Mormon Church Investment Portfolio Hits $100 Billion. SEC Starts Investigation.

-

WATCH: NYC Construction Worker Goes Viral After Saying Exactly What He Thinks of Biden Following Trump’s Visit

-

Don’t Mess with Texas! Troopers in Helmets Arrest Palestine Protesters

-

Israel Hits 40 Sites in Lebanon, Says It Has Killed ‘Half’ of Hezbollah Commanders

-

Man Who Punched Several Random Women in NYC Is Arrested

The Securities and Exchange Commission is investigating the Mormon Church’s past efforts to keep its giant investment portfolio a secret, a practice that ended after a former employee revealed in 2019 that the church had amassed $100 billion of holdings.

The SEC’s investigation has focused on whether the Church of Jesus Christ of Latter-day Saints, also known as LDS, complied with disclosure requirements for large money managers. It is at an advanced stage and is likely to lead to a settlement in the coming months, people familiar with the matter said.

The SEC historically has punished violations of money-manager reporting rules by levying fines. The size of the fine being sought by the SEC’s enforcement staff couldn’t be learned. The agency sometimes closes investigations, even those that have reached an advanced stage, without taking formal enforcement action.

The entity at the center of the SEC’s investigation is Ensign Peak Advisors Inc., an investment firm owned by the church that manages its assets. Ensign Peak has made disclosure filings under its own name with the SEC since February 2020.

Doug Andersen, a spokesman for the Church of Jesus Christ of Latter-day Saints, declined to confirm or deny the SEC investigation’s existence. “The church works with many government regulators to ensure we are in compliance with the law,” he said. “We take those responsibilities very seriously.” Ensign Peak executives didn’t respond to requests for comment.

The current size of Ensign Peak’s holdings remains a tightly held secret. The firm, based in Salt Lake City, was incorporated in 1997. Under SEC rules, it must disclose some types of investments, like U.S.-listed stocks, that it manages directly, which amounted to roughly $40 billion on Sept. 30. The remainder of the portfolio is made up of investments such as fixed-income securities, private companies or funds. Ensign Peak had an estimated $100 billion of holdings in 2019.

Investment managers with at least $100 million under management publicly report their stockholdings quarterly. The numbers are tracked by public companies and investors. About 5,000 entities file the form, according to SEC data made public in 2020.

The size of the church’s investment holdings first came to light in 2019, after a former Ensign Peak investment manager, David Nielsen, filed a whistleblower complaint with the Internal Revenue Service, claiming that Ensign Peak shouldn’t be treated as a tax-exempt charity because it didn’t engage in any charitable activities.

The complaint showed for the first time how big Ensign Peak had grown. At the time it was more than twice the size of the Harvard endowment and on par with some of the biggest sovereign-wealth funds in the world. “We’ve tried to be somewhat anonymous,” Roger Clarke, then head of Ensign Peak, said in an interview at the time. The firm operated out of a fourth-floor office, above a Salt Lake City food court.

Ensign Peak and church officials said they hadn’t violated any tax laws and that the fund was a rainy-day account to be used in difficult economic times. Mr. Clarke said he believed church leaders were concerned that public knowledge of the scale of the firm’s assets might discourage church members from making donations, known as tithing.

At the time, some church members asked why details about the fund had been tightly held for so long, what the money was for, and whether tithing so much to the church should still be the standard practice. Members of the church must give 10% of their income each year to remain in good standing.

More recently, attorneys for Mr. Nielsen on Jan. 31 gave a 90-page memo to the Senate Finance Committee in which they alleged that Ensign Peak had made false statements to the IRS in publicly available filings about the size of its assets and whether the firm held foreign bank accounts. Mr. Nielsen’s attorneys asked the committee to investigate.

Mr. Andersen, the church spokesman, said: “The church, along with our investment manager, Ensign Peak Advisors, have only recently been made aware of allegations brought forward by a former Ensign Peak employee. We are always willing to work with government regulators to resolve concerns and are committed to full compliance.” A spokesman for the Senate Finance Committee confirmed it received the memo, but he declined to comment further.

The bar for enforcing the reporting requirement, known as 13-F, is low; regulators don’t have to prove a company intended to violate the rule. Simply failing to file the forms, or omitting required information, is enough to breach the law.

“The SEC is concerned when people don’t file their 13-F reports because it’s information the market isn’t getting that it’s entitled to get under the law,” said Robert Plaze, a partner at Proskauer Rose LLP who previously was a senior official in the SEC division that oversees investment funds and managers.

The data that investment managers are required to disclose is released with a 45-day delay, making it less valuable to traders interested in following the moves of large funds. Even so, public companies tap the information to track their major shareholders, while activist investors use the data to identify the investors whose support they may need during a contest for control of a company.

News

Trump Could Get Partial Victory After Supreme Court Hears Immunity Case

Former President Trump seems likely to win at least a partial victory from the Supreme Court in his effort to avoid prosecution for his role in Jan. 6.

The court heard more than two hours of oral arguments today over Trump’s assertion that former presidents cannot be prosecuted, even after leaving office, for actions they took while in office.

A definitive ruling against Trump — a clear rejection of his theory of immunity that would allow his Jan. 6 trial to promptly resume — seemed to be the least likely outcome.

A majority of the justices seemed inclined to rule that former presidents must have at least some protection from criminal charges, but not necessarily the “absolute immunity” Trump is seeking.

The most likely outcome might be for the high court to punt, perhaps kicking the case back to lower courts for more nuanced hearings. That would still be a victory for Trump, who has sought first and foremost to delay a trial in the Jan. 6 case until after Inauguration Day in 2025.

Trump is asserting one of the most sweeping theories of presidential power ever articulated.

His lawyer, John Sauer, told the justices that a former president couldn’t face criminal charges — even if he had a political rival assassinated — unless he had been impeached and convicted by the Senate.

The core distinction during oral arguments came down to a president’s official vs. unofficial actions — and which of Trump’s efforts to overturn the 2020 election results were official vs. unofficial.

Several conservative justices, particularly Justice Brett Kavanaugh, were adamant that former presidents cannot be prosecuted for official acts, and warned that the Justice Department’s position in this case would allow every new president to prosecute their predecessor.

But Chief Justice John Roberts and Justice Amy Coney Barrett both took issue with the sheer breadth of Trump’s position.

No clear, concise majority opinion emerged this morning. But there may be five justices willing to kick the can down the road — and that’s enough for Trump, at least for now.

News

Harvey Weinstein’s Rape Conviction Overturned by New York’s Top Court

New York’s highest court on Thursday overturned Harvey Weinstein ’s 2020 rape conviction, reversing a landmark ruling of the #MeToo era. The court found the trial judge unfairly allowed testimony against the ex-movie mogul based on allegations that weren’t part of the case.

Weinstein, 72, will remain in prison because he was convicted in Los Angeles in 2022 of another rape. But the New York ruling reopens a painful chapter in America’s reckoning with sexual misconduct by powerful figures — an era that began in 2017 with a flood of allegations against Weinstein.

While Thursday’s ruling was a blow to #MeToo advocates, they noted it was based on legal technicalities and not an exoneration of Weinstein’s behavior, saying the original trial irrevocably moved the cultural needle on attitudes about sexual assault.

The Manhattan district attorney’s office said it intends to retry Weinstein, and at least one of his accusers said through her lawyer that she would testify again.

The state Court of Appeals overturned Weinstein’s 23-year sentence in a 4-3 decision, saying “the trial court erroneously admitted testimony of uncharged, alleged prior sexual acts” and permitted questions about Weinstein’s “bad behavior” if he had testified. It called this “highly prejudicial” and “an abuse of judicial discretion.”

In a stinging dissent, Judge Madeline Singas wrote that the Court of Appeals was continuing a “disturbing trend of overturning juries’ guilty verdicts in cases involving sexual violence.” She said the ruling came at “the expense and safety of women.”

In another dissent, Judge Anthony Cannataro wrote that the decision was “endangering decades of progress in this incredibly complex and nuanced area of law” regarding sex crimes after centuries of “deeply patriarchal and misogynistic legal tradition.”

The reversal of Weinstein’s conviction is the second major #MeToo setback in the last two years. The U.S. Supreme Court refused to hear an appeal of a Pennsylvania court decision to throw out Bill Cosby’s sexual assault conviction.

Weinstein has been in a New York prison since his conviction for forcibly performing oral sex on a TV and film production assistant in 2006, and rape in the third degree for an attack on an aspiring actress in 2013. He was acquitted on the most serious charges — two counts of predatory sexual assault and first-degree rape.

He was sentenced to 16 years in prison in the Los Angeles case.

Weinstein’s lawyers expect Thursday’s court ruling to have a major impact on the appeal of his Los Angeles rape conviction. Their arguments are due May 20.

