Six Banks Under Review Following SVB Collapse

-

WATCH: Las Vegas Teacher Fights Student ‘Who Called Him the N-Word’

-

WATCH: NYC Construction Worker Goes Viral After Saying Exactly What He Thinks of Biden Following Trump’s Visit

-

Don’t Mess with Texas! Troopers in Helmets Arrest Palestine Protesters

-

Israel Hits 40 Sites in Lebanon, Says It Has Killed ‘Half’ of Hezbollah Commanders

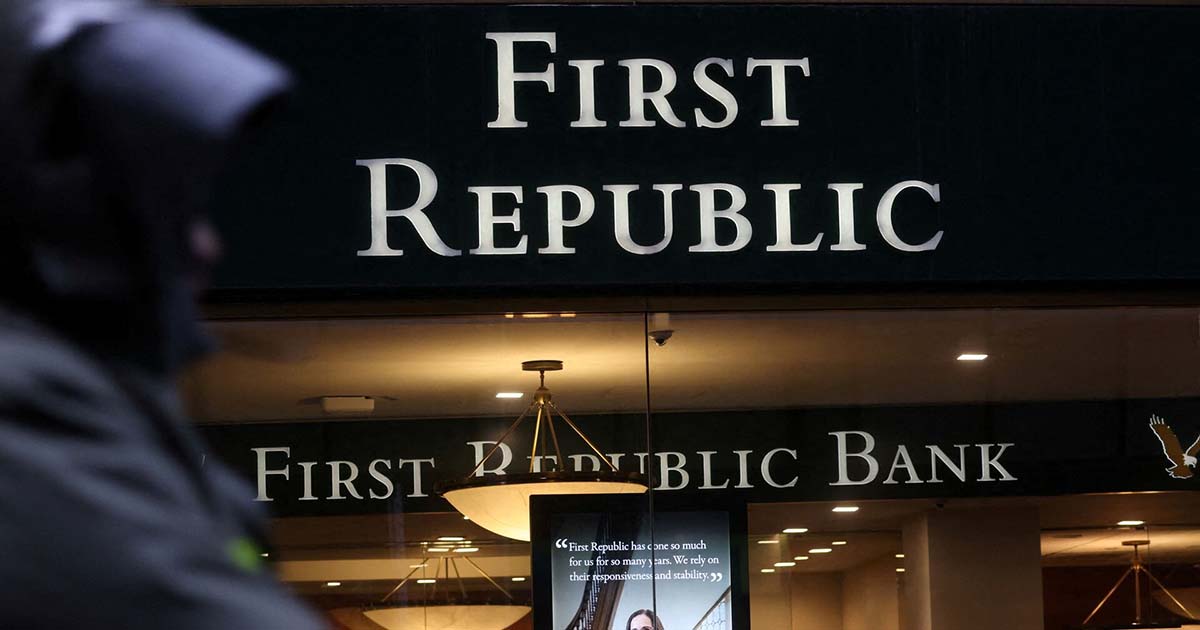

Moody’s Investors Service said Tuesday that it is examining a half-dozen banks to decide whether they should be downgraded.

The six banks in question are all facing “extremely volatile funding conditions” amid the fallout from Silicon Valley Bank’s dramatic failure last week. Moody’s is also looking into the banks’ exposure to deposits that are uninsured, according to the Wall Street Journal.

The banks are:

- First Republic Bank

- Western Alliance Bank

- Zions Bancorp

- Intrust Financial

- Comerica

- UMB Financial Corp

Moody’s also changed its outlook on the entire U.S. banking system from stable to negative.

“We have changed to negative from stable our outlook on the US banking system to reflect the rapid deterioration in the operating environment following deposit runs at Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank (SNY) and the failures of SVB and SNY,” Moody’s said in a report.

Some of the six banks suffered heavy losses on Monday as investors reacted to SVB’s collapse and the failure of major cryptocurrency lender Signature Bank over the weekend.

At one point on Monday, shares of San Francisco-based First Republic Bank plunged by more than 73%. Western Alliance Bancorp was down by some 65% at times during the day, and Zions Bancorp was down by more than 20%.

The pendulum swung back on Tuesday after markets opened and investors began buying back shares of the flagging banks.

First Republic was up a whopping 64% after opening, Western Alliance bounded back 53%, and Zions rose by 22%.

The sigh of relief for the markets was driven in large part by strong action by the federal government to prevent a run on the banks, which appeared likely over the weekend before the Fed acted to protect depositors. The federal government announced that it would back all deposits at SVB and Signature, even those in excess of the Federal Deposit Insurance Corporation’s $250,000 threshold.

The SVB collapse sent shudders through the markets and raised fears that the United States was closer to entering another recession.

The yields on U.S. Treasurys tumbled on Monday, continuing declines incurred late last week. At one point, the yield on the 10-year Treasury fell by 0.2% to 3.498%. The two-year Treasury yield was down a full percentage point since Wednesday — the worst three-day plunge since 1987 after the famous crash known as “Black Monday.”

News

George Soros Is Paying Student Radicals Who Are Fueling Nationwide Explosion of Israel-Hating Protests

George Soros and his hard-left acolytes are paying agitators who are fueling the explosion of radical anti-Israel protests at colleges across the country.

The protests, which began when students took over Columbia University’s Morningside Heights campus lawn last week, have mushroomed nationwide.

Copycat tent cities have been set up at colleges including Harvard, Yale, Berkeley in California, the Ohio State University and Emory in Georgia — all of them organized by branches of the Soros-funded Students for Justice in Palestine (SJP) — and at some, students have clashed with police.

The SJP parent organization has been funded by a network of nonprofits ultimately funded by, among others, Soros, the billionaire left-wing investor.

At three colleges, the protests are being encouraged by paid radicals who are “fellows” of a Soros-funded group called the US Campaign for Palestinian Rights (USCPR).

USCPR provides up to $7,800 for its community-based fellows and between $2,880 and $3,660 for its campus-based “fellows” in return for spending eight hours a week organizing “campaigns led by Palestinian organizations.”

They are trained to “rise up, to revolution.”

The radical group received at least $300,000 from Soros’ Open Society Foundations since 2017 and also took in $355,000 from the Rockefeller Brothers Fund since 2019.

It has three “fellows” who have been major figures in the nationwide protest movement.

Nidaa Lafi, a former president of the University of Texas Students for Justice in Palestine, was seen at an encampment at UT Dallas Wednesday making a speech demanding an end to the war in Gaza.

Lafi, a former legislative intern for the late Democratic Congresswoman Eddie Bernice Johnson, graduated from the school last year with a degree in global business and is now a law student at Southern Methodist University in Dallas.

In January, she was detained for blocking the route of President Biden’s motorcade after he arrived in Dallas for the funeral of Johnson, her former boss.

At Yale, USCPR’s fellow Craig Birckhead-Morton was arrested Monday and charged with first-degree trespassing when SJP’s branch, Yalies4Palestine, occupied the school’s Beinecke Plaza, the Yale Daily News reported.

Birckhead-Morton — also a former intern for a Democrat, Maryland rep John Sarbanes — emerged from custody to address a sit-in blocking traffic in New Haven.

The most high-profile of the fellows is Berkeley’s Malak Afaneh, co-president of the Berkeley Law Students for Justice in Palestine.

She has been a serial speaker at an anti-Israel protest on the campus this week — which came after she first shot to prominence by hijacking a dinner at the law school dean’s home to shout anti-Israel slogans, then accused the dean’s wife of assaulting her when she asked the radical to leave.

The cash from Soros and his acolytes has been critical to the Columbia protests that set off the national copycat demonstrations.

Three groups set up the tent city on Columbia’s lawn last Wednesday: Students for Justice in Palestine (SJP), Jewish Voice for Peace (JVP) and Within Our Lifetime.

At the “Gaza Solidarity Encampment,” students sleep in tents apparently ordered from Amazon and enjoy delivery pizza, coffee from Dunkin’, free sandwiches worth $12.50 from Pret a Manger, organic tortilla chips and $10 rotisserie chickens.

An analysis by The Post shows that all three got cash from groups linked to Soros. The Rockefeller Brothers Fund also gave cash to JVP.

The fund is chaired by David Rockefeller Jr., a fourth-generation member of the oil dynasty, and gives money to “sustainable development” and “peace-building.”

