Biden Cancels $7.4 Billion in Student Debt for 277,000 Borrowers

-

NYPD Storms Columbia to Clear Occupied Building — 100 Pro-Palestine Protesters Arrested

-

Islamist Extremists Attack & Burn Christian Homes in Egypt

-

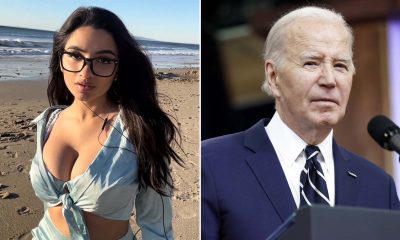

OnlyFans Creator Claims She Was Paid to Spread ‘Political Propaganda’ for Biden Admin

-

WATCH: 13-Year-Old Girl Allegedly Mobbed by Parents, Beaten by Student at NY High School

The Biden administration announced Friday that it will forgive $7.4 billion in student debt for 277,000 borrowers.

The latest round of loan cancellations is a result of the U.S. Department of Education’s recent changes and improved oversight of income-driven repayment plans and the popular Public Service Loan Forgiveness program.

“As long as there are people with overwhelming student loan debt competing with basic needs such as food and healthcare, we will remain relentless in our pursuit to bring relief to millions across the country,” U.S. Secretary of Education Miguel Cardona said in a statement.

Here is who benefits from this round of forgiveness

In this round of forgiveness, more than 206,000 borrowers will collectively get $3.6 billion in debt erased through the Biden administration’s new Saving on a Valuable Education, or SAVE, plan, due to the provision that allows for debt forgiveness after shorter periods than other income-driven repayment plans for those who originally took out small amounts for college.

More than 65,000 borrowers will have their loans canceled through fixes to the Department of Education’s income-driven repayment plans, and 4,600 borrowers are benefiting from the improvements to the government’s loan forgiveness program for public servants. Aid for these groups in this round of forgiveness amounts to $3.5 billion and $300 million, respectively.

Biden’s 2020 campaign promise to erase student debt was thwarted at the Supreme Court last June. The conservative justices ruled that Biden’s $400 billion loan cancellation plan was unconstitutional.

After that, the president directed the Department of Education to examine its existing authority to reduce and eliminate students’ debts. Mainly by improving current loan relief programs, the department has cleared the federal education loans of 4.3 million people, totaling $153 billion in aid, while Biden has been in office.

Relief is a result of fixes to federal student loan system

Income-driven repayment plans, which cap a borrower’s monthly bill at a share of their discretionary earnings, are supposed to lead to debt cancellation after a certain period of time. However, loan servicers were not always keeping accurate track of borrowers’ payments, advocates say. As a result, few people received the promised relief in the past.

The Biden administration has been reviewing borrowers’ payment timelines and allowing them to get credit for periods that historically did not qualify, such as during certain deferments and forbearances.

It also rolled out a new income-driven repayment plan, the SAVE plan, in which borrowers with smaller loan balances can get debt forgiveness after as little as 10 years.

The Department of Education has been going over the accounts of borrowers pursuing Public Service Loan Forgiveness, too, trying to deliver more people relief under the program.

Previously, PSLF was famously complicated and excluded borrowers on technicalities, including their federal loan type, even if they were working a qualifying public service job. The Biden administration has loosened some of these rules.

The president also rolled out his wide-scale student loan forgiveness do-over plan earlier this week.

News

White House Considers Accepting Gaza Palestinians as Refugees

The Biden administration is considering bringing certain Palestinians to the U.S. as refugees, a move that would offer a permanent safe haven to some of those fleeing war-torn Gaza, according to internal federal government documents obtained by CBS News.

In recent weeks, the documents show, senior officials across several federal U.S. agencies have discussed the practicality of different options to resettle Palestinians from Gaza who have immediate family members who are American citizens or permanent residents.

One of those proposals involves using the decades-old United States Refugee Admissions Program to welcome Palestinians with U.S. ties who have managed to escape Gaza and enter neighboring Egypt, according to the inter-agency planning documents.

Top U.S. officials have also discussed getting additional Palestinians out of Gaza and processing them as refugees if they have American relatives, the documents show. The plans would require coordination with Egypt, which has so far refused to welcome large numbers of people from Gaza.

Those who pass a series of eligibility, medical and security screenings would qualify to fly to the U.S. with refugee status, which offers beneficiaries permanent residency, resettlement benefits like housing assistance and a path to American citizenship.

In a statement provided to CBS News late Tuesday night, a White House spokesperson said that the U.S. “has helped more than 1,800 American citizens and their families leave Gaza, many of whom have come to the United States. At President Biden’s direction, we have also helped, and will continue to help, some particularly vulnerable individuals, such as children with serious health problems and children who were receiving treatment for cancer, get out of harm’s way and receive care at nearby hospitals in the region.”

The statement went on to say that the U.S. “categorically rejects any actions leading to the forced relocation of Palestinians from Gaza or the West Bank or the redrawing of the borders of Gaza. The best path forward is to achieve a sustainable cease-fire through a hostage deal that will stabilize the situation and pave the way to a two-state solution.”

The Israeli government launched a military offensive and aerial bombardment of Gaza after Hamas staged an unprecedented attack across Israel on Oct. 7, killing roughly 1,200 people, most of them civilians. Hamas militants also abducted more than 200 people, many of whom continue to be in captivity.

The proposals to resettle certain Palestinians as refugees would mark a shift in longstanding U.S. government policy and practice. Since its inception in 1980, the U.S. refugee program has not resettled Palestinians in large numbers.

Over the past decade, the U.S. has resettled more than 400,000 refugees fleeing violence and war across the globe. Fewer than 600 were Palestinian. In fiscal year 2023, the U.S. welcomed 56 Palestinian refugees, or 0.09% of the more than 60,000 refugees resettled during those 12 months, State Department statistics show.

While many Democrats would likely support the move, admitting Palestinians as refugees could spur even more political challenges for the Biden administration related to the Israel-Hamas war. The conflict has already exposed rifts within the Democratic Party, triggered massive protests on college campuses and divided communities across America.

To qualify to enter the U.S. as a refugee, applicants have to prove they are fleeing persecution based on certain factors, such as their nationality, religion or political views. While some Palestinians could say they are fleeing repression by Hamas, others could identify the military and government of Israel, a top U.S. ally and recipient of American aid, as a persecutor.

The resettlement of Palestinian refugees, even if small in scale, could also garner criticism from Republicans, who have sought to make concerns about immigration and illegal crossings at the U.S.-Mexico border defining issues in November’s elections.

Soon after the Oct. 7 attacks by Hamas and the start of Israel’s offensive in Gaza, leading Republicans, including presidential candidates, said the U.S. should not welcome Palestinian refugees, claiming that they are antisemitic and potential national security risks.

In recent years, the Biden administration has dramatically increased refugee resettlement, which was slashed to record lows by former President Donald Trump. U.S. officials have set a goal of admitting up to 125,000 refugees in fiscal year 2024, which ends at the end of September.

News

NYPD Storms Columbia to Clear Occupied Building — 100 Pro-Palestine Protesters Arrested

NYPD riot cops stormed Columbia University to quickly disperse protesters at an encampment and an occupied building in less than two hours.

Panicked pro-Palestine demonstrators tumbled down stairs as they tried to flee when cops flooded the Ivy League campus on Tuesday night.

Almost 100 people were arrested at the New York City university, according to NBC. Police stated there were no injuries or people resisting arrest.

Around 40 of those detained were picked up in on the first floor of Hamilton Hall, which students violently took over early Tuesday. Cops swooped in on the building through a window after using flash bangs to clear the way.

President Minouche Shafik called in the police ‘to restore order and safety’ to the campus amid the escalating protests and fears the demonstrations had been co-opted by external agitators.

University administrators have asked the NYPD to maintain a presence on campus until at least May 17, two days after graduation.

🚨#BREAKING: Police have begun entering the Hamilton Hall building through a second-floor window, deploying tear gas inside. Reports indicate there is an unconscious student in front of Hamilton Hall pic.twitter.com/IgoXOi6ZI6

— R A W S A L E R T S (@rawsalerts) May 1, 2024

Dozens of cops poured into Hamilton Hall via a window using a ramp attached to a huge armored truck. Video showed the police hammering at locked doors before sweeping in with riot shields.