Jennifer Bonjean, a Weinstein attorney, said the California prosecution also relied on evidence of uncharged conduct alleged against him.

“A jury was told in California that he was convicted in another state for rape,” Bonjean said. “Turns out he shouldn’t have been convicted and it wasn’t a fair conviction. … It interfered with his presumption of innocence in a significant way in California.”

Weinstein lawyer Arthur Aidala called the Court of Appeals ruling “a tremendous victory for every criminal defendant in the state of New York.”

Attorney Douglas H. Wigdor, who has represented eight Harvey Weinstein accusers including two witnesses at the New York criminal trial, called the ruling “a major step back” and contrary to routine rulings by judges allowing evidence of uncharged acts to help jurors understand the intent or patterns of a defendant’s criminal behavior.

Debra Katz, a prominent civil rights and #MeToo attorney who represented several Weinstein accusers, said her clients are “feeling gutted” by the ruling, but that she believed – and was telling them – that their testimony had changed the world.

“People continue to come forward, people continue to support other victims who’ve reported sexual assault and violence, and I truly believe there’s no going back from that,” Katz said. She predicted Weinstein will be convicted at a retrial, and said accusers like her client Dawn Dunning feel great comfort knowing Weinstein will remain behind bars.

Dunning, a former actor who served as a supporting witness at the New York Weinstein trial, said in remarks to The Associated Press conveyed through Katz that she was “shocked” by the ruling and dealing with a range of emotions, including asking herself, “Was it all for naught?”

“It took two years of my life,” Dunning said. “I had to live through it every day. But would I do it again? Yes.”

She said that in confronting Weinstein, she had faced her worst fear and realized he had no power over her.

Weinstein’s conviction in 2020 was heralded by activists and advocates as a milestone achievement, but dissected just as quickly by his lawyers and, later, the Court of Appeals when it heard arguments on the matter in February.

Allegations against Weinstein, the once powerful and feared studio boss behind such Oscar winners as “Pulp Fiction” and “Shakespeare in Love,” ushered in the #MeToo movement.

Dozens of women came forward to accuse Weinstein, including famous actresses such as Ashley Judd and Uma Thurman. His New York trial drew intense publicity, with protesters chanting “rapist” outside the courthouse.

“This is what it’s like to be a woman in America, living with male entitlement to our bodies,” Judd said Thursday.

Weinstein, incarcerated at the Mohawk Correctional Facility, about 100 miles (160 kilometers) northwest of Albany, maintains his innocence. He contends any sexual activity was consensual.

His lawyers argued on appeal that the trial overseen by Judge James Burke was unfair because three women whose claims of unwanted sexual encounters with Weinstein were not part of the charges were allowed to testify. Burke’s term expired at the end of 2022, and he is no longer a judge.

They also appealed the trial judge’s ruling that prosecutors could confront Weinstein over his long history of brutish behavior, including allegations of punching his movie producer brother at a business meeting, snapping at waiters, hiding a woman’s clothes and threatening to cut off a colleague’s genitals with gardening shears.

As a result, Weinstein, who wanted to testify, did not take the stand, Aidala said.

The appeals court labeled the allegations “appalling, shameful, repulsive conduct” but warned that “destroying a defendant’s character under the guise of prosecutorial need” did not justify some trial evidence and testimony.

In a majority opinion written by Judge Jenny Rivera, the Court of Appeals said defendants have a right to be held accountable “only for the crime charged and, thus, allegations of prior bad acts may not be admitted against them for the sole purpose of establishing their propensity for criminality.”

The Court of Appeals agreed last year to take Weinstein’s case after an intermediate appeals court upheld his conviction. Prior to their ruling, judges on the lower appellate court at oral arguments had raised doubts about Burke’s conduct. One observed that Burke had let prosecutors pile on with “incredibly prejudicial testimony” from additional witnesses.

At a news conference, Aidala predicted that the lasting effect of the reversal would be that more defendants will testify at their trials, including Weinstein, who “will be able to tell his side of the story.”

He said that when he spoke to Weinstein Thursday, his client told him: “I’ve been here for years in prison for something I didn’t do. You got to fix this.”

News

Biden Proposes the Biggest Capital Gains Tax in 100 Years — 44.6%

President Joe Biden’s budget proposal for next year includes the largest capital gains tax seen in the last century.

The proposal, released last month, notes that the administration wants to increase the top marginal rate on long-term capital gains dividends up to 44.6 percent, which would make the tax rate exceed 50 percent in states like California, New Jersey, New York and others.

Critics note that the idea will ‘disincentivize investing’ and could massively hurt U.S. industries like tech while further shrinking the middle class.

The last time the capital gains tax was even close to this high was in the late 1970s under Democratic President Jimmy Carter when the rate topped out at 40 percent, setting an all-time-high at the time. Otherwise, the rates have remained below 30 percent and dipping as low as 13 percent spanning back to the 1920s.

Capital gains are profits made from selling assets like stocks, businesses, homes and other investments. The sale of these assets can usually trigger a taxable event.

Biden’s Treasury Department notes that increasing the capital gains tax is a way to level the playing field financially between different races in the U.S., claiming that this would disproportionately apply to white Americans.

‘Black and Hispanic families are much less likely to hold stock, and of those families who do, their composition of investment portfolios looks much different than White families,’ wrote Biden’s team in a document titled Advancing Equity through Tax Reform: Effects of the Administration’s Fiscal Year 2025 Revenue Proposals on Racial Wealth Inequality.

It notes that 73 percent of white families owned a home in 2023 compared to 46 percent of black families and 51 percent of Hispanic families. White families also own more stocks and businesses in 2023 compared to black and Hispanic Americans.

The idea of capital gains and taxes on them were established in the1920s, and Biden’s proposal is the highest federal rate since its inception.

While 44.6 percent is the proposal for the federal rate, when combined with state rates the capital gains tax would far exceed that in places like California (59 percent), New Jersey (55.3 percent), Oregon (54.5 percent), Minnesota (54.4 percent) and New York (53.4 percent), according to Kitco News.

A footnote from the General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals notes: ‘A separate proposal would first raise the top ordinary rate to 39.6 percent … An additional proposal would increase the net investment income tax rate by 1.2 percentage points above $400,000 .’

‘Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.’

Two separate proposals would need to pass in the final 2025 budget for the 44.6 percent figure to come to fruition.

John Kartch, an analyst with Americans for Tax Reform, told Kitco: ‘The proposed Biden top capital gains tax rate is more than twice as high as China’s rate… and puts the United States in uncharted territory.’

‘Biden’s proposed capital gains tax hike will also hit many families when parents pass away,’ Kartch added. ‘Biden has proposed adding a second Death Tax (separate from and in addition to the existing Death Tax) by taking away stepped-up basis when parents die. This would result in a mandatory capital gains tax at death – a forced realization event.’

Specifically, the proposal also eliminates a special tax subsidy for cryptocurrency and other transactions. If the budget is approved it could mean crypto and higher-earning stock investors could see their proceeds significantly diminished in future years.

Capital gains tax is added on top of the federal income tax, currently at 22 percent.

Biden’s FY2025 budget proposal also seeks to increase the corporate income tax rate to 28 percent.

News

DEI FAIL: Kamala Harris’s Secret Service Agent Who Attacked Senior Officer Is Identified

An incident involving a physical attack by a female Secret Service agent tasked with protecting Vice President Kamala Harris is raising questions about whether the agency had thoroughly vetted her during her hiring and whether an ongoing push to increase the numbers of women in the service and boost overall workforce staff played a role in her selection.

The Secret Service agent assigned to Vice President Kamala Harris was removed from her duties Wednesday after physically attacking the commanding agent in charge and other agents trying to subdue her, according to an agency spokesman and knowledgeable Secret Service sources.

Several sources in the Secret Service community identified the agent who physically attacked her superior as Michelle Herczeg. The altercation occurred at approximately 9 a.m. at Joint Base Andrews, the home base for Air Force One and Air Force Two, the call signs of the Boeing aircraft used by the president and vice president. Harris was at the U.S. Naval Observatory at the time of the incident, and it did not delay her travel, said agency spokesman Anthony Guglielmi.

Herczeg showed up at the terminal and began acting erratically, grabbing another senior agent’s personal phone and deleting applications on it, according to two sources familiar with the matter. The other agent, a shift leader, was able to recover his phone and then acted as if nothing had happened.

But Herczeg’s bizarre behavior didn’t stop. She then began mumbling to herself, hid behind curtains, and started throwing items, including menstrual pads, at an agent, telling him that he would need them later to save another agent and telling her peers that they were “going to burn in hell and needed to listen to God,” a source told RealClearPolitics.

Herczeg also screamed at the special agent in charge (SAIC), rattling off the names of female officers on the vice president’s detail and claiming they would show up and help her and allow her to continue working. At that point, other agents on the scene believed Herczeg was suffering from a mental lapse, and the superior officer, SAIC, approached her to tell her she was relieved from the assignment.