And a former Wall Street banker, Felice Gelman, a retired investment banker who has dedicated her Wall Street fortune to pro-Palestinian causes, funded all three groups.

Both SJP and JVP were expelled from Columbia University in November for “threatening rhetoric and intimidation.” JVP blamed Israel for the Oct 7 Hamas terrorist attack that left 1,200 Israelis dead.

“Israeli apartheid and occupation — and United States complicity in that oppression — are the source of all this violence,” JVP said in a statement on its website.

SJP called the terrorist strike on Israel “a historic win.”

An analysis by The Post shows how Soros and Gelman’s cash made its way to the students through a network of nonprofits that help obscure their contributions.

Soros has given billions to the Open Society Foundations which his son Alexander — whose partner is Huma Abedin, Hillary Clinton’s top aide and the estranged wife of pervert Anthony Weiner — now controls.

In turn, Open Society has given more than $20 million to the Tides Foundation, a progressive nonprofit “fiscal sponsor” that then sends the cash to smaller groups.

Those groups include A Jewish Voice for Peace, which between 2017 and 2022 has received $650,000 from Soros’ Open Society. Its advisers include the academic Noam Chomsky and the left-wing feminist author Naomi Klein.

JVP has been a prominent part of the protests at Columbia and one of its student members was among a group expelled from the university for inviting the leader of a proscribed terrorist group, Khaled, to the “Resistance 101” Zoom meeting.

Soros has also donated $132,000 to WESPAC, called in full the Westchester People’s Action Coalition Foundation.

The White Plains-based nonprofit was founded in 1974 to rally for civil rights and against the Vietnam War but is now a major funder of anti-Israel groups, including Within Our Lifetime and Students for Justice in Palestine.

SJP has also received funding from the Sparkplug Foundation, a New York-based nonprofit run by Gelman and her husband, Yoram Gelman.

The couple funneled their $20,000 donation to the group through WESPAC in 2022, according to public filings.

Gelman was previously on WESPAC’s committee for Justice and Peace in the Middle East in 2009 when she was invited to Gaza by the United Nations Relief and Works Agency, according to the group’s website.

The UN group has been slammed for its support of Hamas.

Gelman is on the board of the Bard Lifetime Learning Institute, an offshoot of the infamously progressive college, as well as the Jenin Freedom Theatre, located in the Jenin refugee camp in the West Bank.

WESPAC president Howard Horowitz, a former Orthodox Jew, is a member of the New York chapter of JVP, which says it works for “advocacy and public education for Palestinian human rights.”

Horowitz said he embraced the Palestinian cause after time spent living in Israel, according to a report in the Israel Times.

WESPAC has also given money to Within Our Lifetime, founded by the ubiquitous anti-Israeli protester Nerdeen Kiswani.

Within our Lifetime uses a loophole in the law to avoid declaring how much it receives from donors by not being a 501(c)(3) nonprofit, meaning it is unknown how Kiswani has benefited.

However, WESPAC is named as a fiscal sponsor of Within Our Lifetime.

News

Inside the Failed White House Coup to Oust Biden Press Secretary Karine Jean-Pierre

Top aides to President Biden secretly hatched a plan this past fall to replace White House press secretary Karine Jean-Pierre by recruiting outside allies to nudge her out the door, The Post has learned.

Jean-Pierre, who made history in May 2022 by becoming the first black and first openly gay person to hold the position, had developed the exasperating habit of reading canned answers directly from a binder to reporters at her regular briefings — offering what her superiors viewed as a less-than-compelling pitch for the 81-year-old Biden as he readied his re-election campaign.

De facto White House communications chief Anita Dunn, 66, the wife of Biden personal attorney Bob Bauer, told colleagues she had decided to call in prominent Democrats to explain to Jean-Pierre, 49, that the time was ripe to move on, sources told The Post.

“There were a number of people she asked to engage Karine,” said one source who heard of the strategy directly from Dunn, whose role as senior adviser has been filled during the past three presidencies by Jared Kushner (Donald Trump), Valerie Jarrett (Barack Obama) and Karl Rove (George W. Bush).

The source also told The Post that Dunn had claimed White House chief of staff Jeff Zients knew about and supported the cloak-and-dagger scheme to push Jean-Pierre out of the West Wing.

“There was an effort to have some outside folks who Karine knows and trusts talk to her about why leaving last fall would have made a lot of sense for her and her career,” the source said, calling it an “effort to encourage her to move along.”

Jean-Pierre, the person added, “had been in the job for a year and a half at that point, which is a pretty standard tenure for a press secretary in what is admittedly a very demanding job [and] Jeff and Anita [tried] to have folks that she would listen to and trust talk to her about why it might be wise to do that.”

Jean-Pierre’s predecessor, Jen Psaki, was press secretary for one week shy of 16 months before leaving to take a job as a host and analyst at MSNBC.

A second source told The Post that “Jeff and Anita were trying to find Karine a graceful exit” because of the ugly optics of removing her against her will.

“There’s a huge diversity issue and they’re afraid of what folks are going to say,” added this source, who said they learned of the effort from multiple people briefed by Dunn and confirmed at least one person from outside the administration did speak with Jean-Pierre.

The revelation of Dunn’s plan is likely to make for awkward workplace dynamics, the first source said, but is unlikely to result in Jean-Pierre’s departure.

“She has been pretty consistent in telling people from the minute she got the job that she was going to stay through the election,” they said.

“I think Karine has decided to stay come hell or high water and that’s that.”

While Jean-Pierre isn’t going anywhere, the issues that brought about Dunn’s failed machinations remain — with both sources saying the press secretary is too reliant on notes to provide the pushback and quick-thinking repartee needed to effectively champion Biden’s cause.

“Karine doesn’t have an understanding of the issues and she reads the book [binder] word-for-word,” said the second source, adding that the situation is made worse by the fact that “she thinks she’s doing an amazing job.”

“She doesn’t have a grasp of the issues and doesn’t spend the time to learn,” this person said.

“These issues are not second nature to people. Israel and Gaza is a perfect example. It’s very nuanced. Jen would have calls with people to feel well-versed enough to go to the briefing.”

“There’s an enormous amount of work that goes into getting ready,” the first source said, “and consistently she does not put in that level of work.”

In response, White House deputy press secretary Andrew Bates told The Post: “Not only are these claims wildly false, but the reality is the polar opposite. Karine was never approached by anyone with such a message. She spends four hours preparing every day. And neither Jeff nor Anita did any such thing; both have been unflinchingly supportive of her.”

In December, not long after word of Dunn’s plan circulated in the White House, Jean-Pierre received and rejected an unsolicited offer to become president of EMILYs List, a major Democratic group that raises money for female candidates who support expanded abortion rights.

When NBC News reported on the offer in February, the outlet said Jean-Pierre had emphatically told the group that she was “committed to the president” and “I’m not going anywhere.”

Both the initial offer to Jean-Pierre from EMILYs List and its disclosure to NBC are topics of intrigue within the White House — with unsubstantiated theories suggesting the hand of Dunn behind the approach and Jean-Pierre behind its leak.

By December, Dunn appeared to have accepted that Jean-Pierre was secure in her post.

A West Wing official supportive of the press secretary provided The Post with text from an email written by Dunn ahead of Washington Post media reporter Paul Farhi’s Dec. 11 article that noted National Security Council spokesman John Kirby’s increased profile as co-briefer alongside Jean-Pierre.

“I am happy to talk to [Farhi]. And tell him KJP isn’t going anywhere so this is a ridiculous piece,” Dunn wrote in the message.

The pro-Jean-Pierre official also told The Post that Dunn was among those who had backed the press secretary’s promotion from being Psaki’s deputy — with the comms chief even calling in a former White House official to request their help communicating to reporters that “Karine is very strong and doing a very good job in the briefing room.”

“She is an incredibly quick study on a variety of policy issues that she has to be appraised of every single day,” that ex-official said.

Those with less glowing reviews acknowledge Jean-Pierre is not short of confidence.

“I think everyone’s resigned to the fact that she’s not going anywhere on her own,” said the second source who described Dunn’s autumn conservations.

”She thinks she’s doing a really good job and thinks the president wants her to stay.”

What Biden really wants was unclear to The Post’s sources, with a third source familiar with administration dynamics and skeptical of Jean-Pierre’s performance saying the president “trusts his senior advisers to manage the team as needed.”