Footage showed protesters being dragged out of the campus, some carried by several officers if they refused to walk, and loaded on to buses.

Just after 10pm, the campus was cleared out and locked down by police with many protesters heading north to City College of New York, where police were also raiding a similar encampment.

An encampment first sprung up at Columbia on April 17 after Shafik was hauled before Congress to address anti-Semitism on campus.

Around 9pm on Tuesday, officers stormed the university as the crowd chanted and yelled at them, some confronted the officers and pushed barricades to try and block their path.

A shelter in place warning was issued to students on Morningside campus in the moments before officers descended.

In a statement, the university said the decision to call in police was, ‘made to restore safety and order to our community’.

‘We regret that protesters have chosen to escalate the situation through their actions,’ the statement read.

Playtime is over.

NYPD is dragging protesters out of Columbia University.

US and Israel and Antifa are now both currently trending pic.twitter.com/bVaNBrDe9J

— Real Life Footage (@RealLifeFootage) May 1, 2024

NYPD is arresting Columbia student protesters and bussing them away after school officials calling police in pic.twitter.com/75plr4MDoB

— Bahar Ostadan (@BaharOstadan) May 1, 2024

‘After the University learned overnight that Hamilton Hall had been occupied, vandalized, and blockaded, we were left with no choice.

‘Columbia public safety personnel were forced out of the building, and a member of our facilities team was threatened. We will not risk the safety of our community or the potential for further escalation.’

Former president Donald Trump praised officer’s response to the situation, but said it should have come ‘a lot sooner.’

‘There’s tremendous damage that’s been done to that building, when you look at it it’s a landmark and it’s really been damaged by these people,’ he told Fox News. ‘People have to respect the law and order of this country.’

He also hit out at president Joe Biden and called for him to speak up more strongly against anti-Semitism.

The occupation of Hamilton Hall was the latest escalation in the unrest which has rocked the school in recent weeks. Protesters have been demanding the college divest from companies with links to Israel or firms profiting from its war on Hamas.

These large NYPD passenger buses just passed the Columbia campus entrance pic.twitter.com/HU4rnpCcsQ

— Steven Romo (@stevenromo) May 1, 2024

College officials have been battling to shut down the encampment, stating it violates university polices. Following the occupation of Hamilton Hall, Shafik warned that those involved would face expulsion.

More than 100 activists had already been arrested at the school prior to Tuesday’s operation.

A first encampment was broken up by NYPD officials. But university officials had vowed not to take similar steps for the current protest.

They gave students an ultimatum to leave, but few followed the instructions.

‘We will not leave until Columbia meets every one of our demands,’ one activist screamed from a balcony in the building after the takeover.

Officials then started to suspend students before a group raided Hamilton Hall.

‘We believe that the group that broke into and occupied the building is led by individuals who are not affiliated with the University,’ officials continued.

‘Sadly, this dangerous decision followed more than a week of what had been productive discussions with representatives of the West Lawn encampment.

‘The decision to reach out to the NYPD was in response to the actions of the protesters, not the cause they are championing. We have made it clear that the life of campus cannot be endlessly interrupted by protesters who violate the rules and the law.’

But the move was condemned by the Columbia University Chapter of the American Association of University Professors, which said its members had been locked out of campus.

‘NYPD presence in our neighborhood endangers our entire community. Armed police entering our campus places students and everyone else on campus at risk,’ a statement read.

‘We hold university leadership responsible for the disastrous lapses of judgement that have gotten us to this point.’

The statement added faculty had spent the trying to defuse the situation, but were ‘rebuffed or ignored.’

At a press conference prior to the raid, NYPD Assistant Commissioner Rebecca Weiner warned the protest had been co-opted by external agitators who were not affiliated with the university.

She stressed the occupation had the potential to spill into other campus buildings, as well as other universities across the country.

‘This is not about what’s happening overseas, it’s not about the last seven months, it’s about a very different commitment to at times violent protest activity as an occupation,’ she said.

BREAKING: POLICE AT COLUMBIA UNIVERSITY BARRICADING OBSERVERS, MEDICS, JOURNALISTS, STUDENTS INTO JOHN JAY AFTER PUSHING THEM ALL THE WAY BACK pic.twitter.com/w3p6NLpNa3

— Columbia Students for Justice in Palestine (@ColumbiaSJP) May 1, 2024

‘They haven’t got a right to be on campus and this violates university polices and most importantly, presents a danger to students and the university and communities.

‘When we see what we saw last night, we think these tactics are a result of guidance being given to students from these external actors.’

Police confirmed those occupying Hamilton Hall could be charged with trespass and burglary, while those in the encampment could be hit with trespassing and disorderly conduct charges.

The raid at Columbia came as cops flooded other campuses in the Big Apple including the City College of New York.

Video taken at the campus showed protesters letting off flares near the gates to the school.

News

Fight Over Johnson’s Fate Heats to a Boil as Dems Vow Unprecedented Rescue

The simmering debate over the fate of Speaker Mike Johnson (R-La.) reached a rolling boil on Tuesday when top Democrats vowed to shield the embattled GOP leader from a conservative coup — and immediately prompted the coup’s ringleader to pledge a vote to boot him from power.

Rep. Marjorie Taylor Greene (R-Ga.), who’s been sitting on her motion to vacate resolution for more than a month, said the Democrats’ promised rescue mission was the last straw in a long list of grievances she’s compiled against the Speaker since he won the gavel in October. In a scorching statement, she accused Johnson of cutting “slimy” deals with Democrats, urged him to switch parties and vowed to force the full House to vote on his removal.

“If the Democrats want to elect him Speaker (and some Republicans want to support the Democrats’ chosen Speaker), I’ll give them the chance to do it,” she posted on the social platform X.

“I’m a big believer in recorded votes because putting Congress on record allows every American to see the truth and provides transparency to our votes,” Greene continued. “Americans deserve to see the Uniparty on full display. I’m about to give them their coming out party!”

But Greene is keeping her cards close to her chest, refusing to say as of press time when she plans to force her resolution to the floor.

Greene declined to speak with reporters Tuesday when entering the House chamber — “I have to go vote” — then marched into the parliamentarian’s office afterwards alongside Rep. Thomas Massie (R-Ky.), a co-sponsor of the motion to vacate.

“Plans are still developing,” she told reporters on her way out of the Capitol.

The Georgia Republican has scheduled a press conference for 9 a.m. Wednesday, where she intends to detail her plan.

Greene’s fiery threat came less than an hour after the top three House Democrats — Minority Leader Hakeem Jeffries (N.Y.), Democratic Whip Katherine Clark (Mass.) and House Democratic Caucus Chair Pete Aguilar (Calif.) — issued an unprompted statement announcing their intent to protect Johnson from Greene’s effort to remove his gavel. The plan is not to have Democrats vote for Johnson’s Speakership directly, but to support a proposal to table Greene’s resolution — a procedural move preventing it from ever reaching the floor.

“There is a distinction there,” Aguilar told reporters.

The strategy was not quite a surprise: A number of rank-and-file Democrats had pledged to help Johnson remain in power if he ensured passage of key legislation, including aid for Ukraine, and Democratic leaders said nothing publicly to discourage that unusual offer.

Still, for the minority party to swoop in to keep a majority leader in power is unprecedented, and it highlights the extraordinary difficulties facing GOP leaders as they try to manage their hard-line critics with a hairline majority and steer legislation to President Biden’s desk.

A number of Democrats said they simply wanted to reward Johnson for responsible governance and bring some stability to the volatile lower chamber.

“It would be wrong to have Marjorie Taylor Greene drag him down into the gutter and drown him down there,” Rep. Juan Vargas (D-Calif.) said. “We’re not going to allow that.”

Democrats discussed that track record during a closed-door caucus meeting in the Capitol on Tuesday morning, where party leaders announced their plan to help Johnson survive a revolt.