“That’s when she snapped entirely,” one source recounted.

Herczeg then chest-bumped and shoved her superior, then tackled him and punched him. The agents involved in restraining Herczeg were especially concerned because she still had her gun in the holster. They wrestled her to the ground, took the gun from her, cuffed her, and then removed her from the terminal.

The agent was immediately “removed from their assignment,” a Secret Service spokesman told RCP in a statement. The Washington Examiner first reported the incident.

“A U.S. Secret Service special agent supporting the Vice President’s departure from Joint Base Andrews began displaying behavior their colleagues found distressing,” said Guglielmi, chief of communications for U.S. Secret Service.

The agents on the scene then called medical personnel to remove Herczeg from the terminal. Guglielmi has described the incident as a “medical matter” and said the agency would not “disclose further details.”

“The U.S. Secret Service takes the safety and health of our employees very seriously,” he added. But the bizarre scuffle is once against raising concerns about the state of the once-vaunted force charged with protecting the president.

Following the incident, Secret Service agents and officers are privately questioning the hiring process and whether the agency had adequately screened Herczeg’s background. Some also wonder whether her hire was part of a diversity, equity, and inclusion push in response to years of staff shortages that may have required the agency to lower its once-strict employment standards and physical performance to reach quotas for female agents and officers.

In 2016, Herczeg, then an officer with the Dallas police force, filed a gender discrimination lawsuit against the city, claiming she was assaulted by a male superior and asking for more than $1 million in damages.

The suit alleged that Herczeg was “targeted for being a female officer and treated less favorably” and was retaliated against after she reported sexual harassment and illegal actions of other officers. She also claimed she was not allowed to return to a crime-reduction team after she alleged a senior officer assaulted her. A Texas trial court dismissed the suit, Herczeg appealed, and a Texas court of appeals affirmed the lower court’s decision in 2021 and denied a rehearing in 2022.

While serving on the Dallas police force, Herczeg and another officer shot an armed man while he sat in a parked car. . According to a department spokesman, the officers were firing in self defense because the man, who had previously been convicted of sexually assaulting a child, was brandishing a weapon and eventually shot himself in the head. A headline in the Dallas Observer raised some doubt about the official police account: “Two Dallas Cops Shot a Man Last Night, but They Say He Killed Himself.”

Ronald Kessler, a former investigative reporter for the Washington Post who has written several books on the Secret Service said the agency would have traditionally viewed the dismissed discrimination lawsuit as disqualifying.

“Yes, that should have been enough to exclude her, because you really have to have a pristine record,” he told RCP Wednesday. “Certainly, this has been true in the past. There’s tremendous competition, and she never should have been hired.”

Kessler also pointed to a new initiative to increase the number of women in the Secret Service workforce. Guglielmi confirmed that the agency is one of numerous federal, state, and local law enforcement agencies that have signed onto the 30×30 initiative, an effort to increase the representation of women in all ranks of policing across the country to 30% of the workforce by 2030.

“Claims that the Secret Service’s standards have been lowered as a result of our signing this pledge are categorically false,” Guglielmi told RCP. According to the initiative’s website, women currently make up only 12% of sworn officers and 3% of police leadership in the U.S., a low statistic that 30×30 advocates says “undermines public safety.”

“Research shows that women officers use less force and less excessive force; are named in fewer complaints and lawsuits; are perceived by communities as being more honest and compassionate, see better outcomes for crime victims, especially in sexual assault cases, and make fewer arrests,” the website states.

“It is critical that participating agencies focus on increasing the representation of all women,” the website adds. “They must account for the diverse experiences of all women of all backgrounds and life experiences to better promote the creation of a diverse and inclusive workplace for everyone.”

The Secret Service has an “Inclusion and Engagement Council,” which pledges to become the agency’s “game-changers” when it comes to helping the agency “build, foster, create and inspire a workforce where diversity and inclusion are not just ‘talked about’ but demonstrated by all employees through ‘Every Action, Every Day.’”

During President Obama’s time in office, the Secret Service experienced a string of scandals and several changes in leadership, including the appointment of its first female director, Julia Pierson. Obama appointed Pierson in March 2013 in an attempt to change the culture of the agency, which was then under scrutiny after a Colombian prostitution scandal. But Pierson lasted less than two years on the job when she resigned in the face of multiple revelations about drunken behavior and security breaches, including one in which Obama had shared an elevator in Atlanta with an armed guard who was not authorized to be around him.

In 2014, a blue-ribbon panel convened at the height of several scandals, and several members of Congress urged Obama to tap an “outsider” to head the agency, a recommendation he ignored. There were complaints that only a new director unconnected to the current and former leadership could truly change the insular culture and uneven discipline partially responsible for low morale and a mass exodus of agents and uniformed division officers fleeing the agency.

In August 2022, President Biden appointed Kimberly Cheatle, a 27-year veteran of the agency, as the director and only the second woman to lead it. She replaced James Murray, a Trump appointee, who announced his retirement after three years on the job. During the Trump administration, the agency faced its own set of controversies, including missing text messages to and from agents around the time of the Jan. 6, 2021, attack on the Capitol.

In recent years, the Secret Service has ranked either dead last or near the bottom of a government employee survey of job satisfaction conducted annually by the nonpartisan Partnership for Public Service. The agency’s most recent ranking for 2023 is near the bottom at No. 375 out of 432 agencies.

Those morale problems, tied to agents’ and officers’ crushing workloads – long hours amid increased security demands from the White House and in protecting presidential candidates in recent years – have led to lagging employment and poor retention rates.

Gary Byrne, a former Uniformed Division officer who wrote a book about his experiences protecting President Clinton, said there have been plenty of exceptions to usual Secret Service standards in the agency’s hiring practices, including numerous incidents of nepotism.

Byrne remembered a push for more female agents during the Clinton administration and one female Secret Service officer telling him that she was never required to take a polygraph before she was hired, which is a requirement for all officers and agent applicants.

“They tell you if you have character issues or mental-stability issues, you can’t take the job, they’ll find out about it,” he said, though many times mental health issues have remained hidden until they surface under stress.

“If you have any instability issues at all, this job will expose them,” he said.

News

WATCH: NYC Construction Worker Goes Viral After Saying Exactly What He Thinks of Biden Following Trump’s Visit

One of the hundreds of construction workers who turned out to support Donald Trump in New York has captured the heart of the nation with his savage takedown of Joe Biden.

The unknown worker had been part of the crowds gathered as the former president made a visit to a construction site in Midtown Manhattan on Thursday morning.

Crowds of construction workers and supporters lined up through the night as they anxiously waited to catch a glimpse of their beloved former president in what is normally Liberal heartland.

After Trump left the site one construction worker was asked by a Newsmax reporter: ‘What’s it like seeing so many Republicans in Manhattan, so many Trump supporters in Manhattan. Does that surprise you?’

The man, dressed ready for work, didn’t hesitate.

‘No, not at all. It’s turning now. It’s Trump’s turn again.’

He was then asked for his message to Joe Biden.

Without missing a beat, he quipped: ‘F**k you.’

He is now being hailed as a hero on social media.

Watch:

What’s your message to Joe Biden??

*Union Worker – “Fuck you” 🔥🔥🔥🔥 pic.twitter.com/CipHhTnJMe— Jay’V (@JayVTheGreat) April 25, 2024

‘This is pretty much the sentiment of all blue collar hard working Americans. Really any American for that matter. Well said sir.’

Another person posted: ‘This is the man representing the working class!’

While another commented: ‘This man represents the majority of America. Verbatim.’

Another added: ‘I think he speaks for most of us Americans.’

A user added: ‘Sounds like the rank and file are not supporting Biden. Bidenomics is bad for workers so of course that makes perfect sense.’

Trump was greeted by hundreds chanting ‘USA, USA’ as he met union workers in New York on the morning of a monumental day in the courts.

The former president greeted teamsters on a construction site and signed MAGA hats as he prepared for another day of testimony in the Manhattan hush money trial.

Union Workers for Trump. 🇺🇸 pic.twitter.com/I6pqe74Ax5

— Karoline Leavitt (@kleavittnh) April 25, 2024

Meanwhile his lawyers are heading to the Supreme Court in Washington, D.C. on Thursday morning in attempts to persuade the nine justices that he is immune from prosecution.

‘This whole thing it’s election interference’ Trump told the crowd regarding his multiple legal battles before taking a shot at President Joe Biden.

‘We’re leading by a lot. He is the worst president in the history of our country. He makes Jimmy Carter look great.

‘He is destroying our country. Our country is going to hell.’ He then insisted it would take Biden ‘one phone call’ to close the border.

Supporters had started gathering shortly after 4AM, many wearing signature red MAGA hats and carrying flags and banners with them, one of which said: ‘Trump won, save America’.