‘Serious tension’

Kirby, who has two stints as Pentagon press secretary under his belt and also fronted State Department briefings in the final 20 months of the Obama administration, has shared the stage with Jean-Pierre at most White House briefings since Hamas terrorists massacred about 1,200 people in Israel on Oct. 7 — contributing to what one source called “serious tension” within the West Wing.

“Sometimes he talks to her and she acts as if he is not talking,” said a fourth source familiar with the situation and critical of Jean-Pierre.

“She has been pretty aggressive about marking her territory,” agreed the first source.

Kirby, who is widely respected by journalists as a valuable source of both information and soundbites, has requested to pick out who asks him questions at briefings, but Jean-Pierre has not agreed to allow him to do so.

Dunn has supported Kirby’s ask, said the fourth source, but still Jean-Pierre has not relented, even after Kirby’s desire was publicly reported in January by Axios.

Kirby, 60, and Jean-Pierre have sought to tamp down the perception of a power struggle.

In February, they “issued a statement praising the other,” the New York Times wrote in an article focused on the relationship.

Kirby told the Times, “It’s a privilege to be in her company, to watch her work and to learn from her.”

The Gray Lady did not publish Jean-Pierre’s statement on Kirby, but it was provided to The Post and read: “Admiral Kirby is an excellent colleague and I’m proud to work with him. I’ve enjoyed getting to know him and have great respect for his service to our country. His military experience and the work he has done as part of the national security team have been immensely helpful to the White House, particularly with two ongoing conflicts around the world.”

While Kirby is the odds-on favorite to replace Jean-Pierre as press secretary should she depart the position, there are other contenders for the opening — including Brian Fallon, formerly Hillary Clinton’s 2016 campaign press secretary and currently Vice President Kamala Harris’ re-election campaign communications director, who one source said has undergone an “ego detoxing” in his current post.

A number of Democrats both inside and close to the White House said they were unaware of Dunn’s plot to replace Jean-Pierre, or claimed to only know about it through the rumor mill, but several said that the accounts by The Post’s sources rang true.

One source close to Dunn and Zients insisted, to the contrary, that “my experience over the last year is Dunn and Zients being supportive of Karine” and added that “I’ve never heard of any such plan.”

The Post spoke with almost a dozen prominent Democratic staffers for this article, including current and former White House officials, all of whom requested anonymity to discuss internal personnel matters.

The sources agreed that Dunn does not appear to harbor any ill will toward Jean-Pierre, with many suggesting that the encouragement that the press secretary shift to an outside role was meant to be a long-term boost to Jean-Pierre that plays more to her strengths.

“I witnessed Jeff and Anita coming pretty hard to Karine’s defense after [the January Axios report on Kirby wanting to call on reporters himself] and asking others to do the same,” said one Democrat who supports the press secretary.

“They were like, ‘This is palace intrigue bulls— that was dramatically sensationalized,’” that source said.

Thursday evening, Zients told The Post in a statement: “The President and everyone in the White House deeply values Karine — she is an incredibly talented communicator and trusted advisor who keeps a cool head in any crisis and always has your back. We are lucky to have her on the core team advancing the President’s historic agenda every day.”

Jean-Pierre does have important allies within the White House, including first lady Jill Biden’s top adviser Anthony Bernal, who is widely considered to rival even Zients in power due to his closeness to the first family.

Multiple former colleagues of Bernal accused him to The Post last month of verbal sexual harassment, building on earlier reports of workplace bullying.

In a sign of Bernal’s influence, Zients quickly affixed his name to a statement calling those allegations “unfounded” just hours after receiving a request for comment, without investigating them.

News

Adam Schiff Robbed in San Francisco, Has to Attend Campaign Dinner with No Suit

California Senate candidate Rep. Adam Schiff was given a rude welcome to San Francisco on Thursday as he was reportedly a victim of a carjacking just hours before a ritzy campaign dinner.

According to The San Francisco Chronicle, thieves broke into his car that was parked in a downtown parking garage and stole his bags. Without business clothes to wear, Schiff still proceeded to the event in shirt sleeves and a hiking vest, according to the Chronicle, with others dressed in suits.

At the dinner, Schiff thanked attorney Joe Cotchett for supporting Schiff’s bid to replace the late Dianne Feinstein and represent California in the U.S. Senate.

“I guess it’s ‘Welcome to San Francisco,’” joked Cotchett’s press agent Lee Houskeeper, who was at the dinner at Ristorante Rocca, located in Burlingame.

During his own remarks, Schiff was reportedly unperturbed by the theft.

“Yes, they took my bags,” the California representative said, per the Chronicle. “But I’m here to thank Joe.”

Schiff’s resilient demeanor prompted a compliment from Cotchett.

“Adam really showed himself tonight,” Cotchett said. “He’ll be a great senator — he’s going to change the Senate tremendously.”

The apparent theft came just days after the San Jose Mayor Matt Mahan’s security guard was assaulted in downtown San Jose Tuesday, according to KRON4, a local Bay Area news outlet.

“While interviewing Mayor Matt Mahan in downtown San Jose, a man was shouting at us and fought Mayor Mahan’s security guard,”KRON4 reporter Jack Molmud wrote in a post along with a video of the incident. “The fight lasted a couple minutes and the man was arrested by SJPD. Police said they were compiling evidence and sending it to the DA’s office.”

The San Jose Police Department “said the motive and circumstances surrounding the altercation are under investigation.”

San Francisco Mayor London Breed is proposing various efforts to combat a part of the city that is notorious for high crime, homelessness and public drug use.

News

Bird Flu Is Starting to Spread Rapidly Among Cow Populations. FDA Sounds the Alarm.

Federal agencies with competing interests are slowing the country’s ability to track and control an outbreak of highly virulent bird flu that for the first time is infecting cows in the United States, according to government officials and health and industry experts.

The response has echoes of the early days of 2020, when the coronavirus began its deadly march around the world. Today, some officials and experts express frustration that more livestock herds aren’t being tested for avian flu, and that when tests and epidemiological studies are conducted, results aren’t shared fast enough or with enough detail. They fear that the delays could allow the pathogen to move unchecked — and potentially acquire the genetic machinery needed to spread swiftly among people. One dairy worker in Texas has already fallen ill amid the outbreak, the second U.S. case ever of this type of bird flu.

Officials and experts said the lack of clear and timely updates by some federal agencies responding to the outbreak recall similar communication missteps at the start of the coronavirus pandemic. They point, in particular, to a failure to provide more details publicly about how the H5N1 virus is spreading in cows and about the safety of the milk supply.

“This requires multiple agencies to coordinate and communicate internally, but most importantly externally, which doesn’t seem to be happening due to different cultures, priorities, legal responsibilities, scientific expertise, and agility,” said Katelyn Jetelina, an epidemiologist who writes a weekly infectious-diseases newsletter and has closely tracked the avian flu outbreak. “Mix that in with the usual challenges of scientific uncertainty, complexity and, quite frankly global pressure, and you got yourself an utterly, unacceptable mess.”

A senior administration official said there have been “no competing interests.” The White House’s Office of Pandemic Preparedness and Response Policy is coordinating the outbreak response with relevant agencies “that are working quickly and methodically.” The government is “committed to sharing results as soon as possible,” said the official, who spoke on the condition of anonymity to discuss internal deliberations.

“This work is an urgent priority as we work to ensure the continued effectiveness of the federal-state milk safety system and reinforce [the Food and Drug Administration’s] current assessment that the commercial milk supply is safe,” the administration official said.

Until Wednesday, testing for H5N1 in dairy herds was voluntary and limited to cows with certain symptoms. The number of tests per farm was limited, too. That protocol provoked sharp criticism from public health experts. With growing evidence that the virus is more widespread than feared among cows, the U.S. Agriculture Department announced Wednesday that lactating dairy cows must be tested for bird flu before moving across state lines, starting Monday.

Responsibility for monitoring and containing the outbreak is divided among three agencies. USDA leads the investigation into the virus in cows, the FDA oversees food safety, and the Centers for Disease Control and Prevention is monitoring risks to people.

Agencies have given individual updates on their parts of the outbreak investigation, but Wednesday marked the first time since bird flu was detected in cows four weeks ago that CDC, FDA and USDA, along with other agencies, held a news briefing jointly. On Thursday, government scientists shared detailed data at a webinar hosted by the Association of State and Territorial State Health Officials.

For weeks, key federal agencies have expressed confidence in the safety of the commercial milk supply, including pasteurized products sold at grocery stores.

