

‘My boss was calling me there for forty minutes, he berated me and chewed me out. I have a work phone that he could use but he called me on my personal phone.

‘It reminds me of people calling you on your personal phone to let you know they know where you live, they know where you are, and they can hurt you.

‘After the threats, and after this, it really scares me – believe me. But I am at peace.’

His lawyers say that Boeing has ignored his concerns and prevented him from talking to experts about fixing the problems.

On Tuesday night, Salehpour told NBC News that the jets should be grounded on account of ‘fatal flaws’ that could cause the plane to fall apart mid air.

When asked by the outlet if he would put his own family on a 787, he replied: ‘Right now, I would not.’

The Democrat who chairs the panel and its senior Republican have asked Boeing for troves of documents going back six years.

The lawmakers are seeking all records about manufacturing of Boeing 787 and 777 planes.

This will include any safety concerns or complaints raised by Boeing employees, contractors or airlines.

A Boeing spokesperson said the company is cooperating with the lawmakers’ inquiry and offered to provide documents and briefings.

The company says claims about the 787’s structural integrity are false. Two Boeing engineering execs said this week that in both design testing and inspections of planes – some of them 12 years old – there have been no findings of fatigue or cracking in the composite panels.

They suggested that the material, formed from carbon fibers and resin, is nearly impervious to fatigue that is a constant worry with aluminum fuselages.

The Boeing officials also dismissed another of Salehpour’s allegations: that he saw factory workers jumping on sections of fuselage on 777s to make them align.

Salehpour is the latest whistleblower to emerge with allegations about manufacturing problems at Boeing.

In March, whistleblower John Barnett was found dead in his truck in South Carolina while going throwing a whistleblowing suit against his former employer.

The 62-year-old alleged that under-pressure workers were deliberately fitting sub-standard parts to aircraft while on the assembly line.

Barnett had alleged that second-rate parts were literally removed from scrap bins, before being fitted to planes that were being built to prevent delays.

A 2017 review by the FAA upheld some of his concerns, requiring Boeing to take action.

He had just given a deposition to Boeing’s lawyers for the case the week before his death, his attorney Brian Knowles said.

Barnett’s job for 32 years was overseeing production standards for the firm’s planes – standards he said were not met during his four years at the then-new plant in Charleston from 2010 to 2014.

Barnett claimed he alerted superiors at the plant about his misgivings, but no action was ever taken. Boeing denied this, as well as his claims.

The company has been pushed into crisis mode since a door-plug panel blew off a 737 Max jetliners during an Alaska Airlines flight in January.

Investigators are focusing on four bolts that were removed and apparently not replaced during a repair job in Boeing´s factory.

The company faces a criminal investigation by the Justice Department and separate investigations by the FAA and the National Transportation Safety Board.

CEO David Calhoun, who will step down at the end of the year, has said many times that Boeing is taking steps to improve its manufacturing quality and safety culture.

He called the blowout on the Alaska jet a ‘watershed moment’ from which a better Boeing will emerge. There is plenty of skepticism about comments like that.

Senator Tammy Duckworth, member of the Senate Commerce Committee, said: ‘We need to look at what Boeing does, not just what it says it’s doing.’

The FAA is also likely to take some hits. Duckworth said that until recently, the agency ‘looked past far too many of Boeing´s repeated bad behaviors’.