Many of the construction workers at the site wore hard hats plastered in Trump stickers.

As his motorcade pulled up outside the site, the crowd broke into chats of ‘USA! USA! USA!’ before breaking into applause as Trump made his appearance.

The former President then spent the next 30 minutes signing hats and helmets, taking selfies with supporters and workers who waited anxiously to meet him.

After the motorcade left the area, the large group quickly dispersed with the majority of workers who had gathered for hours returning to the site.

After his stop in Manhattan, he headed to court for the third day of former National Enquirer publisher David Pecker’s testimony.

Just a few hundred miles south of New York, the Supreme Court will consider on Thursday arguments that could have huge implications for Trump’s federal criminal trials.

‘Well, we have a big case today, the judge isn’t allowing me to go,’ he lamented.

He added of the Supreme Court case: ‘A president has to have immunity. If you don’t have immunity, you just have a ceremonial president.’

Trump claims that should not be prosecuted for election fraud or crimes linked to January 6 because he was president at the time.

Speaking to Fox News on Wednesday, Trump said that Judge Juan Merchan ‘thinks he is above the Supreme Court’, after he prohibited him from attending arguments on presidential immunity.

He told the outlet: ‘Because he thinks he is above the Supreme Court, he is prohibiting me from going to the presidential immunity hearing where some of the great legal scholars will be arguing the case — the most important case in many years on the Supreme Court.’

Judge Merchan is currently overseeing his hush money trial and has implemented a gag order barring Trump from attacking witnesses, jurors, trial prosecutors and some others.

On Thursday morning, Trump told reporters that he doesn’t know if he would pay fines if Merchan finds he has violated that gag order.

Trump said: ‘I have no idea. They’ve taken my constitutional right away with a gag order. That’s all it is. It’s election interference.’

Judge Merchan must decide whether to punish Trump for alleged violations of the gag order, prosecutors want the former President fined $1,000 for each ten alleged violations and to warn him of possible imprisonment should he continue.

Trump’s meeting with union workers came less than 24 hours after rival Biden nabbed an endorsement from the North America’s Building Trades Union.

Biden hinted that his 2024 opponent deserves a punch and mocked his ‘bleached’ hair.

He then sparked mockery when he read the teleprompter word-for-word by saying: ‘Four more years. Pause’.

The president will also be in New York on Thursday, visiting Syracuse and Westchester to tout his economic agenda and participate in a campaign event, respectively.

News

Axios Poll: Americans Support Mass Deportations

Half of Americans — including 42% of Democrats — say they’d support mass deportations of undocumented immigrants, according to a new Axios Vibes survey by The Harris Poll.

And 30% of Democrats — as well as 46% of Republicans — now say they’d end birthright citizenship, something guaranteed under the 14th Amendment of the Constitution.

Americans are open to former President Trump’s harshest immigration plans, spurred on by a record surge of illegal border crossings and a relentless messaging war waged by Republicans.

President Biden is keenly aware the crisis threatens his re-election. He’s sought to flip the script by accusing Trump of sabotaging Congress’ most conservative bipartisan immigration bill in decades.

But when it comes to blame, Biden so far has failed to shift the narrative: 32% of respondents say his administration is “most responsible” for the crisis, outranking any other political or structural factor.

Amid a record number of border crossings, nearly two-thirds of Americans said illegal immigration is a real crisis, not a politically driven media narrative.

“I was surprised at the public support for large-scale deportations,” said Mark Penn, chairman of The Harris Poll and a former pollster for President Clinton.

“I think they’re just sending a message to politicians: ‘Get this under control,’ ” he said, calling it a warning to Biden that “efforts to shift responsibility for the issue to Trump are not going to work.”

Trump has vowed to carry out the “largest domestic deportation operation in American history,” eyeing sweeping raids and detention camps in a plan that would target millions of undocumented immigrants.

Americans typically aren’t eager to deport immigrants who have put down roots in the U.S. But the poll of 6,251 U.S. adults suggests that the dynamic may be changing amid rising fears about crime and violence.

Trump has fanned those fears at every opportunity, campaigning on false claims of a “migrant crime wave” and declaring that immigrants are “poisoning the blood of our country.”

When asked to identify their greatest concern around illegal immigration, Americans most frequently cited:

Increased crime rates, drugs, and violence (21%).

The additional costs to taxpayers (18%).

Risk of terrorism and national security (17%).

The survey found discrepancies between Americans’ perceptions of immigration and the reality established by data.

64% wrongly believe immigrants receive more in welfare and benefits than they pay in taxes.

56% wrongly believe illegal immigration is linked to spiking U.S. crime rates.

Individual instances of violent crime by undocumented individuals drive headlines. But data doesn’t show that undocumented immigrants are more likely to commit crimes.

Border cities have some of the nation’s lowest violent crime rates.

Data also shows that undocumented immigrants have lower homicide conviction rates than the general public.

The survey still found Americans strongly support immigration as long as it is lawful. “Illegal” immigration is what’s giving people anxiety.

58% said they support expanding legal pathways for orderly immigration, while 46% said asylum seekers should be protected if their cases are legitimate.

68% said illegal immigration causes major problems in communities, while only 27% said the same about legal immigration.

And 65% of Americans think the U.S. should make it easier for anyone seeking a better life to enter legally so they don’t need to enter illegally.

“The tradeoff here in the poll is, people would take expanded legal immigration if they saw there’s a crackdown on the border,” Penn said.

That’s not out of the question for Biden, who’s still considering a dramatic executive order to stem illegal border crossings.

News

GDP Growth Slowed to a 1.6% Rate in the First Quarter, Well Below Expectations

U.S. economic growth was much weaker than expected to start the year, and prices rose at a faster pace, the Commerce Department reported Thursday.

Gross domestic product, a broad measure of goods and services produced in the January-through-March period, increased at a 1.6% annualized pace when adjusted for seasonality and inflation, according to the department’s Bureau of Economic Analysis.

Economists surveyed by Dow Jones had been looking for an increase of 2.4% following a 3.4% gain in the fourth quarter of 2023 and 4.9% in the previous period.

Consumer spending increased 2.5% in the period, down from a 3.3% gain in the fourth quarter and below the 3% Wall Street estimate. Fixed investment and government spending at the state and local level helped keep GDP positive on the quarter, while a decline in private inventory investment and an increase in imports subtracted. Net exports subtracted 0.86 percentage points from the growth rate while consumer spending contributed 1.68 percentage points.

There was some bad news on the inflation front as well.

The personal consumption expenditures price index, a key inflation variable for the Federal Reserve, rose at a 3.4% annualized pace for the quarter, its biggest gain in a year and up from 1.8% in the fourth quarter. Excluding food and energy, core PCE prices rose at a 3.7% rate, both well above the Fed’s 2% target. Central bank officials tend to focus on core inflation as a stronger indicator of long-term trends.

The price index for GDP, sometimes called the “chain-weighted” level, increased at a 3.1% rate, compared to the Dow Jones estimate for a 3% increase.

Markets slumped following the news, with futures tied to the Dow Jones Industrial Average off more than 400 points. Treasury yields moved higher, with the benchmark 10-year note most recently at 4.69%.

“This was a worst of both worlds report – slower than expected growth, higher than expected inflation,” said David Donabedian, chief investment officer of CIBC Private Wealth US. “We are not far from all rate cuts being backed out of investor expectations. It forces [Fed Chair Jerome] Powell into a hawkish tone for next week’s [Federal Open Market Committee] meeting.”

The report comes with markets on edge about the state of monetary policy and when the Federal Reserve will start cutting its benchmark interest rate. The federal funds rate, which sets what banks charge each other for overnight lending, is in a targeted range between 5.25% to 5.5%, the highest in some 23 years though the central bank has not hiked since July 2023.

Investors have had to adjust their view of when the Fed will start easing as inflation has remained elevated. The view as expressed through futures trading is that rate reductions will begin in September, with the Fed likely to cut just one or two times this year. Futures pricing also shifted after the GDP release, with traders now pointing to just one cut in 2024, according to CME Group calculations.

“The economy will likely decelerate further in the following quarters as consumers are likely near the end of their spending splurge,” said Jeffrey Roach, chief economist at LPL Financial. “Savings rates are falling as sticky inflation puts greater pressure on the consumer. We should expect inflation will ease throughout this year as aggregate demand slows, although the path to the Fed’s 2% target still looks a long ways off.”

Consumers generally have kept up with inflation since it began spiking, though rising inflation has eaten into pay increases. The personal savings rate decelerated in the first quarter to 3.6% from 4% in the fourth quarter. Income adjusted for taxes and inflation rose 1.1% for the period, down from 2%.

Spending patterns also shifted in the quarter. Spending on goods declined 0.4%, in large part to a 1.2% slide in bigger-ticket purchases for long-lasting items classified as durable goods. Services spending increased 4%, its highest quarterly level since the third quarter of 2021.