“People talked about how he was the architect of the ‘Big Steal’ denial and the legal challenge there. So he did not come to this with clean hands,” Rep. Stephen Lynch (D-Mass.) said. “However, I think most members appreciate that we’re back in operative mode here, and we’re actually doing some things that are very, very important.”

Others were much more passionate in their criticisms.

“He’s dangerous, he’s an election denier, he’s a fundamentalist, and he’s not the leadership this country needs,” Rep. Jamaal Bowman (D-N.Y.) said.

For many Democrats, however, rescuing Johnson is preferable to allowing Greene to shut down the House, as a different group of conservatives had done in ousting former Speaker Kevin McCarthy (R-Calif.) in October.

“It’s not lost on me, the role that Mike Johnson played in the lead-up to Jan. 6,” said Aguilar, who sat on the Jan. 6 investigative committee. “However, we want to turn the page. We don’t want to turn the clock back and let Marjorie Taylor Greene dictate the schedule and the calendar of what’s ahead.”

The prospect that Democrats would keep Johnson in power sparked immediate questions about the impact on the Speaker’s standing in a GOP conference where conservatives are already furious at him for cutting bipartisan deals on big-ticket legislation.

Rep. Dan Bishop (R-N.C.) said a Democratic rescue mission would only “intensify” Johnson’s image problem among many Republican voters, who might come to believe he doesn’t fight hard enough for conservative priorities. But the change would be “in degree,” he added, “not in kind.”

“Speaker Johnson, a person for whom I have warm feelings, has formed a habit of passing legislation for Democrats. And he’s done it repeatedly,” Bishop said.

Rep. Chip Roy (R-Texas), another frequent leadership critic, offered a similar assessment of the potential fallout.

“We’ve been passing bills with Democrat votes all year anyways,” Roy said. “I’m not sure what difference it makes.”

Johnson, for his part, brushed off concerns about serving as a Speaker propped up by Democrats, describing his job as one that leads the entire House and not just the GOP conference.

“I am a conservative Republican — a lifelong conservative Republican. That’s what my philosophy is, that’s what my record is, and we’ll continue to govern on those principles,” Johnson said Tuesday.

“We shouldn’t be playing politics and engaging in the chaos that looks like palace intrigue here.”

The Democratic statement opposing Johnson’s ouster was just the latest blow to Greene’s vacate effort, which has failed to gain traction among Republicans.

A number of hard-line conservatives have said that, with elections quickly approaching, they simply don’t want to plunge the conference into a state of chaos.

“The sentiment is, and I’m taking this viewpoint, it’s not the right time to do this,” Rep. Ralph Norman (R-S.C.) said.

“Mike Johnson, saying all that, is a good man. He’s doing, in his mind, what he thinks is right,” Norman added. “Did he draw the red line with Biden? No. Did he take the Schumer-Pelosi-McConnell bill? Yes. But it is what it is.”

Making matters worse for Greene, former President Trump — of whom Greene considers herself a close ally — has sided with Johnson over the Georgia Republican.

“I stand with the Speaker, we’ve had a very good relationship,” Trump said during a joint press conference with Johnson at Mar-a-Lago earlier this month.

News

Israel Preps Delegation to Cairo for Last-Chance Gaza Cease-Fire

Israel is ready to send a delegation to Cairo in the coming days to discuss a halt in fighting in the Gaza Strip, Israeli and Egyptian officials said Tuesday, as Arab mediators push militant group Hamas to accept cease-fire terms before an impending military operation in Rafah.

David Barnea, the head of the Mossad intelligence agency, is considering a trip to the Egyptian capital this week after Arab mediators presented to Hamas over the weekend a deal to free hostages held by the group in return for a fighting pause, Egyptian officials said. An Israeli official said Tuesday that Israel could send a delegation depending on developments in the negotiations.

Israel has said the proposal is the last chance to delay a planned offensive on the southern Gazan city of Rafah that its officials hope would destroy the U.S.-designated terrorist group’s remaining military units there. An Israeli official said that preparations for a Rafah offensive are continuing.

White House officials stressed on Tuesday that Hamas should accept the proposal, and said that the U.S. is working hard to get the parties to reach a deal.

“This is a really good proposal, and Hamas ought to jump at it, and time is of the essence,” said National Security Council spokesman John Kirby.

Secretary of State Antony Blinken, who is traveling in the Middle East this week, said Monday that the U.S. couldn’t support a major military operation in Rafah without a plan to protect civilians, which he said Israel hadn’t yet provided.

Kirby reiterated that the U.S. wants Israel to hold off. “We don’t want to see a major ground operation in Rafah, certainly we don’t want to see operations that haven’t factored the safety and security into the 1.5 million folks who have tried to seek refuge down there,” he said Tuesday.

Kirby said the U.S. was being pragmatic about the negotiations. “We’re not going to give up…about getting these hostages home, about getting this cease-fire in place,” he said.

Israeli Prime Minister Benjamin Netanyahu said Tuesday that Israel would evacuate the civilian population in Rafah and move to destroy Hamas’s battalions there “with or without a deal,” echoing comments he has made in recent weeks. “The idea that we would stop the war before achieving all of its goals is out of the question,” he told the families of hostages held in Gaza.

Netanyahu faces pressure from far-right partners in his governing coalition not to ease up on Hamas. National Security Minister Itamar Ben-Gvir released a video on Tuesday saying that Netanyahu “understands very well” the consequences of stopping the war before a Rafah invasion or accepting what he called an irresponsible deal with Hamas. It was an apparent threat to exit from the coalition and collapse the government. Israel’s war cabinet canceled a meeting planned for Tuesday without saying why.

Whether the two warring sides in Gaza can come to an agreement is unclear: Hamas wants the cease-fire to include a pathway to a permanent end to the fighting, an aim at odds with Israel’s ultimate goal of taking out the group’s military capabilities.

Blinken, who is in the region to discuss a broader postwar plan that could help move the cease-fire talks forward, met with Jordanian officials in Amman on Tuesday and then traveled to Israel. As part of that plan, the U.S. hopes to establish diplomatic relations between Saudi Arabia and Israel, lay the groundwork for an Arab force to stabilize Gaza and define a road map leading to the creation of a Palestinian state.

A civilian evacuation from Rafah to other parts of Gaza would take at least 10 days, according to a senior United Nations official, though should they be transferred across the border into Egypt it could happen faster. Egypt refuses to take in Palestinians, citing threats to security and concerns it would undermine a future Palestinian state. U.N. agencies and international NGOs wouldn’t assist in the process because they consider it a form of forced displacement.

A wave of protests over the war on U.S. college campuses has heaped pressure on President Biden from progressives to do more to end the conflict, and a wider agreement would be a huge win for the U.S. leader as he heads into re-election season against former President Donald Trump.

In the latest cease-fire proposal, Israel has lowered the number of hostages it would require to be released as a first step and showed a willingness to enter a period of calm, a nod to the key Hamas demand of a pathway to a permanent cease-fire.

The proposal, which Israel helped draft but has yet to agree to, envisages two stages: The first would involve the release of at least 20 hostages over three weeks for an unspecified number of Palestinian prisoners, Egyptian officials said. The length of the first phase could then be extended at a rate of one day for another hostage.

The second phase would include a 10-week cease-fire during which Hamas and Israel would agree on a larger hostage release and an extended pause in fighting that could last up to a year.

While Hamas’s political wing initially responded positively, the group later complained that the terms lack any explicit reference to ending the war, Egyptian officials familiar with the talks said. Yahya Sinwar, the Hamas leader in Gaza who is close to the group’s armed wing, is widely considered to be the main decision maker in talks.

Hamas delegates who were in Cairo said they would consult with the military wing and other factions in Gaza and revert to mediators. But, they said, the proposal currently doesn’t provide clear guarantees Israel is serious about the second phase of the deal.

Because Arab-brokered talks about a cease-fire deal have yet to yield results, the U.S. is also discussing with Israeli officials how Israel plans to reduce the risk to civilians if its Rafah offensive goes ahead, U.S. officials said.

U.S. officials say an Israeli plan to safeguard civilians needs more work and want Israel to show how it would provide shelter, food and medical care for hundreds of thousands of Palestinians displaced by an operation in Rafah.