But it was two weeks before the FDA responded directly to The Washington Post’s questions about whether the agency was testing milk on grocery store shelves for H5N1. On Tuesday, the agency confirmed that viral particles had been found “in some of the samples,” but it declined to provide details. On Wednesday, an FDA official confirmed fragments were found in milk on shelves but declined to say how many samples the agency has tested, how many had virus fragments and where the milk originated. The testing does not indicate whether genetic traces of the virus are active or dead.

During the Thursday webinar, Donald A. Prater, acting director of the FDA’s Center for Food Safety and Applied Nutrition, said early results showed 1 of 5 samples had viral fragments, “maybe with some preponderance for areas with known [infected dairy] herds.” He did not say how many samples were tested, or from what parts of the country. Additional tests must be done to check whether the virus is infectious. Even with these results, the agency has seen nothing to change its assessment that the commercial milk supply remains safe, Prater said.

Officials are seeking answers to other key questions: They want to know whether the virus is spreading among cows through mechanical means, such as milking equipment, as evidence suggests, or through the air, which would be more dangerous and lead to more sustained spread. They are also interested in knowing how long livestock will shed virus in their milk once they have recovered from an infection. And, crucially, they will seek to ascertain the risks for human exposure and whether protocols are in place at the state level if additional people test positive.

The investigation “involves different types of samples, different types of studies and really being methodical about how we’re approaching answers to those questions around things like ensuring safety of the food supply,” said one senior government official who spoke on the condition of anonymity to share internal policy discussions.

“We’re not trying to pull the fire alarm here and suggest that there’s more of a risk to people than exists,” said another federal health official, who also spoke on the condition of anonymity to share internal deliberations.

The key to the outbreak resides with the cows.

Public health officials and industry experts say the USDA should be doing broader testing to paint a clearer picture of the scale of the outbreak. The government has been too slow in sharing genetic information and epidemiological studies, they said. More routine testing on herds and even other animals would reduce the risk of spreading the virus to other cattle and poultry farms, public health experts and veterinarians have said.

“Given this is a novel outbreak, testing needs to be done widely and rapidly, investigators need to be on affected farms, and scientists and policymakers need to be bringing it all together to set a coordinated plan of action,” Tom Inglesby, director of the Johns Hopkins Center for Health Security, said in an email last week. Inglesby was the White House testing czar during the Biden administration’s coronavirus response.

“This isn’t just about protecting U.S. agricultural interests,” said Jennifer Nuzzo, director of the Pandemic Center at the Brown University School of Public Health. “This is about protecting human health, protecting farmworkers that may be in harm’s way and preventing another pandemic from happening.”

Nearly three dozen livestock herds in eight states have been infected in the last month. The virus has also spread from dairy farms to poultry farms and infected barn cats. Epidemiologists fear that indicates cows can pass the virus to birds, and possibly other animals, broadening the potential for spread.

Scientists who performed genetic analyses of virus taken from infected animals say the tests suggest the outbreak may have been occurring for longer and across more of the United States than previously thought.

Michael Worobey, a University of Arizona virologist who led a team of scientists who analyzed 239 genetic sequences released Sunday by the USDA, said the evolutionary tree of the virus “resoundingly indicates that this outbreak had a single origin and that it had been circulating under our noses for months before it was noticed.”

“The concerning thing was it meant that all of these outbreaks in at least eight different states traced back to a common ancestor that had been around probably since late 2023 and that meant that this outbreak almost certainly has its tendrils all across the U.S. and perhaps beyond,” Worobey said.

Scientists trying to piece together the outbreak’s genesis said the USDA was too slow in sharing critical genetic data initially, and when “a big dump” of 239 genetic sequences arrived Sunday, it was not comprehensive.

“Like what samples they are coming from, when exactly they were collected … and where exactly they were collected,” said Angela Rasmussen, a virologist and principal research scientist at the Vaccine and Infectious Disease Organization at the University of Saskatchewan in Canada.

Public health and veterinary experts say they also want more epidemiological data — including information on the movement of animals, their feed sources and how many workers are on-site — to understand how and where the virus is circulating.

Beth Thompson, South Dakota’s state veterinarian and president of the National Assembly of State Animal Health Officials, said such information needs to be shared quickly.

“It’s like if you just rip one page out of a chapter in a book and hand it to the states, that isn’t the whole chapter,” Thompson said. “We need all of the information to be given back to us.”

The lack of more aggressive testing of livestock and transparent data-sharing has frustrated officials at the Department of Health and Human Services, according to another federal health official and a public health expert who were briefed on the response.

USDA officials may be constrained by their mission to promote new markets for farmers and protect animal health and welfare, said an administration official who spoke on the condition of anonymity to discuss internal deliberations. “They’re just twisting themselves into knots because they’ve got two missions that are, in this instance, pointing in different directions,” the administration official said.

The official suggested the agency is operating at a level of urgency closer to a 4 when it should be a 10, the official said.

Not true, said USDA spokeswoman Marissa Perry.

“USDA’s top priority is containing this emerging animal health issue,” Perry said.

While H5N1 is typically fatal in poultry, the disease in infected cows has been relatively mild, and animals have recovered in a week to 10 days, according to agriculture officials.

The biggest challenge so far has been identifying farms willing to share samples, said Rosemary Sifford, the USDA’s chief veterinary officer. The agency has been testing sick and healthy cows in affected herds, and in recent days began testing in unaffected herds, she said in an interview last week.

The virus appears to be spreading in cows that are producing milk “and the place that those animals are most closely congregated, have the most contact, would be as they’re moving through the milking parlor,” Sifford said. “We are not seeing this virus moving outside the lactating herd.”

This strain of avian flu has been circulating for more than 20 years, but its leap into cows is of significant concern, surprising even longtime observers of the virus. While avian flu has infected humans — especially in Asia — the virus has yet to prove able to spread efficiently in people. But the more the virus jumps animal to animal, the greater the chance mutations will emerge that allow sustained person-to-person transmission, the required next step for a pandemic.

State health officials have tested at least 23 people; only the dairy worker in Texas, who has since recovered, was confirmed positive. Ongoing surveillance of emergency department visits and flu testing results in regions with bird flu have not identified any unusual or concerning patterns, the CDC’s principal deputy director, Nirav Shah, said Wednesday. The risk to the public from bird flu remains low.

For dairy farmers, the potential impact on their business is top of mind.

“Lots of farms aren’t raising their hands to be tested because they don’t want to be known as having an infected herd,” said Keith Poulsen, director of the veterinary diagnostic lab at the University of Wisconsin-Madison.

Jamie Jonker, chief science officer for the National Milk Producers Federation, described as appropriate the USDA announcement on testing and interstate movement. But milk producers are waiting for the USDA’s detailed guidance to know how many tests may need to be performed on milk cows, estimated to number about 8 million, Jonker said.

The testing mandate could help overcome reluctance from some milk producers to allow testing in their herds, the USDA’s Mike Watson said Wednesday. The cost of mandatory testing would be reimbursed by the agency.

A wide swath of federal agencies are mobilizing in the event the highly pathogenic virus evolves.

At highest risk are farmworkers, who, like many in the agriculture sector, are undocumented or do not wish to interact with the government, Shah said.

In an emergency call three weeks ago with state health and lab officials, Shah laid out a detailed list of operational questions state officials needed to answer to prepare for potential exposures in people.

“What nurse and what epidemiologist have you trained up to do this? Do you have the [nasal] swabs ready? Do they know how to approach that conversation in a culturally competent and linguistically competent manner? … Is the lab ready to go?”

News

Biden Forgets Date of Jan. 6 Capitol Riots in Embarrassing Gaffe

President Joe Biden suffered yet another gaffe Thursday as he mixed up the date of the Jan. 6 riots during a glitzy fundraiser hosted by Hollywood stars Michael Douglas and Catherine Zeta-Jones at their Westchester home.

Biden, the oldest-ever US president at 81, made the blunder as he ripped his Republican rival, former President Donald Trump, 77, in front of the star-studded crowd.

“We’ll certainly never forget the dark days of June 6, January 6th, excuse me,” the commander-in-chief said, according to a White House pool report.

“One of the dark days in history. The idea that wasn’t an insurrection — I don’t understand.”

June 6, otherwise known as D-Day, commemorates the allied invasion of Normandy, France during World War II, during which more than 2,500 American soldiers were killed.