A buoyant labor market has helped underpin the economy. The Labor Department reported Thursday that initial jobless claims totaled 207,000 for the week of April 20, down 5,000 and below the 215,000 estimate.

In a possible positive sign for the housing market, residential investment surged 13.9%, its largest increase since the fourth quarter of 2020.

Thursday’s release was the first of three tabulations the BEA does for GDP. First-quarter readings can be subject to substantial revisions — in 2023, the initial Q1 reading was an increase of just 1.1%, which ultimately was taken up to 2.2%.

News

Australian PM Wants to Ban Memes of Himself

The Australian Prime Minister appeared to call for a ban on memes on social media Wednesday, as his government continues a full on assault on freedom of speech online.

During a press appearance, Anthony Albanese seemed to lump in memes making fun of him with “misinformation” he is claiming should be purged from the internet.

“Social media platforms have a responsibility to make sure that misinformation isn’t got out there,” Albanese stated.

He continued, “I noticed today, for example, on the way up here, they’ve removed various sites that were up containing fake images of myself superimposed on other people.”

Yeah that’s not illegal, it’s called freedom of expression, and… humour.

“That’s the sort of thing that is going on, on social media. Social media has a responsibility to do the right thing here,” he further asserted.

The Australian Prime Minister appeared to call for a ban on memes on social media Wednesday, lumping them under the category of “misinformation” as his government continues a full on assault on freedom of speech online. Report: https://t.co/ezpQYEIfZd pic.twitter.com/iru6WROGpR

— m o d e r n i t y (@ModernityNews) April 25, 2024

As we earlier highlighted, Albanese and his government are at war with Elon Musk, after the X owner refused demands to remove all copies of a video of Christian Bishop Mar Mari Emmanuel being attacked by a Muslim extremist last week.

Australia’s so called ‘eSafety Commissioner’ Julie Inman-Grant, an unelected official, has ordered both X and Meta to remove footage of the stabbing under the Online Safety Act, passed in 2021, which empowers the eSafety department to demand the removal of so-called ‘class 1 material’.

Musk urged that “no president, prime minister or judge has authority over all of Earth! This platform adheres to the laws of countries in those countries, but it would be improper to extend one country’s rulings to other countries. If he [wants] to censor things in other countries, he should bring a legal action to bear in those countries.”

Well, no president, prime minister or judge has authority over all of Earth!

This platform adheres to the laws of countries in those countries, but it would be improper to extend one country’s rulings to other countries.

If he want to censor things in other countries, he should…

— Elon Musk (@elonmusk) April 23, 2024

The Australian government has also proposed a so-called misinformation bill, released as a draft last year.

If passed into law, it would empower the Australian Communications and Media Authority to require online platforms to remove or restrict content considered “false, misleading or deceptive, and where the provision of that content on the service is reasonably likely to cause or contribute to serious harm,” according to the wording of the draft legislation.

Albanese’s wish to see memes completely removed from the internet betrays just how insanely out of touch with reality he is.

And, of course, it has just prompted the world to make millions more memes of him.

— Clown Down Under 🤡 (@clowndownunder) April 24, 2024

— MilkBarTV (@TheMilkBarTV) April 24, 2024

🚨Australian PM @AlboMP orders all memes featuring him to be taken off the internet! #FreeSpeech #IStandWithElon pic.twitter.com/Dkct0LNjC1

— Private Investigator (@Top1Rating) April 24, 2024

— Eric Mac (@EricMcQ) April 24, 2024

News

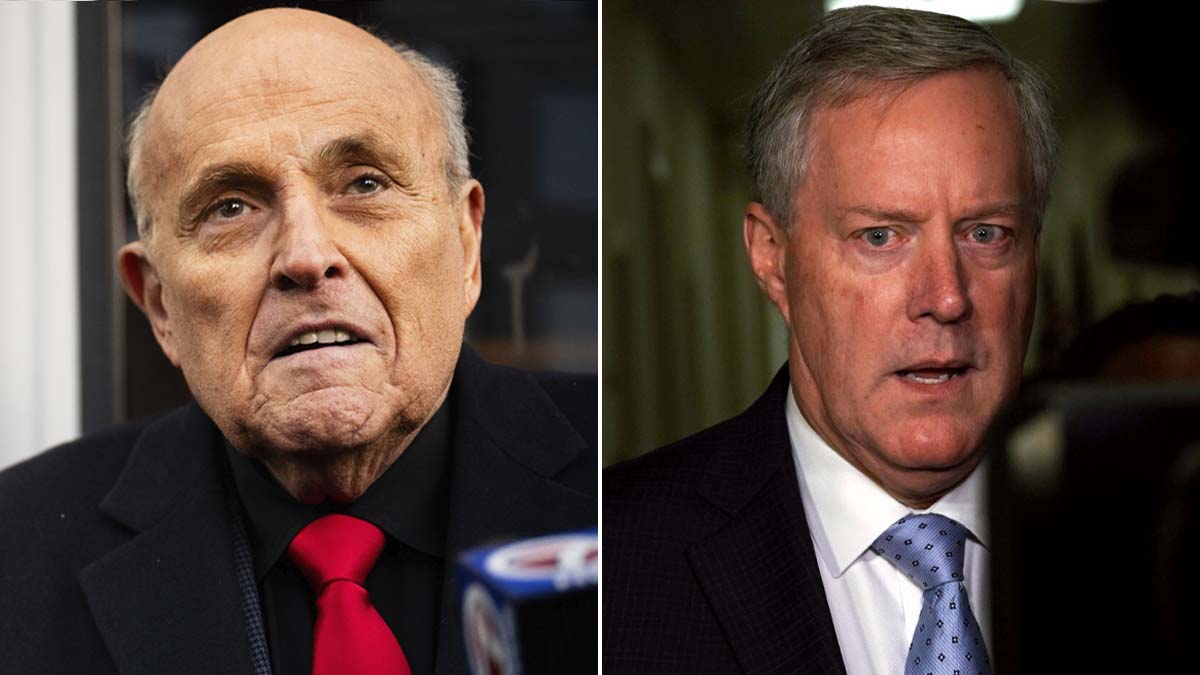

Arizona Indicts 18 Trump Allies In Election Probe

An Arizona grand jury handed up felony charges against Rudy Giuliani, Mark Meadows and other prominent Trump allies for allegedly attempting to prevent the lawful transfer of power from then-President Trump to Joe Biden.

Seven Trump aides were charged alongside 11 pro-Trump Arizona Republicans who signed documents purporting to be the state’s valid electors in 2020.

The former president himself is not charged but is listed as an unindicted co-conspirator.

Prosecutors accuse the 18 defendants of devising a scheme to raise false claims of election fraud to pressure Arizona election officials to overturn Biden’s narrow victory in the state.

The indictment, which was dated Tuesday but became public on Wednesday, describes lawsuits filed, alleged messages to county and state officials and the signing of the “fake elector” documents in December 2020.

Each of the 11 pro-Trump electors faces nine charges, including conspiracy, fraud and forgery counts.

“In Arizona, and the United States, the people elected Joseph Biden as President on November 3, 2020,” the indictment reads.

“Unwilling to accept this fact, Defendants and unindicted coconspirators schemed to prevent the lawful transfer of the presidency to keep Unindicted Coconspirator 1 in office against the will of Arizona’s voters,” it continued, referring to Trump. “This scheme would have deprived Arizona voters of their right to vote and have their votes counted.”

Only the 11 alternate electors are identified by name, but descriptions contained within the charging documents make clear the other defendants include Giuliani, the former New York City mayor turned Trump attorney; Meadows, Trump’s White House chief of staff; Boris Epshteyn, a longtime Trump adviser; John Eastman, an attorney involved in Trump’s efforts to overturn the election; Christina Bobb, another Trump attorney who now works for the Republican National Committee; and Mike Roman, the director of Election Day operations for Trump’s 2020 campaign.

Arizona Attorney General Kris Mayes’s (D) office said their names will be made public after they have been served.

“I understand for some of you, today didn’t come fast enough. And I know I’ll be criticized by others for conducting this investigation at all,” Mayes said in a recorded video announcing the charges.

“But as I have stated before, and we’ll say here again today, I will not allow American democracy to be undermined. It’s too important,” she added.

Mayes said her office is continuing to investigate the alleged scheme to subvert the state’s election results.

The 2020 presidential race in Arizona was one of the nation’s tightest, with Biden prevailing against Trump by just more than 10,000 votes.

Arizona was one of seven battleground states where slates of “alternate electors” convened and claimed without basis that they were “duly elected” electors. The hope was that then-Vice President Mike Pence would recognize those Trump-supporting electors instead of the true electoral votes cast for Biden.