In response to concerns about the likely humanitarian toll, Israel is now planning to wage an operation in Rafah on a gradual, neighborhood-by-neighborhood basis. Egyptian officials said Israel has shared a plan with them that shows several areas the Israeli military plans to hit where it claims Hamas fighters are hunkering in tunnels.

Palestinian health authorities say that more than 34,000 people—most of them civilians—have been killed in Gaza so far in the war, roughly 1.5% of the total prewar population. Their figures don’t say how many were combatants.

Hamas attacks on Oct. 7 that sparked the war killed roughly 1,200 people, mostly civilians, according to Israeli authorities. The group and other Palestinian factions took more than 240 hostages. Some of those were freed late last year, but roughly 129 remain as captives in the strip. Of those remaining hostages, at least 34 are dead, including three Americans, according to Israel. Israeli and American officials privately estimate the number of dead could be much higher.

Separately, China said on Tuesday that it had hosted reconciliation talks in Beijing between Hamas and Fatah, the two major Palestinian political factions that have been estranged since 2007, when Hamas took control of Gaza after an armed conflict. Mending ties could be an important step toward re-establishing Palestinian control of Gaza after the Israeli military campaign there ends.

The talks in China didn’t produce a breakthrough but the two parties “fully expressed their political will to achieve reconciliation through dialogue and consultation,” said Lin Jian, a spokesman for China’s foreign ministry. The two sides agreed to continue dialogue and agreed on ideas for future steps in that process, he said without offering details.

News

Emerson Poll: Trump Leads Biden in Every Swing State

New polling has revealed that Donald Trump leads Joe Biden in seven swing states, including when third-party candidates are added into the mix.

Swing state polls from Emerson College Polling/The Hill found that Trump leads Biden in Arizona 48 to 44 percent, in Georgia 47 to 44 percent, in Michigan 45 to 44 percent, in Nevada 45 to 44 percent, in North Carolina 47 to 42 percent, in Pennsylvania 47 to 45 percent, and in Wisconsin 47 to 45 percent.

When independent candidate Robert F Kennedy and an option for “other” candidates are added, Trump leads Biden 44 to 40 percent in Arizona, 45 to 39 percent in Georgia, 43 to 42 percent in Michigan, 42 to 37 percent in Nevada, 46 to 37 percent in North Carolina, 45 to 41 percent in Pennsylvania, and 45 to 40 percent in Wisconsin.

“The state of the presidential election in swing states has remained relatively consistent since Emerson and The Hill started tracking them last November,” said Spencer Kimball, executive director of Emerson College Polling. “The share of undecided voters has reduced and Biden gained ground in Georgia and Nevada, narrowing the gap, while Trump has maintained a slight edge on Biden in Pennsylvania and Wisconsin.”

Kimball noted that independent voters preferred Trump over Biden in Arizona (48-38 percent), Michigan (44-35 percent), Nevada (43-37 percent), Pennsylvania (49-33 percent), and North Carolina (41-38 percent). Independent voters preferred Biden over Trump in Georgia (42-38 percent) and Wisconsin (44-41 percent).

Speaking outside the Manhattan courtroom where District Attorney Alvin Bragg’s falsified business records trial continued on Monday, Trump noted the polling results.

“The whole thing is a hoax, all of them are hoaxes, including the civil cases. They’re controlled by the White House, they’re controlled by Democrat judges and prosecutors that were put there, specifically they hate Trump and the people are getting it. That’s why what just came out — a new Emerson poll just was released about two minutes ago. And I’m leading by a lot in every swing state, and leading in the general election and you saw the CNN poll. I’m sure they aren’t too happy with it, but the CNN poll was fantastic. So we’re here.”

Trump makes a statement: “This is a case that should never have been brought … But the good news is my poll numbers are the highest I’ve ever been.” pic.twitter.com/u2T3xfPXnL

— The Post Millennial (@TPostMillennial) April 30, 2024

The polls were conducted between April 25 and 29 of 1000 registered voters in each respective state. “The credibility interval, similar to a poll’s margin of error, for the sample is +/- 3% in 19 of 20 cases in each state,” the poll states.

News

Judge Rules Trump Can Attend Barron’s High School Graduation

The judge presiding over the NY v. Trump trial in Manhattan granted former President Trump permission on Tuesday to attend his son’s high school graduation in Florida next month.

“I don’t think the May 17 date is a problem,” Judge Juan Merchan told the court Tuesday morning of Barron Trump’s graduation date.

Trump had pushed for weeks to attend his son’s high school graduation on May 17, but a decision on the matter was left in limbo until Tuesday, with Trump speculating earlier this month he would be denied leaving Manhattan for the event.

“(Barron’s) a great student and he’s very proud of the fact he did so well and was looking forward for years to having his graduation with his mother and father there, and it looks like the judge isn’t going to allow me to escape this scam. It’s a scam trial,” the former president said earlier this month when the trial kicked off.

It is unclear if trial proceedings will pause on May 17 or if the president will simply be absent from the courtroom that day, which falls on a Friday.

Barron Trump attends a private high school near Trump’s Mar-a-Lago estate in south Florida.

Trump is currently on day nine of his ongoing trial in Manhattan, where he is facing 34 felony counts of falsifying business records. The case has heard from three witnesses as of late Tuesday morning, including former American Media Inc. CEO and former National Enquirer publisher David Pecker, former executive assistant to Trump and a senior vice president of the Trump Organization Rhona Graff, and Gary Farro, who served as senior managing director at First Republic Bank in 2016.

On Tuesday, Merchan ordered Trump to pay $9,000 in fines for violating a gag order that bans him from speaking publicly about witnesses and family members of court officials. The judge found he violated the order on nine separate occasions, with each violation resulting in a $1,000 fine.

The judge detailed in the order that if Trump carries out “continued willful violations” of the gag order, he could face “incarceratory punishment” if “necessary and appropriate.”

In remarks ahead of court Tuesday morning, Trump called on Merchan to recuse himself, calling the case a “hoax” that is overseen by a “badly conflicted judge.”

“This is a hoax. This is a judge who is conflicted. Badly, badly, badly conflicted. I’ve never seen a judge so conflicted and giving us virtually no rulings,” Trump said outside the courtroom.

“I’m going to sit in the freezing cold icebox for 8 hours, 9 hours or so. They took me off the campaign trail. But the good news is my poll numbers are the highest it’s ever been. So at least we’re getting the word out. And everybody knows this trial is a scam. It’s a scam. The judge should be recused, that he should recuse himself today he should recuse himself today. And maybe he will,” Trump said.

Trump has previously slammed Merchan, including railing against him on Truth Social last month, when he called on the judge to recuse himself and cited Merchan’s daughter and her work as a political consultant for Democratic politicians.

“Judge Juan Merchan, who is suffering from an acute case of Trump Derangement Syndrome (whose daughter represents Crooked Joe Biden, Kamala Harris, Adam ‘Shifty’ Schiff, and other Radical Liberals, has just posted a picture of me behind bars, her obvious goal, and makes it completely impossible for me to get a fair trial) has now issued another illegal, un-American, unConstitutional ‘order,’ as he continues to try and take away my Rights,” Trump posted on Truth Social last month after he was given a gag order limiting what he could publicly say about the case.

News

REVEALED: Biden Sent 200,000 Illegal Migrants in 45 US Cities

The Department of Homeland Security revealed that it sent over 200,000 migrants on a controversial parole program to 45 cities across the United States between January and August 2023.

The policy, which was enacted in October 2022, allowed migrants who had not entered the country illegally to fly directly into America.

Migrants were also required to have a sponsor in the US and pass various vetting tests.

It was initially announced for Venezuelans, before adding Haitians, Nicaraguans and Cubans amid one of the worst migrant crises in American history under President Joe Biden and Department of Homeland Security Secretary Alejandro Mayorkas.

Around 80 percent of the migrants were sent to four cities in the state of Florida: Miami – which got 91,821, more than any other city – Fort Lauderdale, Orlando and Tampa Bay were among the top 15 destinations, according to the DHS.

Under fire Secretary Mayorkas says the program led to a reduction in people from those nations illegally crossing the border.