Just moments before his latest gaffe, Biden had railed off a slew of Trump’s other apparent failures.

“We’ll never forget him wanting tear gas to be sprayed on peaceful protesters outside the White House, and holding the Bible upside down. Now he’s writing his own Bible,” he said.

The president also railed against Trump for “lying about COVID and telling the American people to inject bleach in their arms.”

“He injected it in his hair,” Biden quipped.

The fundraiser was held in the backyard of Douglas and Zeta-Jones’ riverfront home, where about 100 people sat under a tent to listen to both Douglas and Biden speak.

The Hollywood actor had noted his wife was absent because she was filming a new television series in Dublin, Ireland.

“Number 46 must become number 47,” the “Wall Street” actor said, referring to Biden as an “extraordinary, seasoned veteran.”

Biden joked that he had something in common with the Academy-Award-winning actor.

“We both married way above our stations,” he said.

Fashion designer Eileen Fisher; attorney Rodge Cohen and his wife, Barbara; businessman and venture capitalist Robert Goodman and his wife, Jayne Lipman; hedge fund manager John Shapiro and his wife, Shonni Siverberg; and Jonathan and Judy Siegel were all listed as hosts of the reception, along with Douglas and Zeta-Jones.

It wasn’t immediately clear how much Biden raised during the event.

News

Massive Blaze Burns Iconic Oceanside Pier

Firefighters were called out Thursday afternoon to battle an inferno at the far end of the iconic Oceanside Pier.

The fire was reported shortly after 3 p.m., officials said.

A massive plume of smoke quickly filled the sky, and two fire-fighting boats arrived on scene shooting water cannons at the structure at the end of the pier, where it broadens to support two structures and is called the hammerhead. A lone lifeguard vehicle posted up at the foot of pier, with a long fire hose, possibly two, running the length of the pier.

Although smoke obscured the scene, the building at the end of the pier was burning furiously. The structure was once the site of the Ruby’s Diner, which has stood empty since the business closed three years ago. As SkyRanger 7 arrived overhead, smoke was blowing onshore the entire length of the structure.

“The Oceanside Fire Department is currently engaged in fighting a fire on the Oceanside Pier,” OFD tweeted out at 3:14 p.m. “We are asking all citizens to please stay away from the immediate area.”

At 4 o’clock, a third vessel had joined the fight as well as a U.S. Coast Guard cutter, but smoke continued to pour out all sides of the two-story building as well as beneath the pier, with only a few flames actually visible. Over at the coast, people had started to congregate to watch the conflagration, with some posing for selfies with the historic structure aflame behind them.

Luckily for the crews working on the boats, the surf was only 2-3 feet, easing their efforts. High surf would have vastly increased the challenges fighting the fire.

Fifteen minutes later, Oceanside mayor Esther Sanchez told NBC 7 in a phone interview that “what we know is that the fire teams decided to do a defense tactic and not try to save the restaurant but save the rest of the pier.”

At 4:21, a helicopter jointly operated by Cal Fire and the San Diego Sheriff’s Department arrived to make a water drop on the structure fire, a very rare sight. By that time, the roof had collapsed on a small structure next to the old Ruby’s building, which had been the location of a grab-and-go business called the Brine Box, and flames were starting to escape the confines of the much larger structure, with its roof beginning to visibly char.

The firefighting chopper stayed on scene making multiple drops on the inferno, but the fire has resisted all attempts at extinguishing it. Around 4:35, San Diego Fire Rescue’s new Triton firefighting vessel arrived to aid in the efforts. Carlsbad, Vista, North County Fire and Camp Pendleton have all sent ground crews to help out as well, officials told NBC 7.

Businesses and restaurants near the pier, including the Famous High Pie at the Top Gun House, were closed because of the on-shore winds carrying smoke and ash to the coastline, the pie shop’s operator told NBC 7 around 4:45.

Speaking at a news conference at around 5 p.m., Oceanside fire chief David Parsons said lifeguards were the first to report the fire and firefighters arrived five minutes later. He also stated that the main body of the fire had essentially been knocked down and that they were now focusing on keeping it under control, though the deck was still burning, which is where firefighters were concentrating their efforts.

Despite being warned away, hundreds of people assembled along the coast to watch the fire and efforts to put it out.

“Still have a lot of work to do,” Parsons said.

By 5:15, a second firefighting aircraft, this one operated by SDG&E and mostly used to battle brush fires, had been deployed for the pier fire as well, dropping as much as 2,500 gallons at a time. By 5:30 charred pieces of the pier had begun washing ashore.

At a second news conference held at 5:45, Parsons said that fire had been stopped at 15 feet just past the hammerhead.

“This is really, really good news,” Parsons said, “and like I said, we think we have forward progress stopped there. What that means is that the vast majority of the pier itself is in good, undamaged condition.”

Charred pieces of the pier began washing ashore by 5:30 p.m. on Thursday.

By 6 p.m., SkyRanger 7 showed a very different scene than when it arrived hours earlier. Smoke still blew at the scene, but was no longer billowing, with the plume was vastly diminished. Small flames could be scene burning here and there, but the fire, in the structure at least, seemed to be largely knocked down. The firefighting boats and Coast Guard cutter remained on station, water cannons still blasting.

Parson said crews would remain on scene into the night, looking for “hidden fire” or hot spots, to prevent the blaze from rekindling.

As of 10 p.m., crews were still battling active fire on the restaurant building and the pier and boats were still in the water, according to Chief Blake Dorse with the Oceanside Fire Department. However, officials believe the blaze will stay contained to the pier’s end, in part because crews removed several planks of the pier and created a 5-foot trench going across the width of the pier to help stop the fire from spreading east.

Dorse said a large group will work overnight before another group returns in the morning.

Jessica Waite, the co-owner of the Brine Box, told NBC 7 that the business was open when the fire began.

“Chef Rachel saw smoke coming up from underneath the pier, behind the old Ruby’s building,” Waite said. “Thankfully, everyone was evacuated safely. We are so sad to see this happening.”

Last year, the city of Oceanside spent $5.5 million to upgrade aging pipes and electrical systems on the pier, which is 1,954 feet long. The wooden structure was first built in 1888 but has been destroyed twice in its lifetime, once in 1890 by rough seas and, after it was rebuilt, again in 1902.

Thursday’s fire is not the first building to burn on the site: In 1976 “a fire broke out in the Pier Fish Market, located halfway out on the pier and in December the Pier Cafe was completely destroyed by fire,” according to the Oceanside Chamber of Commerce. The current pier was built in 1987.

There were no immediate reports of any injuries. Sanchez, who said the city would rebuild, stated at the news conference that all employees had been accounted for.

Parsons, the fire chief, said that investigators were on the scene but that a cause may not be determined for days.

News

WATCH: Las Vegas Teacher Fights Student ‘Who Called Him the N-Word’

Shocking footage shows the moment a Las Vegas substitute teacher fought a high school student that allegedly called him a racial slur.

Re’Kwon Smith, 27, is seen in footage posted to social media repeatedly punching a student, who is also engaged in the brawl.

The incident occurred in the cafeteria of Valley High School in east Las Vegas on Thursday after the student allegedly called the teacher the n-word.

Smith, a substitute teacher with the Clark County School District since November 2023, was on assignment at the Valley High at the time of the altercation.

Videos of the incident are being used as evidence by local police, who arrested both the student and teacher, according to sources who spoke to 8NewsNow.

Watch:

Las Vegas substitute teacher arrested after fist fight with high school student who called him racial slurs pic.twitter.com/wCX1SkZOo9

— NEWSflp (@NEWS_flp) April 26, 2024

Local police confirmed Smith will be removed from the district’s substitute teaching pool and will no longer be eligible to teach in the district.

Videos from the scene show both parties throwing punches at one another before the student is knocked to the ground.

Sources told Channel 13 the student is recovering from the fight at a local hospital.

Valley High School principal Kimberly Perry-Carter told parents that the school was aware of the incident but that the ‘information is preliminary.’

‘Please know that CCSDPD is investigating the matter.

‘Once we have information to share we will be sure to update our community’ she added.

‘Violence in any form is unacceptable and goes against the fundamental principles of education and respect’ CCSD officials said in a statement on Thursday.’

Adding: ‘Any altercation between a teacher and a student is thoroughly investigated, and appropriate disciplinary action is taken.’