Arizona is now the fourth of those states to bring charges against the slates of pro-Trump electors, following charges brought in Michigan, Nevada and Georgia.

Without naming him, the indictment asserts that Giuliani — often identified as “the Mayor” — spread false claims of election fraud in Arizona. He pressured Arizona officials to change the outcome of the state’s election, and was responsible for encouraging the pro-Trump electors to vote for the former president’s ticket, according to the indictment.

Former Arizona House Speaker Rusty Bowers (R ) implicated Giuliani in his 2022 testimony before the House Jan. 6 committee. Bowers said that, despite repeatedly pushing the New York mayor-turned-Trump-surrogate for proof to back up his 2020 election fraud claims, Giuliani failed to produce any.

“My recollection, [Giuliani] said, ‘We’ve got lots of theories, we just don’t have the evidence,’” Bowers testified.

Meadows, also unnamed in the indictment, allegedly worked with members of Trump’s campaign to “coordinate and implement” the alternate electors’ votes in the battleground states, and was involved in “many efforts to keep Unindicted Coconspirator 1 (Trump) in power despite his defeat at the polls,” the charging document reads.

The other Trump allies allegedly helped implement the scheme, including by pressuring Pence to accept the pro-Trump slate of electors, according to the indictment.

The so-called ‘fake electors’ indicted are former Arizona Republican Party Chair Kelli Ward; her husband, Michael Ward; Tyler Bowyer, the chief operating officer of Turning Point Action; Nancy Cottle, who has held positions on the Maricopa County Republican Committee; Arizona State Sen. Jacob Hoffman; Arizona State Sen. Anthony Kern; former U.S. Senate candidate James Lamon; former Cochise County Republican Party Chair Robert Montgomery; Samuel Moorhead, a former Gila County Republican Party precinct committeeman; former Ahwatukee Republican Women president Lorraine Pellegrino; and Gregory Safsted, the state Republican party’s former executive director.

“It’s unfortunate to see so many so-called ‘leaders’ who are willing to eviscerate our entire justice system in their quest to take down the biggest threat to their grasp on power — President Donald Trump and anyone willing to take on the ruling regime,” Ted Goodman, Giuliani’s political adviser, said in a statement.

Hoffman said in a statement, “Let me be unequivocal, I am innocent of any crime, I will vigorously defend myself, and I look forward to the day when I am vindicated of this naked political persecution by the judicial process.”

Steven Cheung, a spokesperson for Trump’s campaign, said in a statement that the indictment is “another example of Democrats’ weaponization of the legal system.” He defended Bobb, specifically, as having “served our nation and the President with distinction.”

“The Democrat platform for 2024: if you can’t beat them, try to throw them in jail,” Cheung said.

News

Don’t Mess with Texas! Troopers in Helmets Arrest Palestine Protesters

Hundreds of troopers have marched on the University of Texas at Austin before scuffling with pro-Palestine protesters as demonstrations kicked off at campuses across the country.

Police arrested at least four activists – who burst out in tears when they were handcuffed – after warning them they could face criminal charges if they did not disperse.

The rally at the Austin campus was organized by the university’s Palestine Solidarity Committee (PSJ) chapter and quickly descended into anarchy.

The group said it was inspired by their ‘comrades’ at Yale and Columbia University, where in-person classes have been canceled due to the unrest sparked by ‘encampments for Gaza.’

It comes as pro-Gaza groups took to universities across the US and clashed with police and Jewish counter-protesters, with furious demonstrators spotted at USC, Harvard, UC Berkeley, Brown and NYU.

Watch:

UT Austin right now. Protesters and DPS in a standoff on the main drag of campus pic.twitter.com/OipxvXDbWC

— Ryan Chandler (@RyanChandlerTV) April 24, 2024

The PSC chapter at UT Austin said on Instagram: ‘UT administration has called on state troopers in an attempt to scare us into silence.’

They added: ‘get these pics off our campus.’ Texas Department of Public Safety officers were also seen in horses and riot gear at the protest.

Several pro-Palestine demonstrators were seen sobbing as they watched police enter the scene.

BREAKING: Organizers of the Yale divestment encampment have been informed that those at the encampment can expect arrest, likely sometime between now and early morning.

Repeat: ARRESTS ARE EXPECTED AT YALE.

The crowd of hundred of students is sitting in a circle and singing. pic.twitter.com/yjwdxi0hGF

— Thomas Birmingham (@thomasbirm) April 22, 2024

The over 200 protesters are demanding UT-Austin divest from any manufacturers supplying Israel with weapons aid the war against Hamas in Gaza.

They gathered at the university’s Gregory Gym and marched towards the South Lawn, where they planned to sit for the rest of the day.

One of the demonstrators arrested was one of the protest’s organizers, with an officer singling him out saying he would be the first to be arrested, according to the Tribune.

Also on Wednesday, police clashed with protesters at the University of Southern California in Los Angeles.

Officials broke up a tent demonstration after students began camping out for Palestine after a call by USC’s Divest from Death Coalition and National Students for Justice in Palestine.

It comes as the situation in Columbia University in New York City remained tense with campus officials saying it would continue talks with pro-Palestinian protesters for another 48 hours.

University President Minouche Shafik had set a midnight deadline to reach an agreement on clearing an encampment of protesters on campus but the school extended negotiations, saying it was making ‘important progress.’

Student protesters had committed to dismantling and removing a significant number of tents, the Ivy League university said in a statement.

On Wednesday morning, the encampment appeared calm and a little smaller than the previous day.

Police first tried to clear the encampment at Columbia last week, when they arrested more than 100 protesters. But the move backfired, acting as an inspiration for other students across the country to set up similar encampments and motivating protesters at Columbia to regroup.

Elsewhere, at the University of Minnesota, Democratic U.S. Rep. Ilhan Omar attended a protest late Tuesday, hours after nine protesters were arrested on the campus when police took down an encampment in front of the library. Hundreds had rallied in the afternoon to demand their release.

Omar’s daughter was among the demonstrators arrested at Columbia last week.

Students at some protests were hiding their identities. At an encampment of about 40 tents at the heart of the University of Michigan’s campus in Ann Arbor, almost every student wore a mask, which was handed to them when they entered.

Meanwhile more than 40 protesters were arrested Monday at an encampment at Yale University.

The upwelling of demonstrations has left universities struggling to balance campus safety with free speech rights. Many long tolerated the protests, but are now doling out more heavy-handed discipline, citing safety concerns.

News

Israel to Move on Rafah

Israel’s military is poised to evacuate Palestinian civilians from Rafah and assault Hamas hold-outs in the southern Gaza Strip city, a senior Israeli defence official said on Wednesday, despite international warnings of humanitarian catastrophe.

A spokesperson for Prime Minister Benjamin Netanyahu’s government said Israel was “moving ahead” with a ground operation, but gave no timeline.

The defence official said Israel’s Defence Ministry had bought 40,000 tents, each with the capacity for 10 to 12 people, to house Palestinians relocated from Rafah in advance of an assault.

Video circulating online appeared to show rows of square white tents going up in Khan Younis, a city some 5 km (3 miles) from Rafah.

Reuters could not verify the video but reviewed images from satellite company Maxar Technologies which showed tent camps on Khan Younis land that had been vacant weeks ago.

The defence official, who requested anonymity, told Reuters that the military could go into action immediately but was awaiting a green light from Netanyahu.

Rafah, which abuts the Egyptian border, is sheltering more than a million Palestinians who fled the half-year-old Israeli offensive through the rest of Gaza, and say the prospect of fleeing yet again is terrifying.

“I have to make a decision whether to leave Rafah because my mother and I are afraid an invasion could happen suddenly and we won’t get time to escape,” said Aya, 30, who has been living temporarily in the city with her family in a school.

She said that some families recently moved to a refugee camp in coastal Al-Mawasi, but their tents caught fire when tank shells landed nearby. “Where do we go?”

News

Israel Hits 40 Sites in Lebanon, Says It Has Killed ‘Half’ of Hezbollah Commanders

Defense Minister Yoav Gallant on Wednesday claimed that the military had killed half of Hezbollah’s commanders in southern Lebanon, as the Israel Defense Forces carried out a large wave of strikes against dozens of sites belonging to the terror group.

“Half of the Hezbollah commanders in south Lebanon have been eliminated… and the other half hide and abandon south Lebanon to IDF operations,” Gallant said, after holding an assessment at the Northern Command headquarters in Safed with the chief of the command, Maj. Gen. Ori Gordin, and other top officers.

He said Israel’s main goal in the north was to return tens of thousands of Israelis displaced by Hezbollah’s daily attacks to their homes.

“We are dealing with a number of alternatives in order to establish this matter, and the coming period will be decisive in this regard,” Gallant said.

As the defense minister toured the Northern Command, the IDF said some 40 Hezbollah targets in the town of Ayta ash-Shab were hit within just several minutes by fighter jets and artillery shelling.