‘It is a key element of our efforts to address the unprecedented level of migration throughout our hemisphere, and other countries around the world see it as a model to tackle the challenge of increased irregular migration that they too are experiencing,’ Mayorkas said.

New York City, Houston, Los Angeles and San Francisco were also in the top 10 of destinations.

Another 1.6million migrants are waiting to get into the country via this same program, DHS claims.

Multiple states, including Florida, have attempted to sue to stop the program but have thus far been unsuccessful.

‘Biden’s parole program is unlawful, and constitutes an abuse of constitutional authority. Florida is currently suing Biden to shut it down, and we believe that we will prevail,’ said Governor Ron DeSantis’ press secretary, Jeremy Redfern.

Since Biden took office, the U.S. has seen record-high numbers of illegal border crossings.

Customs and Border Protection has apprehended more than 7.6 million migrants illegally crossing the southern border – the majority of which are traveling from Central and South American countries in efforts to claim asylum in the U.S.

The crisis at the border has been a scandal for the Biden administration throughout his presidency, with former President and 2024 opponent Donald Trump promising to fix the problem.

Trump is ready to reshape American policy and detailed in interviews with TIME Magazine what some of these sweeping overhauls would include.

In a wide-ranging interview at Trump’s Mar-a-Lago resort in Palm Beach, Florida on April 12, the former president confirmed he would use detention camps to house illegal immigrants during deportation efforts.

He also didn’t rule out deploying the military to round up the millions of undocumented immigrants living in the country. As of January 2022, the illegal immigrant population in the U.S. was estimated to stand at 11.35 million.

Trump has repeatedly said he would take aggressive actions to address the border issue on Day One of a second term after President Joe Biden reversed almost all of his policies and plunged the country into an all-out illegal immigration crisis.

His proposals would include tapping local law enforcement, National Guard and, if necessary, members of the U.S. Military to round up illegal immigrants for deportation.

TIME National Politics Reporter Eric Cortellessa asked Trump if he would override the Posse Comitatus Act, which states the U.S. military cannot be deployed against civilians.

‘Well, these aren’t civilians,’ the former president replied. ‘These are people that aren’t legally in our country. This is an invasion of our country. An invasion like probably no country has ever seen before.’

‘They’re coming in by the millions. I believe we have 15 million now. And I think you’ll have 20 million by the time this ends,’ Trump predicted. ‘And that’s bigger than almost every state.’

He also said it isn’t likely he would have to house these immigrants in detention camps because he plans to deport them swiftly – but he didn’t rule out building more holding centers if needed during the operation.

‘No, I would not rule out anything,’ Trump said. ‘But there wouldn’t be that much of a need for them [detention camps], because of the fact that we’re going to be moving them out. We’re going to bring them back from where they came.’

Top 10 cities where migrants were flown via DHS program

News

Scientist Who Gave World the Covid Sequence Is Locked Out of His Lab by Chinese

The Chinese scientist who defied Beijing to publish the first coronavirus sequence has staged a sit-in-protest outside his laboratory after authorities suddenly evicted him.

Prof Zhang Yongzhen took to the steps outside the Shanghai Public Health Clinical Center on Sunday, in a rare sign of public dissent in China.

It is the latest of a series of setbacks, demotions and attempts to ostracise Prof Zhang, who experts say has been “treated cruelly for years” for releasing the Sars-Cov-2 sequence without government permission in January 2020.

The move allowed health officials worldwide to test for the virus and kick-started the race to develop vaccines and drugs within weeks.

But the Chinese government – which denies the pandemic’s origins, natural or otherwise, are within its borders – was furious and Prof Zhang has been under immense pressure and scrutiny ever since.

Last weekend, he was barred from entering his laboratory in Shanghai. Photos of him sleeping rough in the rain outside the front door as a protest while being overlooked by security guards have been shared widely on Chinese social media.

The Shanghai Public Health Clinical Center insisted that Prof Zhang’s lab had been closed for “safety reasons”, with alternative space provided while renovations were underway.

But according to an online statement from Prof Zhang, seen by the Associated Press but since deleted, the scientist was only offered another laboratory space after the eviction and it does not meet the safety standards required for his research.

“I won’t leave, I won’t quit, I am pursuing science and the truth!” he wrote in the now-deleted post on Weibo, a Chinese social media platform. “The Public Health Center are refusing to let me and my students go inside the laboratory office to take shelter.”

Prof Stuart Neil, a virologist at King’s College London involved in work tracing Covid’s origins, told The Telegraph that it was “depressing to see this continual harassment and punishment of Zhang Yongzhen”.

“He did a very brave thing by releasing the virus sequence despite the Chinese authorities wanting to control information about the initial outbreak. If he hadn’t forced [China’s] hand, how long would they have delayed releasing the sequence? Two to three weeks after the release of this sequence the first mRNA vaccine constructs were already in production for preclinical testing.

“I don’t think it’s exaggerating to say that without Zhang’s bravery there would have been a real delay in the roll-out of the first vaccine. And for it he has been treated cruelly for years, Prof Neil said.

Prof Peter Hotez, dean of the National School of Tropical Medicine, at the Baylor College of Medicine in Texas, added that Prof Zhang’s work during the pandemic had been “essential”, and stressed that “fighting pandemics relies heavily on open sharing of data”.

Chinese government ‘tightly controls narrative’

But Prof Zhang’s treatment reflects a broader crackdown on coronavirus research by the Chinese state.

Scientists working with collaborators in China, who asked not to be named amid concerns for their colleagues, told The Telegraph that international collaborations have become far more difficult since the pandemic.

Dr. Ingrid d’Hooghe, a senior Research Fellow at the Clingendael China Centre in the Netherlands, said the case is a reminder that it “remains impossible to do independent research into the origin of the virus” because of how tightly the Chinese government controls the narrative.

”[It] sends a signal to scientists in China that they will be punished if they do something without having received permission by the authorities… [and] signals that international collaboration will remain under tight control of the government and carries risks for Chinese scientists,” she told the Telegraph. “[It] reflects the overall further deterioration of academic freedom in China in recent years.”

Prof David Robertson of the University of Glasgow’s Centre for Virus Research, added: “Making that first SARS-CoV-2 genome available was really really important, and Zhang Yongzhen should be celebrated for this, not forced out of his scientific role.”

News

Trump Held in Contempt, Fined for Violating Gag Order in Hush Money Trial

New York County Judge Juan Merchan has ruled that former President Donald Trump violated a gag order during his trial, holding him in criminal contempt and threatening him with jail time for any further infractions.

Merchan also ordered Trump to remove the “seven offending posts” from Truth Social.

“Defendant is hereby warned that the Court will not tolerate continued willful violations of its lawful orders and that if necessary and appropriate under the circumstances, it will impose an incarceratory punishment,” the judge wrote in the order:

ORDERED, that Defendant pay a $1,000 fine for each of the nine violations of this Court’s lawful order by the close of business on Friday, May 3, 2024; and it is further ORDERED that Defendant remove the seven offending posts from Defendant’s Truth Social account and the two offending posts from his campaign website by 2:15pm Tuesday, April 30, 2024.

Merchan had the authority to send Trump to jail for up to 30 days for allegedly violating his gag order. Democrat Manhattan District Attorney Alvin Bragg backed down from asking the judge to jail Trump for allegedly violating the order, according to court reporters.

Trump appeared to call Bragg’s bluff. Trump said in April that it would be a “GREAT HONOR” to become a “modern-day Nelson Mandela” in the “clink” for speaking the truth about Merchan.

The gag order prevents Trump from making public comments about witnesses participating in the trial, counsel other than Bragg, “members of the court’s staff and the District Attorney’s staff, or … the family members of any counsel or staff member, if those statements are made with the intent to materially interfere with … counsel’s or staff’s work” on the case. It also encompasses prospective jurors.

“The gag order has to come off,” Trump previously told reporters outside the Manhattan courthouse. “People are allowed to speak about me, and I have a gag order, just to show you how much more unfair it is.”

“They can say anything they want,” Trump said about his political foes. “They can continue to make up lies and everything else. They lie. They’re real scum. But you know what, I’m not allowed to speak.”