Smith now faces a litany of criminal charges including battery resulting in serious bodily harm, assaulting a school pupil on school property, threatening to do bodily harm to public school student, and interfering with a student from attending school, according to court records.

Smith is currently being held on $9000 bail at the Clark County Detention Center. He is due to appear in court on Friday.

News

NO SALE: TikTok Prefers Shutdown If Legal Options Fail, Sources Say

TikTok owner ByteDance would prefer to shut down its loss-making app rather than sell it if the Chinese company exhausts all legal options to fight legislation to ban the platform from app stores in the U.S., four sources said.

The algorithms TikTok relies on for its operations are deemed core to ByteDance’s overall operations, which would make a sale of the app with algorithms highly unlikely, said the sources close to the parent.

TikTok accounts for a small share of ByteDance’s total revenues and daily active users, so the parent would rather have the app shut down in the U.S. in a worst case scenario than sell it to a potential American buyer, they said.

A shutdown would have limited impact on ByteDance’s business while the company would not have to give up its core algorithm, said the sources, who declined to be named as they were not authorised to speak to the media.

It said late on Thursday in a statement posted on Toutiao, a media platform it owns, that it had no plan to sell TikTok, in response to an article by The Information saying ByteDance is exploring scenarios for selling TikTok’s U.S. business without the algorithm that recommends videos to TikTok users.

In response to a Reuters request for comment, a TikTok spokesperson referred to ByteDance’s statement posted on Toutiao.

TikTok’s CEO Shou Zi Chew said on Wednesday the social media company expects to win a legal challenge to block legislation signed into law by President Joe Biden that he said would ban its popular short video app used by 170 million Americans.

The bill, passed overwhelmingly by the U.S. Senate on Tuesday, is driven by widespread worries among U.S. lawmakers that China could access Americans’ data or use the app for surveillance.

Biden’s signing sets a Jan. 19 deadline for a sale – one day before his term is poised to expire – but he could extend the deadline by three months if he determines privately owned ByteDance is making progress.

ByteDance does not publicly disclose its financial performance or the financial details of any of its units. The company continues to make most of its money in China, mainly from its other apps such as Douyin, the Chinese equivalent of TikTok, separate sources have said.

The U.S. accounted for about 25% of TikTok’s overall revenues last year, said a separate source with direct knowledge.

Reuters interviewed more than half a dozen investment bankers who said it was tough to value how much TikTok is worth compared with like-for-like competitors Meta Platforms’ Facebook and Snap, as TikTok’s financials are not widely available nor easy to access.

ByteDance’s 2023 revenues rose to nearly $120 billion in 2023 from $80 billion in 2022, said two of the four sources. TikTok’s daily active users in the U.S. also make up just about 5% of ByteDance’s DAUs worldwide, said one of the sources.

Algorithms not for sale

TikTok shares the same core algorithms with ByteDance domestic apps like short video platform Douyin, three of the sources said. Its algorithms are considered better than ByteDance rivals such as Tencent and Xiaohongshu, said one of them.

It would be impossible to divest TikTok with its algorithms as their intellectual property licence is registered under ByteDance in China and thus difficult to disentangle from the parent company, said the sources.

Moreover, separating the algorithms from TikTok’s U.S. assets would be an extremely complicated procedure and ByteDance is unlikely to consider that option, the sources added.

ByteDance also would not agree to sell one of its most valuable assets – its “secret source” – to rivals, said the four sources, referring to the TikTok algorithm.

In 2020, the Trump administration sought to ban TikTok and Chinese-owned WeChat but was blocked by the courts. The short-form video app has since faced partial and attempted bans in the U.S. and other countries.

China indicated it would be likely to reject a forced divestment of the TikTok app during a U.S. congressional hearing in March last year.

“China will firmly oppose it (the forced sale of TikTok),” said a spokeswoman for the Ministry of Commerce at a news conference in Beijing in late March 2023.

“The sale or divestiture of TikTok involves technology export and must go through administrative licensing procedures in accordance with Chinese laws and regulations.”

China in 2020 unveiled the Export Control Law and the final text extended the definition of “controlled items” from prior drafts. According to state media, the amendment ensures that the exports of algorithms, source codes and similar data are subject to an approval process.

Excluding algorithms, TikTok’s main assets include user data and product operations and management, said two of the people.

Former U.S. Treasury Secretary Steven Mnuchin has expressed interest in putting together an investor group to try to buy TikTok. ByteDance may struggle to attract any buyers for TikTok’s U.S. assets excluding algorithms, the sources said.

ByteDance, backed by Sequoia Capital, Susquehanna International Group, KKR & Co and General Atlantic among others, was valued at $268 billion in December when it offered to buy back around $5 billion worth of shares from investors, Reuters reported at the time.

News

Trump Could Get Partial Victory After Supreme Court Hears Immunity Case

Former President Trump seems likely to win at least a partial victory from the Supreme Court in his effort to avoid prosecution for his role in Jan. 6.

The court heard more than two hours of oral arguments today over Trump’s assertion that former presidents cannot be prosecuted, even after leaving office, for actions they took while in office.

A definitive ruling against Trump — a clear rejection of his theory of immunity that would allow his Jan. 6 trial to promptly resume — seemed to be the least likely outcome.

A majority of the justices seemed inclined to rule that former presidents must have at least some protection from criminal charges, but not necessarily the “absolute immunity” Trump is seeking.

The most likely outcome might be for the high court to punt, perhaps kicking the case back to lower courts for more nuanced hearings.

That would still be a victory for Trump, who has sought first and foremost to delay a trial in the Jan. 6 case until after Inauguration Day in 2025.

His lawyer, John Sauer, told the justices that a former president couldn’t face criminal charges — even if he had a political rival assassinated — unless he had been impeached and convicted by the Senate.

The core distinction during oral arguments came down to a president’s official vs. unofficial actions — and which of Trump’s efforts to overturn the 2020 election results were official vs. unofficial.

Several conservative justices, particularly Justice Brett Kavanaugh, were adamant that former presidents cannot be prosecuted for official acts, and warned that the Justice Department’s position in this case would allow every new president to prosecute their predecessor.

But Chief Justice John Roberts and Justice Amy Coney Barrett both took issue with the sheer breadth of Trump’s position.

No clear, concise majority opinion emerged this morning. But there may be five justices willing to kick the can down the road — and that’s enough for Trump, at least for now.

News

Harvey Weinstein’s Rape Conviction Overturned by New York’s Top Court

New York’s highest court on Thursday overturned Harvey Weinstein ’s 2020 rape conviction, reversing a landmark ruling of the #MeToo era. The court found the trial judge unfairly allowed testimony against the ex-movie mogul based on allegations that weren’t part of the case.

Weinstein, 72, will remain in prison because he was convicted in Los Angeles in 2022 of another rape. But the New York ruling reopens a painful chapter in America’s reckoning with sexual misconduct by powerful figures — an era that began in 2017 with a flood of allegations against Weinstein.

While Thursday’s ruling was a blow to #MeToo advocates, they noted it was based on legal technicalities and not an exoneration of Weinstein’s behavior, saying the original trial irrevocably moved the cultural needle on attitudes about sexual assault.

The Manhattan district attorney’s office said it intends to retry Weinstein, and at least one of his accusers said through her lawyer that she would testify again.

The state Court of Appeals overturned Weinstein’s 23-year sentence in a 4-3 decision, saying “the trial court erroneously admitted testimony of uncharged, alleged prior sexual acts” and permitted questions about Weinstein’s “bad behavior” if he had testified. It called this “highly prejudicial” and “an abuse of judicial discretion.”

In a stinging dissent, Judge Madeline Singas wrote that the Court of Appeals was continuing a “disturbing trend of overturning juries’ guilty verdicts in cases involving sexual violence.” She said the ruling came at “the expense and safety of women.”

In another dissent, Judge Anthony Cannataro wrote that the decision was “endangering decades of progress in this incredibly complex and nuanced area of law” regarding sex crimes after centuries of “deeply patriarchal and misogynistic legal tradition.”

The reversal of Weinstein’s conviction is the second major #MeToo setback in the last two years. The U.S. Supreme Court refused to hear an appeal of a Pennsylvania court decision to throw out Bill Cosby’s sexual assault conviction.

Weinstein has been in a New York prison since his conviction for forcibly performing oral sex on a TV and film production assistant in 2006, and rape in the third degree for an attack on an aspiring actress in 2013. He was acquitted on the most serious charges — two counts of predatory sexual assault and first-degree rape.