The wave of strikes came hours after the terror group fired anti-tank missiles at a community in northern Israel.

The military said the targets included weapon depots and other assets belonging to Hezbollah, and charged that Ayta ash-Shab was used by the group for “terror” and that it places dozens of its sites in the area.

In a statement, the IDF said the strikes were “part of the effort to destroy the organization’s infrastructure in the border area,” and not a response to any specific attack.

Ahead of the strikes, the military issued an unusual statement announcing that it had begun to attack Hezbollah targets in south Lebanon.

Amid the ongoing war, the military has generally announced strikes in Lebanon only after they have been completed. The announcement indicated that the strikes were on a much larger scale than usual.

⚡ In the recent massive strike on Ayta Ash Shab in Southern Lebanon, 40 Hezbollah sites were hit by Airstrikes and Artillery fire, according to IDF. These sites were used by Hezbollah as Weapon depots and other assets to strike against #Israel.#breaking #news pic.twitter.com/imHc0fOB87

— Storyline Global 🔍 (@storylineglobal) April 24, 2024

Hours before the wave of strikes, Hezbollah fired several anti-tank guided missiles at the northern community of Avivim, striking two homes and causing a fire.

The Merom HaGalil Regional Council, which has jurisdiction over Avivim, said the missiles caused no injuries.

Hezbollah claimed the attack in a statement, saying it “targeted a building in Avivim in which ‘enemy soldiers’ were present.”

The missile attack on Avivim came after a wave of overnight Israeli Air Force strikes against Hezbollah positions in Lebanon, following repeated attacks by the Iran-backed terror group on northern Israel.

תיעוד פגיעת טילי הנ”ט באביבים@rubih67

(צילום: מועצה אזורית מרום הגליל) pic.twitter.com/lzglkKF7IJ— כאן חדשות (@kann_news) April 24, 2024

The overnight strikes targeted a rocket launcher in the town of Tayr Harfa after it was used in an attack on the northern community of Shomera on Tuesday night, the IDF said.

The IDF said additional targets included Hezbollah infrastructure in Markaba, a building in Ayta ash-Shab and an observation post in Marwahin.

Troops also shelled areas near Chihine and Kfarchouba with artillery to “remove threats,” the military added.

Since October 8, Hezbollah-led forces have attacked Israeli communities and military posts along the border on a near-daily basis, with the group saying it is doing so to support Gaza amid the war there.

So far, the skirmishes on the border have resulted in eight civilian deaths on the Israeli side, as well as the deaths of 11 IDF soldiers and reservists. There have also been several attacks from Syria, without any injuries.

Hezbollah has named 287 members who have been killed by Israel during the ongoing skirmishes, mostly in Lebanon, but some also in Syria. In Lebanon, another 54 operatives from other terror groups, a Lebanese soldier and at least 60 civilians, three of whom were journalists, have been killed.

Israel has threatened to go to war to force Hezbollah away from the border if it does not retreat and continues to threaten northern communities, from where some 70,000 people were evacuated to avoid the fighting.

News

The Gateway Pundit Declaring Bankruptcy Amid Lawsuit

Conservative website The Gateway Pundit is declaring bankruptcy, founder Jim Hoft announced Wednesday.

The site is facing a lawsuit from two election workers over accusations it committed ballot fraud to alter the outcome of the 2020 presidential election in Georgia.

Hoft said in a message that the website’s parent company made the decision “as a result of the progressive liberal lawfare attacks against our media outlet,” though he did not name specific lawsuits.

He added, “This is not an admission of fault or culpability. This is a common tool for reorganization and to consolidate litigation when attacks are coming from all sides.”

But Hoft indicated the site will continue its work and “will not be deterred from our mission of remaining fearless.”

Two Georgia election workers filed a lawsuit in 2021 accusing The Gateway Pundit “of committing ballot fraud to alter the outcome of the 2020 presidential election in Georgia.”

The site published articles claiming that the two election workers, Ruby Freeman and her daughter, Shaye Moss, “were involved in a conspiracy to commit election fraud.”

The website allegedly identified them by name and published their pictures online, claiming they interfered with the election results in favor of President Biden.

The two elections workers recently won a separate $148 million defamation case against Rudy Giuliani related to his alleged efforts to undermine the results of the 2020 presidential election.

News

Man Who Punched Several Random Women in NYC Is Arrested

A deranged, woman-hating maniac wanted for more than a half-dozen random attacks on women in the Big Apple is finally in custody, police and sources said Tuesday.

Daquan Armstead, 31, was picked up by cops shortly after midnight and charged with third-degree assault and harassment in eight unprovoked attacks on women this year, the sources said.

That includes an April 17 attack on a 27-year-old administrator at New York University, who was slugged in the face while walking through Washington Square Park around 10:30 a.m., according to police.

The NYPD Hate Crimes Task Force is investigating, although details weren’t released.

Armstead is also being charged in seven other attacks this year.

The violent spree began on Feb. 12, when police said Armstead allegedly walked up to a 30-year-old woman on Elizabeth Street around 11:50 a.m. and punched her without warning, then fled.

On March 24, he allegedly attacked a 30-year-old woman on Delancey Street around 2 a.m., hitting the victim in the back of the head as she turned. He then ran away.

The following day, Armstead is charged with punching a 36-year-old woman in the back as she walked at Chrystie and Rivington streets around 10:15 a.m., police said.

On April 2, he allegedly slugged another woman after he asked the 38-year-old victim for $1 and she replied that she had no cash — so he punched her in the back of the head.

Police said he is also accused of attacking two women in separate incidents on Delancey Street on April 5 — a 25-year-old who was slugged on the right side of her head around 12:25 p.m. and a 44-year-old who was punched in the face just five minutes later, according to cops.

In the last alleged attack before the assault on the NYU administrator, police said Armstead punched a 24-year-old woman on Stanton Street after she also refused when he asked her for $1 shortly before 10 a.m.

Records show his prior busts date to a 2021 misdemeanor assault case.

He is expected to be arraigned on the new charges later Tuesday.

@mikaylatoninato @halley ♬ original sound – mikayla

Police have also been investigating a series of other attacks on women that have not been linked to Armstead, including a 23-year-old woman slugged outside a Union Square McDonald’s last month.

Among the other recent victims was Halley Kate, an influencer with 1.1 million followers on TikTok, who posted a video last week saying she was assaulted so viciously that she blacked out.

@halleykate♬ original sound – halley

Skiboky Stora, 40, a criminal with an extensive criminal record, was busted in that case.

In another random attack, a 57-year-old Brooklyn school bus aide was slugged by an unhinged man — a brutal attack that broke her jaw and knocked out several teeth — in Crown Heights, cops said.

Franz Jeudy, 33 — who has a history of sucker-punch attacks and mental illness — was hit with misdemeanor assault charges in that attack, according to a criminal complaint.

News

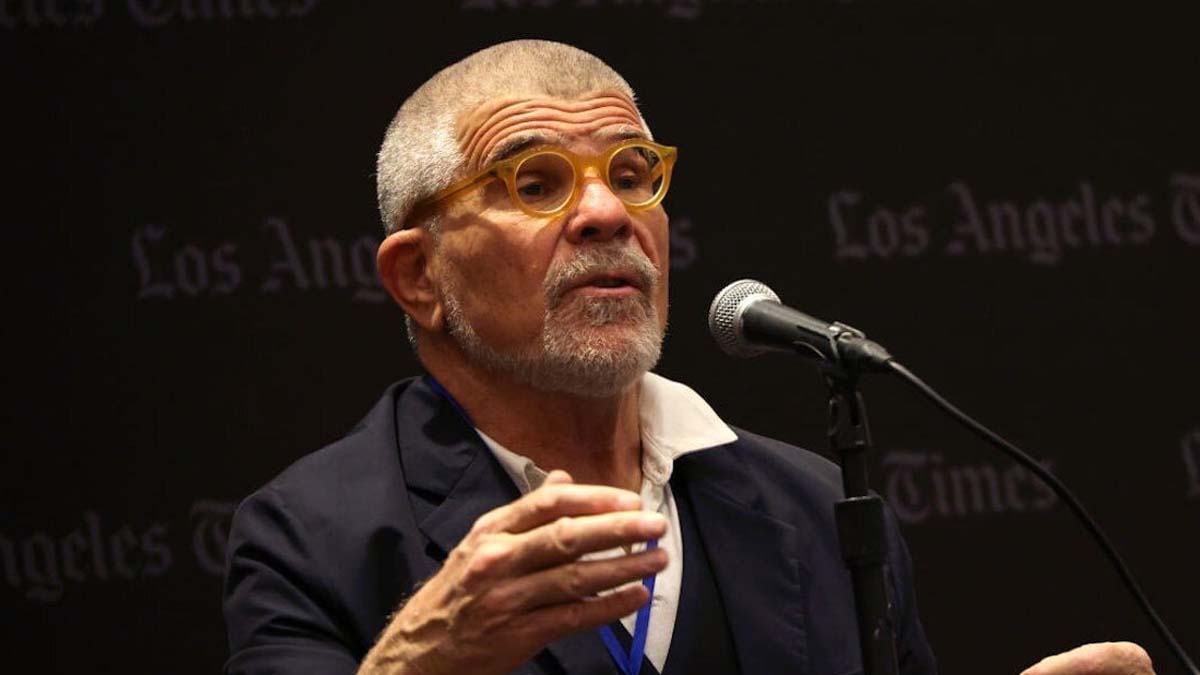

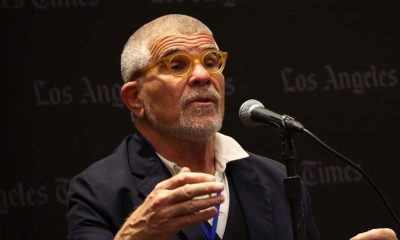

‘DEI Is Garbage’: Pulitzer Prize Winner Delivers Scathing Takedown of Woke Hollywood