“So why am I gagged about telling the truth?” Trump questioned. “I’m only telling the truth. They’re not telling the truth.”

Bragg charged Trump with 34 felonies in the criminal case concerning alleged election interference and a legal retainer paid to Michael Cohen. The trial is the first-ever criminal trial of a president of the United States. Trump could face jail time if convicted.

A majority of Americans doubt Trump’s criminal trial will conclude with a fair outcome, a CNN poll on Friday found. Increasing numbers of Americans see the criminal trial of Trump as irrelevant to his fitness for reelection, the CNN poll further found, while only 13 percent believe Trump is being treated the same as other “criminal defendants.”

Only about one-third of American adults believe Trump did anything illegal regarding the case, an AP-NORC Center for Public Affairs Research poll found Tuesday.

The case is New York v. Trump, No. 71543-23, in the New York Supreme Court for New York County.

News

Protesters Occupying Hamilton Hall Will Be Immediately Expelled from Columbia

Student protesters occupying Hamilton Hall will face expulsion, University spokesperson Ben Chang wrote in a Tuesday press release.

“Protesters have chosen to escalate to an untenable situation – vandalizing property, breaking doors and windows, and blockading entrances – and we are following through with the consequences we outlined yesterday,” Chang wrote.

Dozens of protesters have occupied Hamilton Hall—which they renamed “Hind’s Hall,” in honor of Hind Rajab, a six-year-old Palestinian child killed by the Israeli military—since 12:30 a.m. on Tuesday. Upon entry, protesters sealed the building within five minutes, barricading entrances with wooden tables, chairs, and zip ties.

“We regret that protesters have chosen to escalate the situation through their actions,” Chang wrote. “Our top priority is restoring safety and order on our campus.”

Chang also stated that students who remain in the “Gaza Solidarity Encampment” will face interim suspensions. Columbia began suspending students involved in the encampment on Monday, according to a University spokesperson.

Suspended students do not have access to any University properties, including academic buildings and residence halls, and may not complete the semester nor graduate.

“As we said yesterday, disruptions on campus have created a threatening environment for many of our Jewish students and faculty and a noisy distraction that interferes with teaching, learning, and preparing for final exams, and contributes to a hostile environment in violation of Title VI,” Chang wrote.

The disciplinary action comes against the backdrop of the University’s ongoing Commencement preparations, as staff continues to set up bleachers on Low Plaza and tents on the lawns across south campus.

Columbia University Apartheid Divest identified the protesters occupying Hamilton Hall as an “autonomous group” in a Tuesday 2:07 a.m. press release posted on X.

In a Monday substack post, CUAD reaffirmed their demands for Columbia: divestment from companies with ties to Israel, financial transparency on direct and indirect holdings, and amnesty for all disciplined pro-Palestinian students.

“Admitted students day is over—commencement is on its way,” CUAD wrote in the post. “Let’s see how much of this campus we can reclaim by then!”

News

House Republicans Launch Investigation Into Federal Funding for Universities Amid Campus Protests

House Republicans on Tuesday announced an investigation into the federal funding for universities where students have protested the Israel-Hamas war, broadening a campaign that has placed heavy scrutiny on how presidents at the nation’s most prestigious colleges have dealt with reports of antisemitism on campus.

Several House committees will be tasked with a wide probe that ultimately threatens to withhold federal research grants and other government support to the universities, placing another pressure point on campus administrators who are struggling to manage pro-Palestinian encampments, allegations of discrimination against Jewish students and questions of how they are integrating free speech and campus safety.

The House investigation follows several recent high-profile hearings that precipitated the resignations of presidents at Harvard and the University of Pennsylvania. And House Republicans promised more scrutiny, saying they were calling on the administrators of Yale, UCLA and the University of Michigan to testify next month.

“We will not allow antisemitism to thrive on campus, and we will hold these universities accountable for their failure to protect Jewish students on campus,” said House Speaker Mike Johnson at a news conference.

Nationwide, campus protesters have called for their institutions to cut financial ties to Israel and decried how thousands of civilians in Gaza have been killed by Israel following the deadly attack by Hamas on Oct. 7.

Some organizers have called for Hamas to violently seize Israeli territory and derided Zionism. Jewish students, meanwhile, have reported being targeted and say campus administrators have not done enough to protect them.

After Johnson visited Columbia last week with several other top House Republicans, he said “the anti-Jewish hatred was appalling.”

Republicans are also turning to the issue at a time when election season is fully underway and leadership needs a cause that unites them and divides Democrats. The House GOP’s impeachment inquiry into President Joe Biden has fallen flat and the Republican conference is smarting after a series of important bills left GOP lawmakers deeply divided. Democrats have feuded internally at times over the Israel-Hamas war and how campus administrators have handled the protests.

Senate Majority Leader Chuck Schumer, a New York Democrat, said in a floor speech Tuesday that it was “unacceptable when Jewish students are targeted for being Jewish, when protests exhibit verbal abuse, systemic intimidation, or glorification of the murderous and hateful Hamas or the violence of October 7th.”

Rep. Pete Aguilar, the No. 3 House Democrat, at a news conference Tuesday said that it was important for colleges “to ensure that everybody has an ability to protest and to make their voice heard but they have a responsibility to honor the safety of individuals.”

“For many of Jewish descent, they do not feel safe, and that is a real issue,” he said, but added that he wanted to allow university administrators to act before Congress stepped in.

But the Republican speaker promised to use “all the tools available” to push the universities. Johnson was joined by chairs for six committees with jurisdiction over a wide range of government programs, including National Science Foundation grants, health research grants, visas for international students and the tax code for nonprofit universities.

Without Democratic support in the divided Congress, it is not clear what legislative punishments House Republicans could actually implement. Any bills from the House would be unlikely to advance in the Democratic-controlled Senate.

But so far, the House hearings with university presidents have produced viral moments and given Republicans high-profile opportunities to denounce campuses as hotbeds of antisemitism. In December, the presidents of Ivy League universities struggled to answer pointed questions about whether “calling for the genocide of Jews” would violate each university’s code of conduct.

Rep. Elise Stefanik, the New York Republican who posed the question in the December hearing, said it became the highest-viewed congressional hearing in history. She also cast the campaign against antisemitism as part of a broader conservative push against what they say is overt liberal bias at elite American universities.

“Enough is enough,” she said. “It is time to restore law and order, academic integrity and moral decency to America’s higher education institutions.”

The House Committee on Education and the Workforce is also requesting that the administrators of Yale, UCLA and the University of Michigan appear at a hearing on May 23 that focuses on how they handled the recent protests.

“As Republican leaders, we have a clear message for mealy-mouthed, spineless leaders: Congress will not tolerate your dereliction of duty to your Jewish students,” said the committee chair, North Carolina Rep. Virginia Foxx.

At a hearing of the committee earlier this month, Columbia University’s president took a firm stance against antisemitism. But at the same time, a protest was underway on Columbia’s campus that would soon set off others like it nationwide. The university began suspending students this week in an attempt to clear the protest encampment on campus.

The university is also facing federal legal complaints. A class-action lawsuit on behalf of Jewish students alleges Columbia breached its contract by failing to maintain a safe learning environment.

Meanwhile, a legal group representing pro-Palestinian students is urging the U.S. Department of Education’s civil rights office to investigate whether Columbia’s treatment of the protesting students violated the Civil Rights Act of 1964.

Senate Republican Leader Mitch McConnell called on university administrators to “take charge.”

“On campus, protect Jewish community members. Clear the encampments. Let students go to class and take their exams. And allow graduations to proceed,” he said.

News

Biden Admin Takes Step to Make Marijuana Use Less Serious Crime

The U.S. Drug Enforcement Administration will move to reclassify marijuana as a less dangerous drug, The Associated Press has learned, a historic shift to generations of American drug policy that could have wide ripple-effects across the country.

The DEA’s proposal, which still must be reviewed by the White House Office of Management and Budget, would recognize the medical uses of cannabis and acknowledge it has less potential for abuse than some of the nation’s most dangerous drugs. However, it would not legalize marijuana outright for recreational use.