He was sentenced to 16 years in prison in the Los Angeles case.

Weinstein’s lawyers expect Thursday’s court ruling to have a major impact on the appeal of his Los Angeles rape conviction. Their arguments are due May 20.

Jennifer Bonjean, a Weinstein attorney, said the California prosecution also relied on evidence of uncharged conduct alleged against him.

“A jury was told in California that he was convicted in another state for rape,” Bonjean said. “Turns out he shouldn’t have been convicted and it wasn’t a fair conviction. … It interfered with his presumption of innocence in a significant way in California.”

Weinstein lawyer Arthur Aidala called the Court of Appeals ruling “a tremendous victory for every criminal defendant in the state of New York.”

Attorney Douglas H. Wigdor, who has represented eight Harvey Weinstein accusers including two witnesses at the New York criminal trial, called the ruling “a major step back” and contrary to routine rulings by judges allowing evidence of uncharged acts to help jurors understand the intent or patterns of a defendant’s criminal behavior.

Debra Katz, a prominent civil rights and #MeToo attorney who represented several Weinstein accusers, said her clients are “feeling gutted” by the ruling, but that she believed – and was telling them – that their testimony had changed the world.

“People continue to come forward, people continue to support other victims who’ve reported sexual assault and violence, and I truly believe there’s no going back from that,” Katz said. She predicted Weinstein will be convicted at a retrial, and said accusers like her client Dawn Dunning feel great comfort knowing Weinstein will remain behind bars.

Dunning, a former actor who served as a supporting witness at the New York Weinstein trial, said in remarks to The Associated Press conveyed through Katz that she was “shocked” by the ruling and dealing with a range of emotions, including asking herself, “Was it all for naught?”

“It took two years of my life,” Dunning said. “I had to live through it every day. But would I do it again? Yes.”

News

Biden Proposes the Biggest Capital Gains Tax in 100 Years — 44.6%

President Joe Biden’s budget proposal for next year includes the largest capital gains tax seen in the last century.

The proposal, released last month, notes that the administration wants to increase the top marginal rate on long-term capital gains dividends up to 44.6 percent, which would make the tax rate exceed 50 percent in states like California, New Jersey, New York and others.

Critics note that the idea will ‘disincentivize investing’ and could massively hurt U.S. industries like tech while further shrinking the middle class.

The last time the capital gains tax was even close to this high was in the late 1970s under Democratic President Jimmy Carter when the rate topped out at 40 percent, setting an all-time-high at the time. Otherwise, the rates have remained below 30 percent and dipping as low as 13 percent spanning back to the 1920s.

Capital gains are profits made from selling assets like stocks, businesses, homes and other investments. The sale of these assets can usually trigger a taxable event.

Biden’s Treasury Department notes that increasing the capital gains tax is a way to level the playing field financially between different races in the U.S., claiming that this would disproportionately apply to white Americans.

‘Black and Hispanic families are much less likely to hold stock, and of those families who do, their composition of investment portfolios looks much different than White families,’ wrote Biden’s team in a document titled Advancing Equity through Tax Reform: Effects of the Administration’s Fiscal Year 2025 Revenue Proposals on Racial Wealth Inequality.

It notes that 73 percent of white families owned a home in 2023 compared to 46 percent of black families and 51 percent of Hispanic families. White families also own more stocks and businesses in 2023 compared to black and Hispanic Americans.

The idea of capital gains and taxes on them were established in the1920s, and Biden’s proposal is the highest federal rate since its inception.

While 44.6 percent is the proposal for the federal rate, when combined with state rates the capital gains tax would far exceed that in places like California (59 percent), New Jersey (55.3 percent), Oregon (54.5 percent), Minnesota (54.4 percent) and New York (53.4 percent), according to Kitco News.

A footnote from the General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals notes: ‘A separate proposal would first raise the top ordinary rate to 39.6 percent … An additional proposal would increase the net investment income tax rate by 1.2 percentage points above $400,000 .’

‘Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.’

Two separate proposals would need to pass in the final 2025 budget for the 44.6 percent figure to come to fruition.

John Kartch, an analyst with Americans for Tax Reform, told Kitco: ‘The proposed Biden top capital gains tax rate is more than twice as high as China’s rate… and puts the United States in uncharted territory.’

‘Biden’s proposed capital gains tax hike will also hit many families when parents pass away,’ Kartch added. ‘Biden has proposed adding a second Death Tax (separate from and in addition to the existing Death Tax) by taking away stepped-up basis when parents die. This would result in a mandatory capital gains tax at death – a forced realization event.’

Specifically, the proposal also eliminates a special tax subsidy for cryptocurrency and other transactions. If the budget is approved it could mean crypto and higher-earning stock investors could see their proceeds significantly diminished in future years.

Capital gains tax is added on top of the federal income tax, currently at 22 percent.

Biden’s FY2025 budget proposal also seeks to increase the corporate income tax rate to 28 percent.

News

DEI FAIL: Kamala Harris’s Secret Service Agent Who Attacked Senior Officer Is Identified

An incident involving a physical attack by a female Secret Service agent tasked with protecting Vice President Kamala Harris is raising questions about whether the agency had thoroughly vetted her during her hiring and whether an ongoing push to increase the numbers of women in the service and boost overall workforce staff played a role in her selection.

The Secret Service agent assigned to Vice President Kamala Harris was removed from her duties Wednesday after physically attacking the commanding agent in charge and other agents trying to subdue her, according to an agency spokesman and knowledgeable Secret Service sources.

Several sources in the Secret Service community identified the agent who physically attacked her superior as Michelle Herczeg. The altercation occurred at approximately 9 a.m. at Joint Base Andrews, the home base for Air Force One and Air Force Two, the call signs of the Boeing aircraft used by the president and vice president. Harris was at the U.S. Naval Observatory at the time of the incident, and it did not delay her travel, said agency spokesman Anthony Guglielmi.

Herczeg showed up at the terminal and began acting erratically, grabbing another senior agent’s personal phone and deleting applications on it, according to two sources familiar with the matter. The other agent, a shift leader, was able to recover his phone and then acted as if nothing had happened.

But Herczeg’s bizarre behavior didn’t stop. She then began mumbling to herself, hid behind curtains, and started throwing items, including menstrual pads, at an agent, telling him that he would need them later to save another agent and telling her peers that they were “going to burn in hell and needed to listen to God,” a source told RealClearPolitics.

Herczeg also screamed at the special agent in charge (SAIC), rattling off the names of female officers on the vice president’s detail and claiming they would show up and help her and allow her to continue working. At that point, other agents on the scene believed Herczeg was suffering from a mental lapse, and the superior officer, SAIC, approached her to tell her she was relieved from the assignment.

“That’s when she snapped entirely,” one source recounted.

Herczeg then chest-bumped and shoved her superior, then tackled him and punched him. The agents involved in restraining Herczeg were especially concerned because she still had her gun in the holster. They wrestled her to the ground, took the gun from her, cuffed her, and then removed her from the terminal.

The agent was immediately “removed from their assignment,” a Secret Service spokesman told RCP in a statement. The Washington Examiner first reported the incident.

“A U.S. Secret Service special agent supporting the Vice President’s departure from Joint Base Andrews began displaying behavior their colleagues found distressing,” said Guglielmi, chief of communications for U.S. Secret Service.

The agents on the scene then called medical personnel to remove Herczeg from the terminal. Guglielmi has described the incident as a “medical matter” and said the agency would not “disclose further details.”

“The U.S. Secret Service takes the safety and health of our employees very seriously,” he added. But the bizarre scuffle is once against raising concerns about the state of the once-vaunted force charged with protecting the president.

Following the incident, Secret Service agents and officers are privately questioning the hiring process and whether the agency had adequately screened Herczeg’s background. Some also wonder whether her hire was part of a diversity, equity, and inclusion push in response to years of staff shortages that may have required the agency to lower its once-strict employment standards and physical performance to reach quotas for female agents and officers.

In 2016, Herczeg, then an officer with the Dallas police force, filed a gender discrimination lawsuit against the city, claiming she was assaulted by a male superior and asking for more than $1 million in damages.