Pulitzer Prize-winning playwright David Mamet certainly has a way with words — and he did not mince any when he delivered a blistering takedown of the Diversity, Equity, and Inclusion (DEI) standards that now limit him and others who share his profession.

Mamet made the comments during an interview with Los Angeles Times deputy entertainment editor Matt Brennan and the outlet’s Festival of Books — hosted by University of Southern California — where he was promoting his memoir, “Everywhere an Oink, Oink.”

“DEI is garbage. It’s fascist totalitarianism,” Mamet told Brennan. His memoir, which was published last fall, tells his life story in a series of anecdotes — and follows his political metamorphosis as well.

Mamet refers to himself as a “red diaper baby,” the child of two communists — and details how he made the journey from the far Left to his current position: supporting former President Donald Trump.

The award-winning playwright and screenwriter — whose works include “Glengarry Glen Ross,” “The Untouchables,” and “Hannibal” — also took issue with the new “inclusion standards” that have been implemented by the Academy of Motion Pictures, noting that for films to even be considered for awards, they had to check certain boxes according to DEI standards.

“I can’t give you a stupid f***ing statue unless you have 7% of this, 8% of that,” Mamet complained. “It’s intrusive.”

He did not spare the feelings of those charged with implementing the new standards either, referring to them in his memoir as “diversity capos” and “diversity commissars.”

Mamet conceded that Hollywood had long been a place where discrimination had thrived — but argued that the executives dictating the new rules were better suited to “selling popcorn” than to creating a less restrictive environment.

“The [film industry] has little business improving everybody’s racial understanding as does the fire department,” he said.

Despite his long career in Hollywood, Mamet said that he’s been shuffled off the main stage in recent years — but he did not blame the shift in his political views for that. Instead, he said that his age was the likely culprit — and younger directors preferred to work with people closer to their own age.

“Nobody’s going to pay me a lot of money anymore. Nobody’s going to let me have a lot of fun,” he said.

News

American Caught with Ammo in Airport Faces 12 Years in Prison

An Oklahoma man is facing up to 12 years in prison for having ammunition in his carry-on bag at a Turks and Caicos airport, according to a GoFundMe page for his family.

Ryan and Valerie Watson, the parents of two young children, were flying home from their island vacation, where they were celebrating a friend’s 40th birthday, on April 12 when they were arrested at the airport.

“They had their lives turned upside down when they tried to return home, as local airport security found four rounds of ammunition unknowingly left in a duff[le]bag from a deer hunting trip,” a description on the family’s GoFundMe page states. “It was not noticed by TSA when leaving America. Now, they are facing a legal system that is unfamiliar, daunting, and expensive that operates differently than the American Justice System.”

The U.S. Embassy in the Bahamas issued a travel alert in September 2023 telling Americans not to bring ammunition to the islands.

“TCI authorities strictly enforce all firearms related laws,” the alert states. “The penalty for traveling to TCI with a firearm, ammunition, or other weapon is a minimum custodial sentence of twelve (12) years.”

The embassy further stated that Americans should “carefully check” their luggage “for stray ammunition or forgotten weapons before departing for TCI.”

But the Watsons insist they made a terrible mistake. Valerie Watson was released from jail in Turks and Caicos on Tuesday, but her husband remains in custody “with no current timetable for any possibility of bail or trial date.”

“While we appreciate your support and willingness to help, please do not reach out directly to any of the TCI government officials during this time,” the family wrote on their GoFundMe page.

The Royal Turks and Caicos Islands Police Force on Wednesday confirmed Ryan Watson’s arrest, saying the 40-year-old Oklahoma resident appeared in magistrate court Wednesday, when he was charged with one count of ammunition possession. He was also granted $15,000 bail under the condition that he does not travel outside the islands without the court’s permission, he surrenders his passport, he reports to the Grace Bay Police Station on Tuesdays and Thursdays and he resides at a specific address.

Ryan is due back in court for a “sufficiency” hearing on June 7, officials said.

The Wastson family’s GoFundMe page says the couple faces “mounting legal fees, living expenses, and the overwhelming stress of their situation.”

“The emotional and financial toll is immense, and they are at risk of losing everything,” the page reads.

News

Arizona House Repeals Total Ban on Abortion. State Will Revert Back to 15-Week Ban.

The Arizona House on Wednesday passed legislation that would repeal the state’s 1864 near-total abortion ban, as several Republicans joined with all the chamber’s Democrats.

It was the third repeal attempt in as many weeks. The previous tries were thwarted when Republicans blocked the bill from coming to the floor.

But this time, the bill passed 32-28. Republican state Reps. Tifm Dunn (R) and Justin Wilmeth (R) joined state Rep. Matt Gress (R) and all Democrats to bypass state Speaker Ben Toma (R) and the rest of the GOP caucus.

Last week, Gress was the only Republican who joined House Democrats in their effort to repeal the abortion ban. Democrats needed at least two Republicans to cross party lines.

The measure now heads to the Senate, where it needs votes from at least two Republicans to pass. But the Senate already has begun moving forward on its identical version of the House repeal bill, suggesting it could pass as soon as the chamber meets next week.

If the bill passes, it would be sent to Gov. Katie Hobbs (D), who has called on the Legislature to repeal the law.

Toma took a dig at Hobbs during the session, calling on her to rescind her executive order barring attorneys general from enforcing the law.

“I’m disappointed, as I’ve said before, it appears that Democrats apparently believe that abortion should occur with no limits and no regulations. I fervently disagree,” Toma said when voting. “Most Arizonans do not support unrestricted abortion.”

Republican lawmakers blasted those in their party who voted with Democrats.

“We’re willing to kill infants in order to win an election. Put in that context, it becomes a little bit harder to stomach, doesn’t it? Besides, legalizing abortion up until birth is not going to help us win an election,” state Rep. Alexander Kolodin (R) said. “Politics is important, but it’s not worth our souls.”

Kolodin’s comments highlight the political conundrum Arizona conservatives have found themselves in since the state Supreme Court revived the 1800s abortion law earlier this month.

Some Republicans, including former President Trump and Senate hopeful Kari Lake, want to see the Civil War-era ban repealed. They recognize that the backlash against the 1864 law could upend conservative majorities in the state and hurt Trump’s campaign in the crucial swing state.

Lake has flipped back and forth on how she speaks about the 1864 measure. In 2022, while she was running for governor of Arizona, she called it a “great law.”

House Speaker Pro Tem Travis Grantham (R) said he was “proud of my Republican caucus that has fought this off as long as it has.”

“This did not need to happen this quickly. This does not even change anything for easily four to five months. I think the timing on this is poor. I disagree with it wholeheartedly,” Grantham said. “I hope people are happy now, and I would encourage them to vote no on any further law that expands abortions in our state.”

If the 1864 ban were repealed, the state would revert to the 15-week ban that was invalidated by the court.

Still, the repeal can’t go into effect until 90 days after the legislative session ends, and the session has no end date. The 1864 law will take effect June 8 at the earliest.

The state Supreme Court’s ruling earlier this month to reinstate the 1864 ban caused a national uproar and forced a political reckoning among Republicans, many of whom have long said abortion is morally indefensible.

The century-old law, which was passed before Arizona became a state, makes abortion a felony punishable by two to five years in prison for anyone who performs or helps a woman obtain an abortion.

Abortion-rights advocates have been gathering signatures to place a referendum on the ballot that would protect access until the point of fetal viability, or roughly 24 weeks of pregnancy.

Republicans now want to introduce their own, to limit abortion at 15 weeks or potentially six weeks. If both chambers of the Legislature can pass the same language, it would automatically get on the ballot in November.

The session was filled with raucous language from GOP lawmakers opposed to the bill.