The agency’s move, confirmed to the AP on Tuesday by five people familiar with the matter who spoke on the condition of anonymity to discuss the sensitive regulatory review, clears the last significant regulatory hurdle before the agency’s biggest policy change in over 50 years can take effect.

Once OMB signs off, the DEA will take public comment on the plan to move marijuana from its current classification as a Schedule I drug, alongside heroin and LSD. It moves pot to Schedule III, alongside ketamine and some anabolic steroids, following a recommendation from the federal Health and Human Services Department. After the public-comment period the agency would publish the final rule.

It comes after President Joe Biden called for a review of federal marijuana law in October 2022, and has moved to pardon thousands of Americans convicted federally of simple possession of the drug. He has also called on governors and local leaders to take similar steps to erase marijuana convictions.

“Criminal records for marijuana use and possession have imposed needless barriers to employment, housing, and educational opportunities,” Biden said in December. “Too many lives have been upended because of our failed approach to marijuana. It’s time that we right these wrongs.”

The election year announcement could help Biden, a Democrat, boost flagging support, particularly among younger voters.

Schedule III drugs are still controlled substances and subject to rules and regulations, and people who traffic in them without permission could still face federal criminal prosecution.

Some critics argue the DEA shouldn’t change course on marijuana, saying rescheduling isn’t necessary and could lead to harmful side effects.

On the other end of the spectrum, others argue say marijuana should be dropped from the controlled-substances list completely and instead regulated like alcohol.

Federal drug policy has lagged behind many states in recent years, with 38 having already legalized medical marijuana and 24 legalizing its recreational use.

That’s helped fuel fast growth in the marijuana industry, with an estimated worth of nearly $30 billion. Easing federal regulations could reduce the tax burden that can be 70% or more for businesses, according to industry groups. It could also make it easier to research marijuana, since it’s very difficult to conduct authorized clinical studies on Schedule I substances.

The immediate effect of rescheduling on the nation’s criminal justice system would likely be more muted, since federal prosecutions for simple possession have been fairly rare in recent years. Biden has already pardoned thousands of Americans convicted of possessing marijuana under federal law.

News

Fox News Deletes Hunter Biden ‘Mock Trial’ Miniseries After Lawsuit Threat

Fox News pulled down a mini-series on Hunter Biden after facing a lawsuit threat from the first son’s lawyers, the network confirmed on Tuesday.

The six-part program, “The Trial of Hunter Biden,” had been available on Fox Nation, the network’s digital streaming platform, but will stay down at least temporarily pending a review, per the network.

“This program was produced in and has been available since 2022. We are reviewing the concerns that have just been raised and — out of an abundance of caution in the interim — have taken it down,” a Fox News spokesperson told The Post.

A day prior, Hunter Biden’s lawyers penned a scathing letter to the cable news giant, accusing it of publishing “hacked” intimate images of the scandal-plagued 54-year-old.

They demanded Fox News issue a series of retractions and corrections for its reporting on Biden’s overseas business machinations.

“For the last five years, Fox News has relentlessly attacked Hunter Biden and made him a caricature in order to boost ratings and for its financial gain,” attorneys Mark Geragos, Bryan Freedman and Tina Glandian said, per the Washington Post.

They also specifically called on the network to remove “The Trial of Hunter Biden” mock trial series, which was released in 2022.

“The Trial of Hunter Biden” used a mix of actors and real material to depict what a trial of the first son would be like.

Hunter Biden’s legal team blasted the series as a distortion.

“While using certain true information, the series intentionally manipulates the facts, distorts the truth, narrates happenings out of context, and invents dialogue intended to entertain,” they wrote.

“Thus, the viewer of the series cannot decipher what is fact and what is fiction, which is highly damaging to Mr. Biden.”

Fox News had fired back at the demands for retractions and corrections.

“Hunter Biden’s lawyers have belatedly chosen to publicly attack Fox News’ constitutionally protected coverage regarding their client,” the network said.

“Mr. Biden is a public figure who has been the subject of investigations by both the Department of Justice and Congress, has been indicted by two different US Attorney’s Offices in California and Delaware, and has admitted to multiple incidents of wrongdoing.”

“Consistent with the First Amendment, Fox News has accurately covered these highly publicized events as well as the subsequent indictment of an FBI informant who was the source of certain claims made about Mr. Biden.”

Hunter Biden is facing two indictments out of California and Delaware for nine tax charges as well as three charges related to illegal possession of a firearm while addicted to illicit drugs.

He has pleaded not guilty to all charges thus far and is battling special counsel David Weiss over a collapsed plea deal.

Additionally, Republican investigators in Congress have probed the first son’s overseas business dealings and accused the first family of influence peddling.

Hunter Biden’s team has begun more forcefully pushing back publicly against criticisms against him and his father. He is a central figure in the House GOP impeachment inquiry of President Biden.

Fox News is a subsidiary of Fox Corporation. The executive chairman and CEO of Fox Corp., Lachlan Murdoch, is also the chair of News Corporation, the parent company of The Post.

News

AstraZeneca Admits for First Time Its COVID Vaccine Can Cause Deadly Blood Clots

AstraZeneca has admitted in court for the first time that its Covid jab can cause a deadly blood clotting side effect.

The exceedingly rare reaction is at the heart of a multi million-pound class action by dozens of families who allege they, or their loved ones, were maimed or killed by the pharmaceutical titan’s ‘defective’ vaccine.

Lawyers representing the claimants believe some of the cases could be worth up to £20m in compensation.

Cambridge-based AstraZeneca, which is contesting the claims, acknowledged in a legal document submitted to the High Court in February that its vaccine ‘can, in very rare cases, cause TTS’.

TTS is short for thrombosis with thrombocytopenia syndrome – a medical condition where a person suffers blood clots along with a low platelet count. Platelets typically help the blood to clot.

The complication – listed as a potential side effect of the jab – has previously been called vaccine-induced immune thrombotic thrombocytopenia (VITT).

AstraZeneca’s admission could lead to pay-outs on a case-by-case basis.

Although accepted as a potential side effect for two years, it marks the first time the company has admitted in court that its jab can cause the condition, The Telegraph reports.

Taxpayers will foot the bill of any potential settlement because of an indemnity deal AstraZeneca struck with the Government in the darkest days of Covid to get the jabs produced as quickly as possible while the country was paralysed by lockdowns.

It comes just days after the firm reported a revenue exceeding £10billion in the first quarter of 2024, a rise of 19 per cent. Company officials stated it had enjoyed a ‘very strong start’ to the year.

One of those seeking compensation for injuries linked to AstraZeneca’s vaccine is father-of-two and IT engineer Jamie Scott.

He was left with a permanent brain injury following a blood clot and the bleed on the brain after getting the vaccine in April 2021. He has been unable to work since.

His is one of 51 cases currently lodged in the High Court seeking damages estimated to be worth about £100million in total.

On the revelation, Kate Scott, Mr Scott’s wife, said: ‘I hope their admission means we will be able to sort this out sooner rather than later.

‘We need an apology, fair compensation for our family and other families who have been affected. We have the truth on our side, and we are not going to give up.’

Sarah Moore, a partner at law firm Leigh Day, who is representing claimants against AstraZeneca (AZ), accused the company of using delaying tactics against victims.

She said: ‘Regrettably it seems that AZ, the Government and their lawyers are more keen to play strategic games and run up legal fees than to engage seriously with the devastating impact that their AZ vaccine has had upon our clients’ lives.’

AstraZeneca said in a statement: ‘Our sympathy goes out to anyone who has lost loved ones or reported health problems.

‘Patient safety is our highest priority, and regulatory authorities have clear and stringent standards to ensure the safe use of all medicines, including vaccines.

‘From the body of evidence in clinical trials and real-world data, the AstraZeneca-Oxford vaccine has continuously been shown to have an acceptable safety profile and regulators around the world consistently state that the benefits of vaccination outweigh the risks of extremely rare potential side effects.’

The new documents submitted to the court marks a change of language from the previous AstraZeneca submissions made last year, when it claimed that TSS couldn’t be caused by its jab ‘at a generic level’.

Its new submission also adds that the trigger that causes some people to suffer TSS from the AstraZeneca jab is unknown and can also occur in people independent of any vaccine.