The suit alleged that Herczeg was “targeted for being a female officer and treated less favorably” and was retaliated against after she reported sexual harassment and illegal actions of other officers. She also claimed she was not allowed to return to a crime-reduction team after she alleged a senior officer assaulted her. A Texas trial court dismissed the suit, Herczeg appealed, and a Texas court of appeals affirmed the lower court’s decision in 2021 and denied a rehearing in 2022.

While serving on the Dallas police force, Herczeg and another officer shot an armed man while he sat in a parked car. . According to a department spokesman, the officers were firing in self defense because the man, who had previously been convicted of sexually assaulting a child, was brandishing a weapon and eventually shot himself in the head. A headline in the Dallas Observer raised some doubt about the official police account: “Two Dallas Cops Shot a Man Last Night, but They Say He Killed Himself.”

News

WATCH: NYC Construction Worker Goes Viral After Saying Exactly What He Thinks of Biden Following Trump’s Visit

One of the hundreds of construction workers who turned out to support Donald Trump in New York has captured the heart of the nation with his savage takedown of Joe Biden.

The unknown worker had been part of the crowds gathered as the former president made a visit to a construction site in Midtown Manhattan on Thursday morning.

Crowds of construction workers and supporters lined up through the night as they anxiously waited to catch a glimpse of their beloved former president in what is normally Liberal heartland.

After Trump left the site one construction worker was asked by a Newsmax reporter: ‘What’s it like seeing so many Republicans in Manhattan, so many Trump supporters in Manhattan. Does that surprise you?’

The man, dressed ready for work, didn’t hesitate.

‘No, not at all. It’s turning now. It’s Trump’s turn again.’

He was then asked for his message to Joe Biden.

Without missing a beat, he quipped: ‘F**k you.’

He is now being hailed as a hero on social media.

Watch:

What’s your message to Joe Biden??

*Union Worker – “Fuck you” 🔥🔥🔥🔥 pic.twitter.com/CipHhTnJMe— Jay’V (@JayVTheGreat) April 25, 2024

‘This is pretty much the sentiment of all blue collar hard working Americans. Really any American for that matter. Well said sir.’

Another person posted: ‘This is the man representing the working class!’

While another commented: ‘This man represents the majority of America. Verbatim.’

Another added: ‘I think he speaks for most of us Americans.’

A user added: ‘Sounds like the rank and file are not supporting Biden. Bidenomics is bad for workers so of course that makes perfect sense.’

Trump was greeted by hundreds chanting ‘USA, USA’ as he met union workers in New York on the morning of a monumental day in the courts.

The former president greeted teamsters on a construction site and signed MAGA hats as he prepared for another day of testimony in the Manhattan hush money trial.

Union Workers for Trump. 🇺🇸 pic.twitter.com/I6pqe74Ax5

— Karoline Leavitt (@kleavittnh) April 25, 2024

Meanwhile his lawyers are heading to the Supreme Court in Washington, D.C. on Thursday morning in attempts to persuade the nine justices that he is immune from prosecution.

‘This whole thing it’s election interference’ Trump told the crowd regarding his multiple legal battles before taking a shot at President Joe Biden.

‘We’re leading by a lot. He is the worst president in the history of our country. He makes Jimmy Carter look great.

‘He is destroying our country. Our country is going to hell.’ He then insisted it would take Biden ‘one phone call’ to close the border.

Supporters had started gathering shortly after 4AM, many wearing signature red MAGA hats and carrying flags and banners with them, one of which said: ‘Trump won, save America’.

Many of the construction workers at the site wore hard hats plastered in Trump stickers.

As his motorcade pulled up outside the site, the crowd broke into chats of ‘USA! USA! USA!’ before breaking into applause as Trump made his appearance.

The former President then spent the next 30 minutes signing hats and helmets, taking selfies with supporters and workers who waited anxiously to meet him.

After the motorcade left the area, the large group quickly dispersed with the majority of workers who had gathered for hours returning to the site.

After his stop in Manhattan, he headed to court for the third day of former National Enquirer publisher David Pecker’s testimony.

Just a few hundred miles south of New York, the Supreme Court will consider on Thursday arguments that could have huge implications for Trump’s federal criminal trials.

‘Well, we have a big case today, the judge isn’t allowing me to go,’ he lamented.

He added of the Supreme Court case: ‘A president has to have immunity. If you don’t have immunity, you just have a ceremonial president.’

News

Axios Poll: Americans Support Mass Deportations

Half of Americans — including 42% of Democrats — say they’d support mass deportations of illegal immigrants, according to a new Axios Vibes survey by The Harris Poll.

And 30% of Democrats — as well as 46% of Republicans — now say they’d end birthright citizenship, something guaranteed under the 14th Amendment of the Constitution.

Americans are open to former President Trump’s harshest immigration plans, spurred on by a record surge of illegal border crossings and a relentless messaging war waged by Republicans.

President Biden is keenly aware the crisis threatens his re-election. He’s sought to flip the script by accusing Trump of sabotaging Congress’ most conservative bipartisan immigration bill in decades.

But when it comes to blame, Biden so far has failed to shift the narrative: 32% of respondents say his administration is “most responsible” for the crisis, outranking any other political or structural factor.

Amid a record number of border crossings, nearly two-thirds of Americans said illegal immigration is a real crisis, not a politically driven media narrative.

“I was surprised at the public support for large-scale deportations,” said Mark Penn, chairman of The Harris Poll and a former pollster for President Clinton.

“I think they’re just sending a message to politicians: ‘Get this under control,’ ” he said, calling it a warning to Biden that “efforts to shift responsibility for the issue to Trump are not going to work.”

Trump has vowed to carry out the “largest domestic deportation operation in American history,” eyeing sweeping raids and detention camps in a plan that would target millions of illegal immigrants.

When asked to identify their greatest concern around illegal immigration, Americans most frequently cited:

Increased crime rates, drugs, and violence (21%).

The additional costs to taxpayers (18%).

Risk of terrorism and national security (17%).

News

GDP Growth Slowed to a 1.6% Rate in the First Quarter, Well Below Expectations

U.S. economic growth was much weaker than expected to start the year, and prices rose at a faster pace, the Commerce Department reported Thursday.

Gross domestic product, a broad measure of goods and services produced in the January-through-March period, increased at a 1.6% annualized pace when adjusted for seasonality and inflation, according to the department’s Bureau of Economic Analysis.

Economists surveyed by Dow Jones had been looking for an increase of 2.4% following a 3.4% gain in the fourth quarter of 2023 and 4.9% in the previous period.

Consumer spending increased 2.5% in the period, down from a 3.3% gain in the fourth quarter and below the 3% Wall Street estimate. Fixed investment and government spending at the state and local level helped keep GDP positive on the quarter, while a decline in private inventory investment and an increase in imports subtracted. Net exports subtracted 0.86 percentage points from the growth rate while consumer spending contributed 1.68 percentage points.

There was some bad news on the inflation front as well.

The personal consumption expenditures price index, a key inflation variable for the Federal Reserve, rose at a 3.4% annualized pace for the quarter, its biggest gain in a year and up from 1.8% in the fourth quarter. Excluding food and energy, core PCE prices rose at a 3.7% rate, both well above the Fed’s 2% target. Central bank officials tend to focus on core inflation as a stronger indicator of long-term trends.

The price index for GDP, sometimes called the “chain-weighted” level, increased at a 3.1% rate, compared to the Dow Jones estimate for a 3% increase.

Markets slumped following the news, with futures tied to the Dow Jones Industrial Average off more than 400 points. Treasury yields moved higher, with the benchmark 10-year note most recently at 4.69%.

“This was a worst of both worlds report – slower than expected growth, higher than expected inflation,” said David Donabedian, chief investment officer of CIBC Private Wealth US. “We are not far from all rate cuts being backed out of investor expectations. It forces [Fed Chair Jerome] Powell into a hawkish tone for next week’s [Federal Open Market Committee] meeting.”

The report comes with markets on edge about the state of monetary policy and when the Federal Reserve will start cutting its benchmark interest rate. The federal funds rate, which sets what banks charge each other for overnight lending, is in a targeted range between 5.25% to 5.5%, the highest in some 23 years though the central bank has not hiked since July 2023.

Investors have had to adjust their view of when the Fed will start easing as inflation has remained elevated. The view as expressed through futures trading is that rate reductions will begin in September, with the Fed likely to cut just one or two times this year. Futures pricing also shifted after the GDP release, with traders now pointing to just one cut in 2024, according to CME Group calculations.