It claims: ‘Causation in any individual case will be a matter for expert evidence.’

AstraZeneca denies its new submission represents a U-turn on acknowledging its jab can cause TTS in court documents.

Lawyers representing victims and families are suing AstraZeneca under the Consumer Protection Act 1987.

They argue the vaccine was ‘a defective product’ that was ‘not as safe as consumers generally were reasonably entitled to expect’. AstraZeneca has strongly denied these claims.

Health officials first identified cases of VITT linked to AstraZeneca’s jab in Europe as early as March 2021, just over two months after the vaccine was first deployed in the UK.

However, it wasn’t until April that year that evidence became clear enough that the jab started to be restricted.

Officials first restricted the jab to only people over 30. They then expanded this to only people over 40 in May 2021.

As the vaccine still worked against Covid, it was still deemed worth giving to older Brits who were at greater risk of death or injury from falling ill with the virus.

About 50million doses of the AstraZeneca jab were dished out in the UK in total.

Official data shows at least 81 Brits have died from blood clot complications apparently linked to the AstraZeneca jab, according to figures collected by the UK’s drug watchdog, the Medicines and Healthcare products Regulatory Agency.

A further unconfirmed number have been injured and/or disabled.

News

Elon Musk Fires Tesla’s Entire Supercharger Team

Elon Musk fired two Tesla senior executives and announced plans to go ‘absolutely hardcore’ with layoffs, frustrated by falling sales and the pace of job cuts so far, according to a new report.

The Tesla boss, who sat down with Chinese premier Li Qiang on Sunday promising an imminent roll-out of driverless cars in the country, sent a brutal email to senior managers Monday night, The Information reported.

Rebecca Tinucci, senior director of the electric vehicle maker charging infrastructure, and Daniel Ho, head of the new vehicles program, will leave on Tuesday morning, the report said.

Musk also plans to dismiss everyone working for Tinucci and Ho, including the roughly 500 employees who work in the Supercharger group.

‘Hopefully these actions are making it clear that we need to be absolutely hard core about headcount and cost reduction. While some on exec staff are taking this seriously, most are not yet doing so,’ Musk said.

Ho joined Tesla in 2013 and was a program manager in the development of the Model S, the 3, and the Y before being put in charge of all new vehicles.

Tinucci joined in 2018 as a senior product manager and has been in charge of the Supercharging and Destination Charging businesses since 2022.

Tesla’s public policy team, which was led by former executive Rohan Patel, will also be dissolved.

Patel and battery development chief Drew Baglino announced their departures earlier this month, when Tesla also ordered the layoffs of more than 10 percent of its workforce.

Tesla has already laid off at least 14,000 of its global workforce including from its Texas and Buffalo factories, under pressure from dropping sales and an intensifying price war among EV makers.

Musk’s visit to China came just a week after canceling a meeting with India’s PM Narendra Modi, citing ‘very heavy Tesla obligations’.

The company has lost nearly a third of its value since the start of the year with investors growing tired of repeated delays to its roll-out of cars with full self-driving software (FSD).

But Li praised Tesla as a successful example of US China economic cooperation as analysts hailed ‘a major moment for Tesla’.

‘While the long term valuation story at Tesla hinges on FSD and autonomous, a key missing piece in that puzzle is Tesla making FSD available in China which now appears on the doorstep,’ said equity firm Wedbush.

Musk opened his first Chinese gigafactory in Shanghai six years ago and it is now Tesla’s biggest in the world.

Earlier this month Musk tweeted that a Chinese roll-out of his FSD would happen ‘very soon’, with Li seemingly relaxed about using his country’s crowded streets as the testbed for the pioneering technology.

But Musk was also keen to win his permission to take home data collected in China to train algorithms for Tesla’s autonomous driving technologies in the US, sources told Reuters.

Tesla has since 2021 stored all data collected by its Chinese fleet in Shanghai as required by Chinese regulators and has not transferred any back to the United States.

‘Honored to meet with Premier Li Qiang. We have known each other now for many years, since early Shanghai days,’ Musk posted on his social media platform X, as he appeared in a picture with the premier.

News

Binance Founder Sentenced to 4 Months in Prison

Binance founder Changpeng Zhao was sentenced Tuesday to four months in prison for allowing rampant money laundering on the world’s largest cryptocurrency exchange.

A judge credited Zhao for taking responsibility for his wrongdoing but said he was troubled by the now-former CEO’s decision to ignore U.S. banking requirements that would have slowed the company’s explosive growth. The sentence was far less than the three years prosecutors had sought, but defense attorneys had asked that Zhao spend no time in prison.

“Despite wealth, power or status, no person — regardless of wealth — is immune from prosecution or above the laws of the United States,” U.S. District Judge Richard A. Jones told Zhao.

Zhao pleaded guilty in November to one count of failing to maintain an anti-money-laundering program and stepped down as Binance agreed to pay $4.3 billion to settle related allegations. U.S. officials said Zhao deliberately looked the other way as people conducted transactions that supported child sex abuse, the illegal drug trade and terrorism.

“I failed here,” Zhao told the court Tuesday. “I deeply regret my failure, and I am sorry.”

No one has ever been sentenced to prison time for similar violations of the Bank Secrecy Act, defense attorneys Mark Bartlett and William Burck told the judge. But prosecutors argued that if Zhao did not receive time in custody for the offense, no one would, rendering the law toothless.

Binance allowed more than 1.5 million virtual currency trades, totaling nearly $900 million, that violated U.S. sanctions, including ones involving Hamas’ al-Qassam Brigades, al-Qaeda and Iran.

Bartlett and Burck said there was no evidence Zhao personally knew of any specific transaction that would have been barred by U.S. regulations or sanctions. Also, they argued, the number of suspicious transactions Binance handled was a miniscule proportion for a company whose total transactions were about $500 million a day. And they noted that Zhao began making changes to make Binance a model of compliance with banking transparency regulations before stepping down.

In a letter to the court, Zhao wrote that there was “no excuse for my failure to establish the necessary compliance controls at Binance.”

“I wish I could change that part of Binance’s story. But under my direction, Binance has now implemented the most stringent anti-money laundering controls of any non-U.S. exchange, and those controls have been in place since 2022,” he added.

Prosecutors said no one had ever violated the Bank Secrecy Act to the extent Zhao did.

“He says in hindsight he should have done a better job,” Justice Department lawyer Kevin Mosley told Jones. “This wasn’t a mistake. When Mr. Zhao violated the BSA he was well aware of the requirements.”

Zhao knew that Binance was required to institute anti-money-laundering protocols, but instead directed the company to disguise customers’ locations in the U.S. in an effort to avoid complying with U.S. law, prosecutors said.

Zhao, his legal team and family members left after Tuesday’s hearing without speaking to reporters.

The cryptocurrency industry has been marred by scandals and market meltdowns. Most recently. Nigeria has sought to try Binance and two of its executives on money laundering and tax evasion charges.

Zhao was perhaps best known as the chief rival to Sam Bankman-Fried, the founder of the FTX, which was the second-largest crypto exchange before it collapsed in 2022. Bankman-Fried was convicted last November of fraud for stealing at least $10 billion from customers and investors and sentenced to 25 years in prison.

Zhao and Bankman-Fried were originally friendly competitors in the industry, with Binance investing in FTX when Bankman-Fried launched the exchange in 2019. However, the relationship between the two deteriorated, culminating in Zhao announcing he was selling all of his cryptocurrency investments in FTX in early November 2022. FTX filed for bankruptcy a week later.

Zhao’s attorneys pointed to his willingness to come from the United Arab Emirates, where he and his family live, to the U.S. to plead guilty, despite the UAE’s lack of an extradition treaty with the U.S.

They also argued that he would not be safe in prison. Because he is not a U.S. citizen, he is ineligible for placement in a minimum security facility. Given his high-profile status and wealth, as well as Binance’s cooperation with U.S. law enforcement in certain investigations, he might be a target for violence in a medium security prison, they suggested.

The judge said he took that into account in sentencing Zhao to four months, instead of the five-month sentence recommended by U.S. Probation and Pretrial Services.

News

Pro-Palestinian Protesters Take Over Columbia University Building